Perennial, a DeFi platform for trading derivatives, raised $12 million in a seed round led by Polychain Capital and Variant, with participation from Archetype, Scalar Capital, Robot Ventures, Coinbase Ventures, a.capital and a number of angel investors.

What is Perennial?

Perennial thinks that the DeFi derivatives that are happening now have simple but inefficient mechanisms. With this mindset, they created the protocol by examining the issue of DeFi derivatives from the very beginning. It is a derivative protocol designed from scratch to be specific to Perennial DeFi. The protocol created by Perennial includes;

- The protocol is designed to combine the best features of DeFi and CeFi. While you can trade in a simple and scalable way in the platform, it also uses a DEFI-specific trading model. This model they use includes the features of not having an order book, zero slippage and leverage of the permit.

- The protocol can be customized to appeal to every audience. Users and developers can customize Perennial for themselves and shape it according to different use cases.

- Perennial offers developers all the tools they need to integrate derivatives easily.

How Does Work?

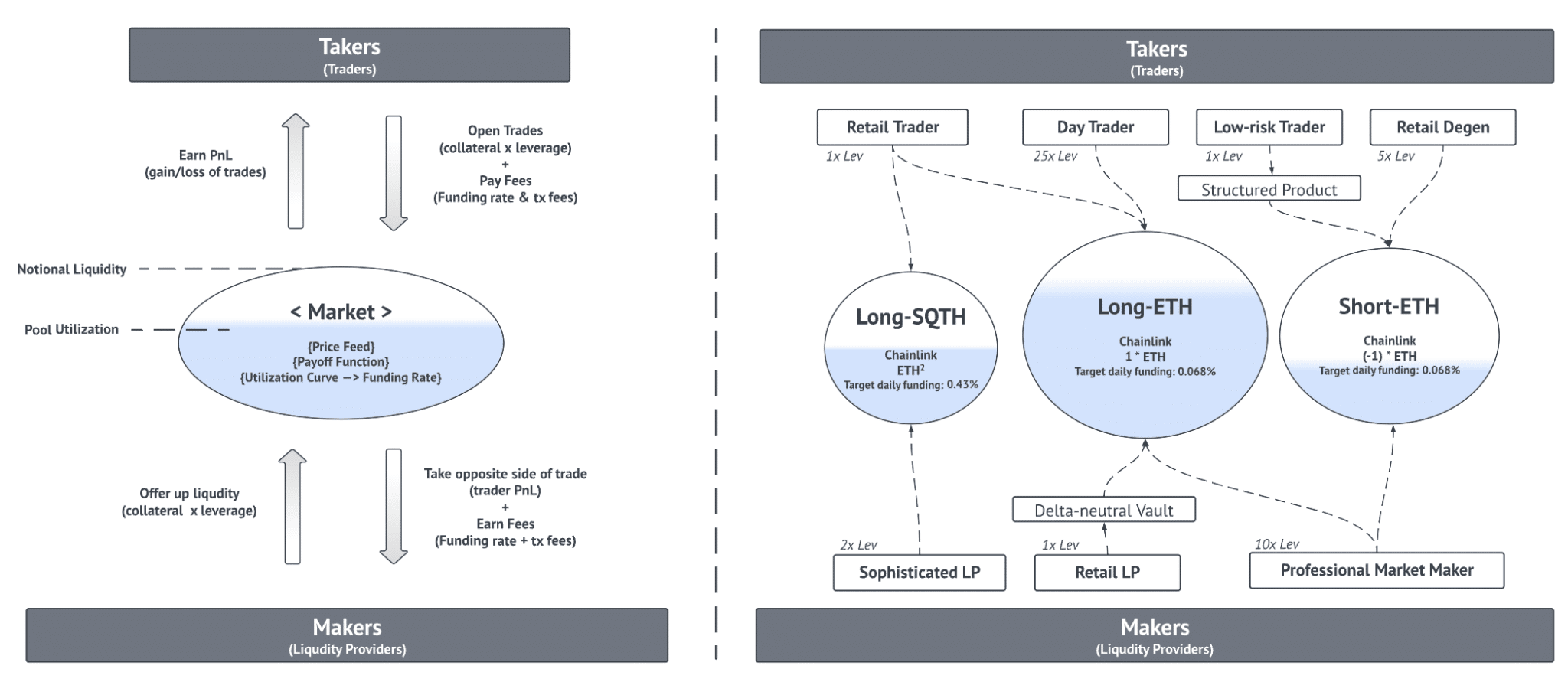

The DeFi platform offers a two-sided market consisting of a combination of traders and liquidity providers. DeFi platform works in a similar way to Aave and Compound. You can examine the working model from the image below.

Perennial’s initial core features include:

- Peer-to-Pool AMM – trade against a pool of capital

- Zero price slippage – trade directly at the current price, regardless of size.

- Cash-settled — trades, both long & short, settled in $USD, not crypto

- Utilization-based funding rate – funding variations with pool utilisation (like Compound)

- Two-sided leverage – Makers & Takers can both open positions with leverage

- Isolated markets – markets & risks are segregated, rather than grouped together

- LP flexibility – LPs customize their market exposure, hedging strategy, leverage, etc.

- Arbitrary exposure – launch markets for any exposure by customizing the payoff function, utilization curve (funding rate), oracle, fee model, etc.

- Permissionless – permissionless market creation, integration, and composability.

DeFi platform will initially be published only on the Ethereum network and there will be simple Long-ETH, Short-ETH, and Long-Squeet transactions. At the first launch of the platform, the liquidity limit and the small number of markets to be traded will disappear with the creation of the L2cross-chain solution.

Leave a comment