Subsea 7 and Saipem Join Forces: Here’s What Investors Need to Know!

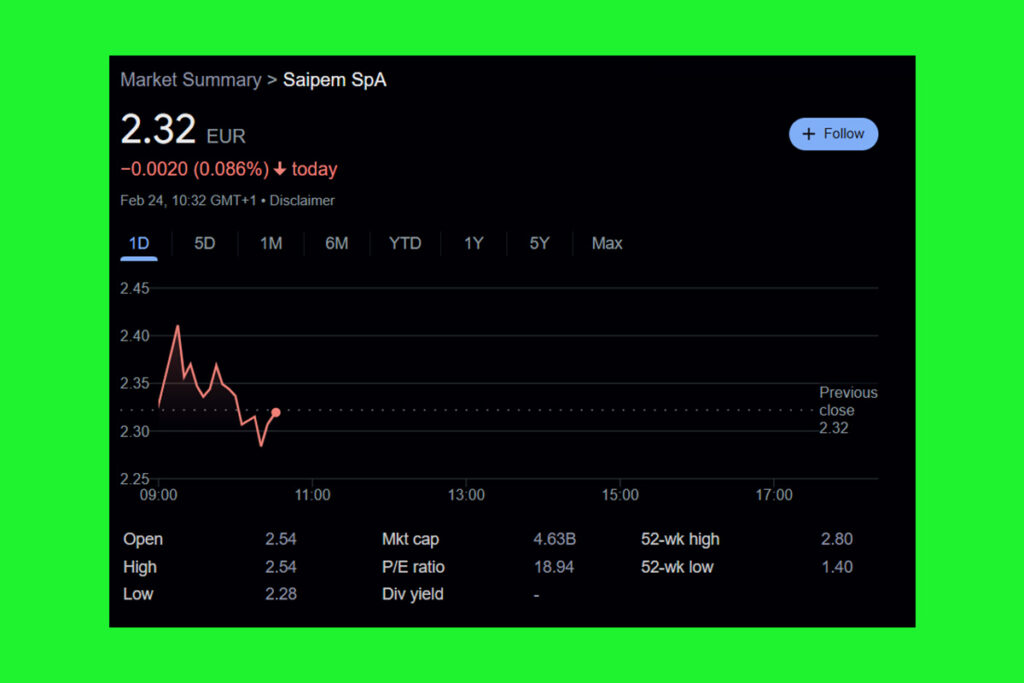

The Norwegian Subsea 7 SA and the Italian oil services company Saipem will unite in a deal valued at around $4.63 billion, the company said on Sunday. Following the news, Subsea 7 shares surged over 7% while Saipem rose almost 3% in Monday’s European trading.

According to a statement from the firms, Subsea 7 owners will get 6.688 Saipem shares for every share they already own under the terms of the agreement. Shortly before the deal closes, the business will pay out a special €450 million dividend.

How Will This $45B Powerhouse Reshape the Oil Services Market?

In addition to having a combined backlog of €43 billion ($45 billion), the combined company, which will be renamed Saipem7, would generate almost €20 billion in revenue annually and have EBITDA of more than €2 billion, the statement said. A 50% ownership in the new business will be held by each of the shareholders of Saipem and Subsea 7.

The deal terms put a premium on Subsea 7’s market cap relative to Saipem based on Subsea 7 distributing €450m in cash to shareholders prior to the deal’s completion,

RBC Capital Markets analysts

Eni and CDP Equity, who own shares in Saipem, as well as Siem Industries, the reference shareholder of Subsea 7, support the agreement. To support the transaction, the parties have signed a memorandum of agreement. The firms noted that within three years of the deal’s conclusion, annual synergies of about €300 million are anticipated.

Agreement in principle by Saipem & Subsea 7 on key terms of a possible merger is a positive move, in our view. Sustained sector demand likely requires combined balance sheet & capabilities while valuation discount to US peers can be addressed. We recall media stories in 2019 on such a move & do not discount a potential role of Elliot in this announcement,

Jefferies analysts

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment