Tesla Shares Nosedive Amid Trade War Turmoil and Musk’s Controversial Moves

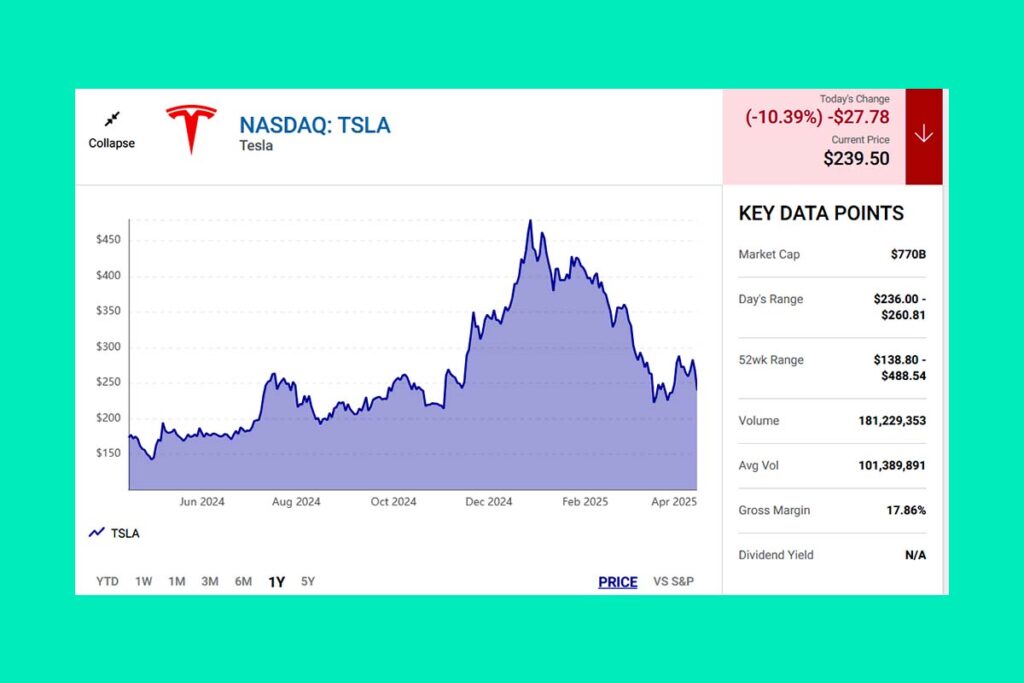

Tesla’s stock declined on Friday. The shares of the electric vehicle manufacturer had dropped 10%, after dropping as high as 11.7% yesterday. The drop coincides with losses of over 5% for the Nasdaq Composite and S&P 500. A major analyst gave Tesla a bearish adjustment as the trade war continues to hit markets, stating that Elon Musk’s political activity has caused unprecedented brand damage for the company.

JPMorgan Cuts Tesla Forecast After Weak Q1 Deliveries and Brand Fallout

The analyst Ryan Brinkman of J.P. Morgan lowered his first-quarter earnings estimate from $0.40 per share to $0.36 per share. Brinkman also reduced his forecast for the entire year to $2.30 per share. $2.70 is the consensus on Wall Street.

Days earlier, Tesla said that it had delivered only 336,681 units in Q1, the weakest quarter for deliveries since 2022, according to Brinkman. He thinks this supports the claim that Tesla’s reputation has suffered greatly as a result of Musk’s political participation.

The sales report causes us to think that — if anything — we may have underestimated the degree of consumer reaction.

Brinkman

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment