Tesla Bears Take Control! Stock Slips Below 200-Day Moving Average

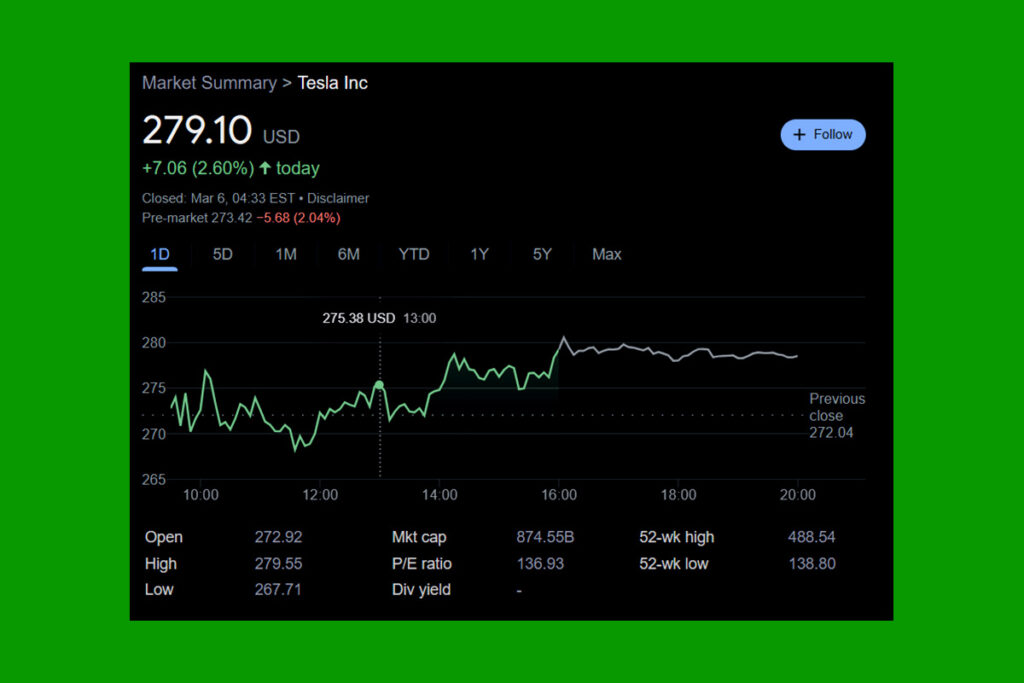

For the first time since August 2024, Tesla’s shares fell below the 200-day moving average on Tuesday, hitting new 2025 lows as President Donald Trump’s tariffs take effect and China and Canada respond with their own taxes. In recent days, TSLA has fallen below possible price floors around the 325–360 range and then the 300 level. It is currently struggling to maintain the 200-day line, or about 279, which is a critical technical support level.

Tesla Crashes 13% in a Week: Will Tariffs Push TSLA Even Lower?

After dropping 4.4% to 272.04 during Tuesday’s stock market activity, Tesla’s shares saw a small decline in the morning hours of Wednesday, reaching a new 2025 low of 261.84. This follows a 2.8% decline to 284.65, following an early Monday high of 303.94 for the stock. Last week, Tesla’s stock fell more than 13%.

Tuesday marked the implementation of President Trump’s 25% tariffs on Canadian and Mexican goods. In response, Canada announced that it would apply 25% tariffs to almost $100 billion worth of U.S. imports. China retaliated with additional tariffs of up to 15% on certain U.S. exports after levies were increased to 20%. There is a lot of uncertainty surrounding tariffs, as Tesla Chief Financial Officer Vaibhav Taneja informed analysts on the Q4 results call.

Over the years, we’ve tried to localize our supply chain in every market, but we are still very reliant on parts from across the world for all our businesses. Therefore, the imposition of tariffs, which is very likely, will have an impact on our business and profitability,

Taneja

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment