Tesla Q4 Disappoints: Low Sales & Revenue Pressure Stock Performance

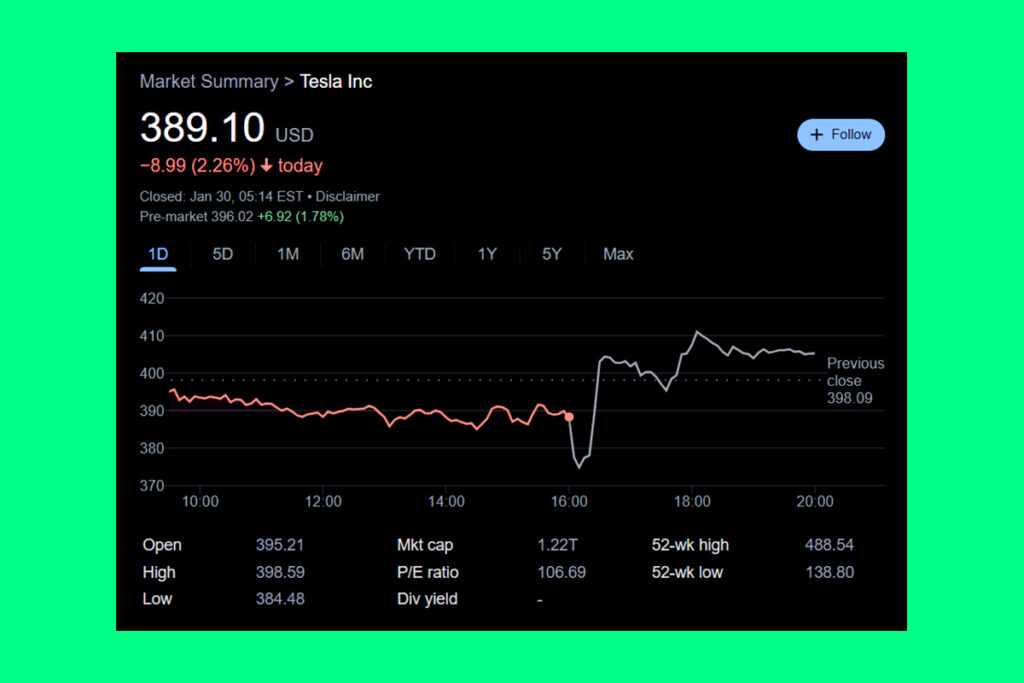

In the final quarter of 2024, Tesla reported a rare profit failure along with underwhelming results due to low sales and revenue, which caused profit margins to erode. In after-hours trading, Tesla shares, which had been rising since the election on expectations that the firm would profit from the tight relationship between CEO Elon Musk and President Donald Trump, first dropped 6% before rising to a slight gain. The company’s electric vehicle options from other manufacturers in the US, China, and Europe have increased competition, which has pushed down the prices it can charge. This has resulted in a loss in earnings.

Tesla’s First-Ever Sales Decline Dampens Q4 Earnings Report

Although Tesla had already revealed that its 2024 sales had dropped for the first time in its history, the company’s $25.7 billion quarterly revenue was around $1.5 billion less than anticipated. Even though its net income of $2.5 billion was up 3% from the previous year, it was still slightly below expectations. However, its 13.6% profit margin—which did not include the selling of regulatory credits—was significantly lower than in previous years. Analysts predicted a margin of 16.2%.

According to the company, production of its more economical variants is still expected to begin in the first half of 2025. Additionally, it stated that its ambitions to launch its Cybercab model of autonomous robotaxi should be accessible by 2026. The business has previously frequently fallen short of production goals for new cars. At the time of the report’s release, when investors were initially focusing on the topline figures, shares appeared to have recovered from their post-market low thanks to the assurances found in the notes buried deep within the earnings report.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment