Crypto News– As observers of the market endeavor to identify the primary purchasers of Bitcoin ETFs, fresh insights have surfaced this week with the commencement of major financial institutions filing their 13Fs for Q1 2024. These filings offer the SEC a snapshot of their holdings as of March 31.

Spot Bitcoin ETFs: Understanding the Investor Base Will Soon Unfold

Form 13F is a mandatory filing by institutional asset managers within 45 days of each quarter’s end. It’s obligatory for institutions overseeing $100 million or more in publicly-traded assets, providing quarterly insights into their holdings. Due between April 1 and May 15, the Q1 2024 filings will offer the initial glimpse into the institutional involvement in Bitcoin ETFs.

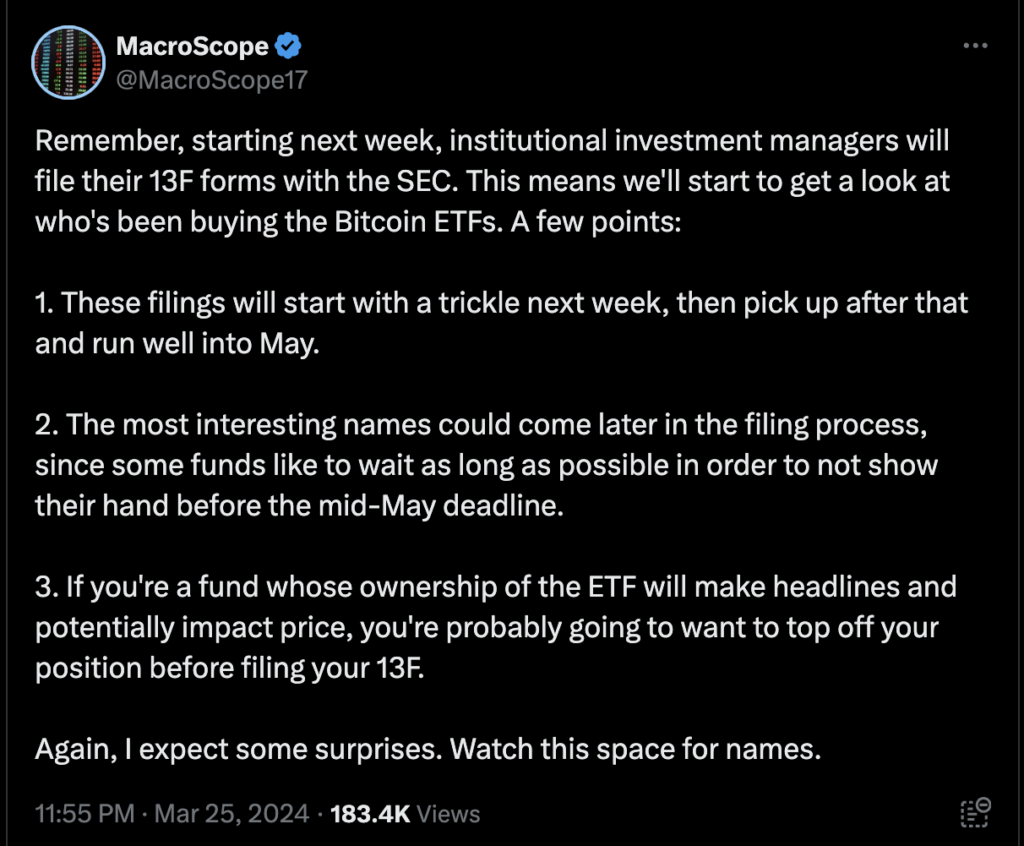

The upcoming 13F filings are anticipated to unveil how major financial institutions are navigating the cryptocurrency realm, particularly their engagement with the new spot Bitcoin ETFs. These filings, mandated for institutions managing over $100 million in equities, act as a significant gauge of institutional sentiment and may signal broader market trends.

In January 2024, a total of 11 spot Bitcoin ETF products debuted in the US market, with some obtaining approval after prolonged negotiations with the SEC. Notable participants in this market launch encompassed prominent asset managers like BlackRock, Fidelity, and Franklin Templeton, alongside more crypto-focused funds such as ARK 21Shares, Bitwise, and Grayscale.

Points of Interest

The forthcoming filings are anticipated to shed light on the Bitcoin ETF markets, although their scope will be limited. Matt Hougan, Chief Investment Officer at Bitwise, explained to Unchained that while these filings will be extremely valuable, he cautioned about a few significant limitations to these disclosures.

Firstly, according to Hougan, investments are aggregated via brokers, concealing individual investor identities.

In essence, all investors holding the ETF through Charles Schwab will be bundled into one omnibus Schwab account (or possibly a few accounts)… You don’t always get a transparent view of the ultimate holder.

Matt Hougan

Secondly, as 13F filings solely provide a snapshot of a firm’s holdings at the quarter’s end, large short-term holders may appear, somewhat inaccurately, as dominant investors.

It is very common for ETFs to show trading firms… as large holders, because they may have a large short-term position as they facilitate liquidity in the ETF,” Hougan said. “This does not mean that these are ‘trading ETFs;’ it’s just the nature of ETFs and how creation/redemptions work.

Matt Hougan

As these filings gradually emerge over the next six weeks, the markets will keenly assess the extent of institutional participation in the cryptocurrency realm. Observers have already highlighted the initial filing from Burkett Financial Services, headquartered in Rock Hill, South Carolina, which disclosed holding 602 shares of BlackRock’s iShares Bitcoin Trust, priced at $37.65 per share at the time of reporting, amounting to a total reported position of $22,665.

Given the inherent limitations of deriving insights from these filings, it’s valuable to understand what indicators to focus on. According to Hougan, the number of investors at this stage could carry more significance than the initial size of their holdings, suggesting that early investors are likely to increase their allocations in the future as they become more familiar with the asset.

For those interested in monitoring these filings as they unfold, they can do so by accessing the SEC’s EDGAR database and searching under a specific company or fund name, or by selecting latest filings and entering 13F. This enables individuals to stay updated on the latest developments.

1 Comment