Santiment: Social Dominance of Bitcoin Dip Buying Peaks Since April

Recent research shows that after Bitcoin dropped below the crucial $100,000 price mark, the percentage of social posts regarding purchasing the crypto plunge has increased to its highest level since April.

With Bitcoin falling as low as $95.5K today, the ratio of crypto discussions that are about buying crypto’s dip has reached its highest level in over 8 months,

crypto analysis firm Santiment

Since Bitcoin had been below $100,000 for almost 12 hours at the time of publication, the social dominance score, which measures references to buying the dip across social media platforms, reached 0.061 on December 19. Since April 12, when the price of Bitcoin fell below $70,000 to a little over $67,000 before dropping to roughly $63,000 the next day, it was the greatest social dominance score. On August 4, when Bitcoin fell below $60,000 and then fell around $53,000 during the next day, it nearly retested this score.

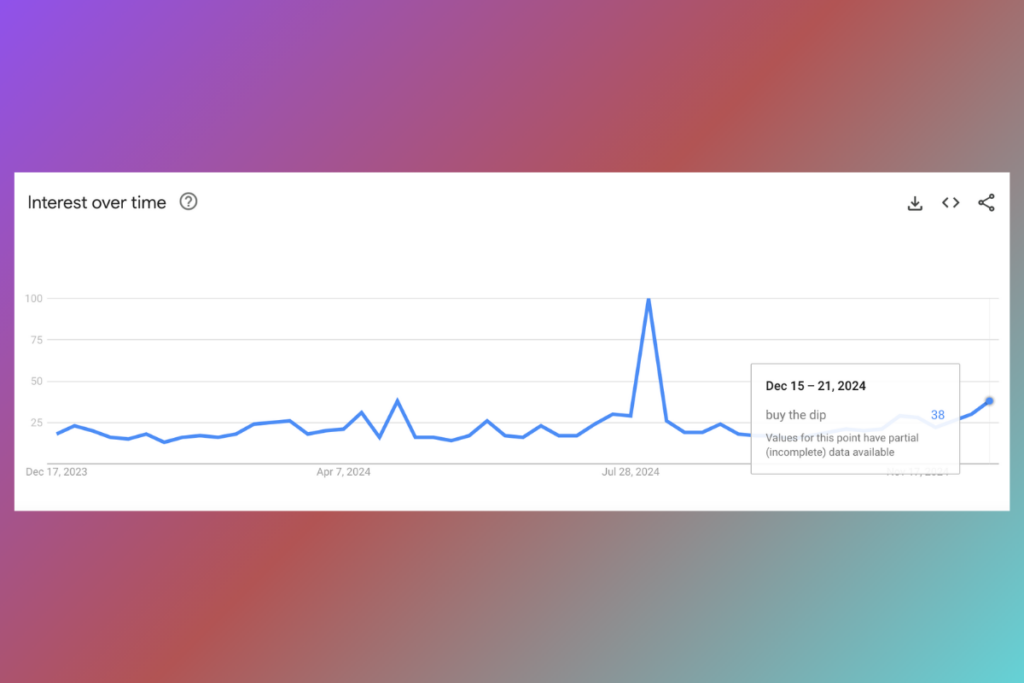

Crypto Market Sentiment Shifts as ‘Buy the Dip’ Queries Spike Globally

Data indicates that while search interest for the phrase crypto is still high, it has decreased since the beginning of December. International searches for crypto have scored 75 during the last seven days, down 25 points from a score of 100 at the start of December, according to Google Trends data from the previous 12 months. In the meantime, during the last seven days, searches for buy the dip have increased globally to a score of 38, the highest since August 10.

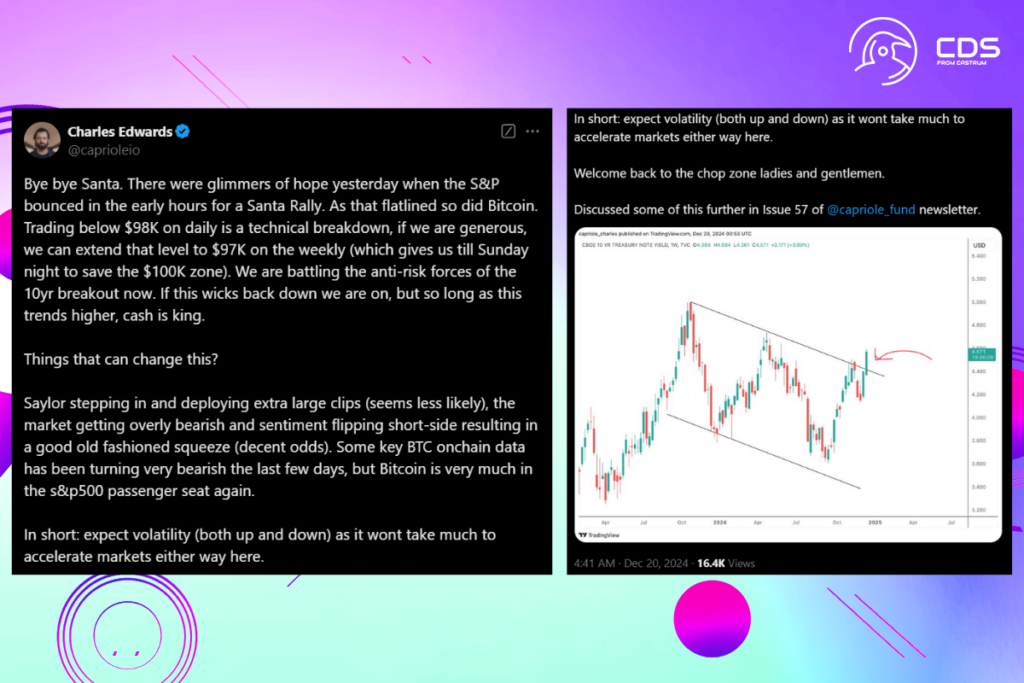

Charles Edwards, the founder, and analyst of the Capriole Fund, stated in an X post that market players should expect volatility in both ways because it won’t take much to shift markets in any direction. According to Edwards, the odds are decent that the market will turn around and maybe experience a short squeeze in the near future.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment