SUI Non-EVM Success: SUI Crypto’s $2.37 Billion TVL Highlights Its Growing Ecosystem Impact

Notably, SUI crypto secured 10% of the total value locked (TVL) of non-EVM (Ethereum Virtual Machine), or roughly $2.37 billion. With Solana dominating at 36.87% and Bitcoin at 27.23%, this put SUI in a notable position among other important networks. SUI’s substantial investment in the non-EVM space demonstrates both its increasing significance and its ability to have a big influence on the larger blockchain ecosystem.

This distribution implied a strong user base and development within the SUI network, which would make it more appealing to developers and investors. Increased network effects, additional integrations, and perhaps a rise in the use of SUI’s blockchain solutions are all possible outcomes of the strategic positioning. Chains like SUI play an increasingly important role in determining the future features of decentralized applications and financial systems outside of the conventional Ethereum landscape as blockchain technology advances.

Navi Protocol Dominates SUI Ecosystem, Outpacing Suilend and Scallop

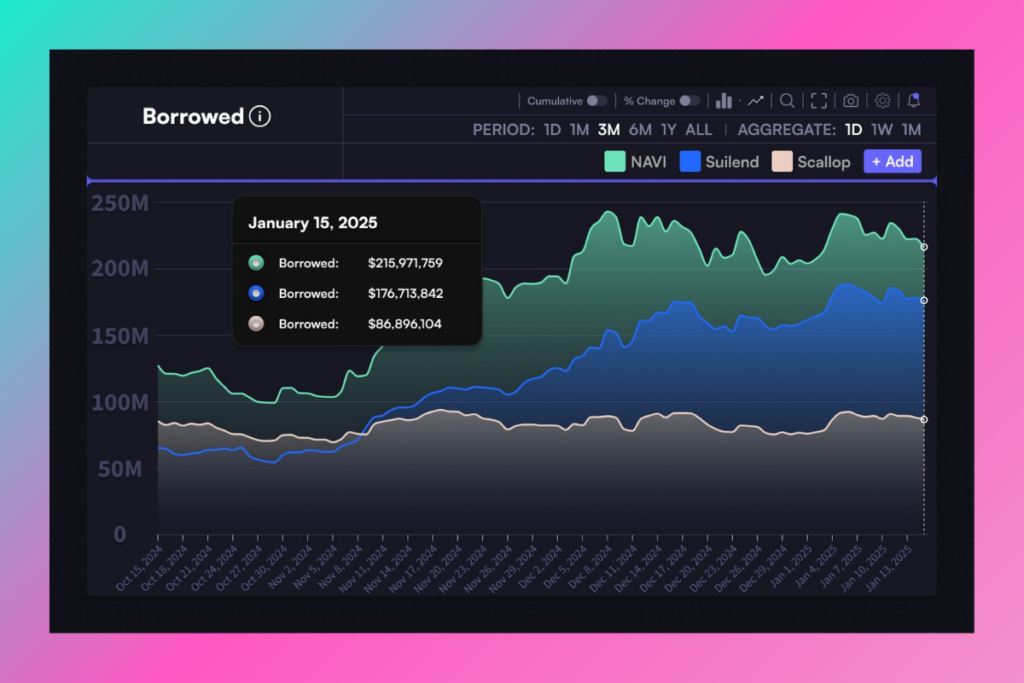

With $215 million in loans, Navi Protocol leads by a wide margin in the chart, which shows a notable expansion in SUI’s lending protocols. Compared to Suilend and Scallop, who reported borrowed assets of $176.7 million and $86.9 million, respectively, Navi is a dominant power in the market. The glaring difference highlights Navi’s strong position inside the SUI ecosystem, drawing the majority of liquidity and potentially having a beneficial impact on SUI’s valuation.

The data visualization illustrates the development trajectories and strategic positioning of different platforms. Navi’s steep slope suggests aggressive borrower uptake and trust. SUI’s stability and increasing popularity could be attributed in large part to its dominance, which demonstrates the platform’s ability to sustain substantial economic activity. This trend may also indicate that SUI cryptocurrency is becoming more widely acknowledged as a competitor in the decentralized financial sector, consolidating its market position in comparison to other networks.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment