SHIB Whales Buy the Dip: Is a Major Rally Incoming?

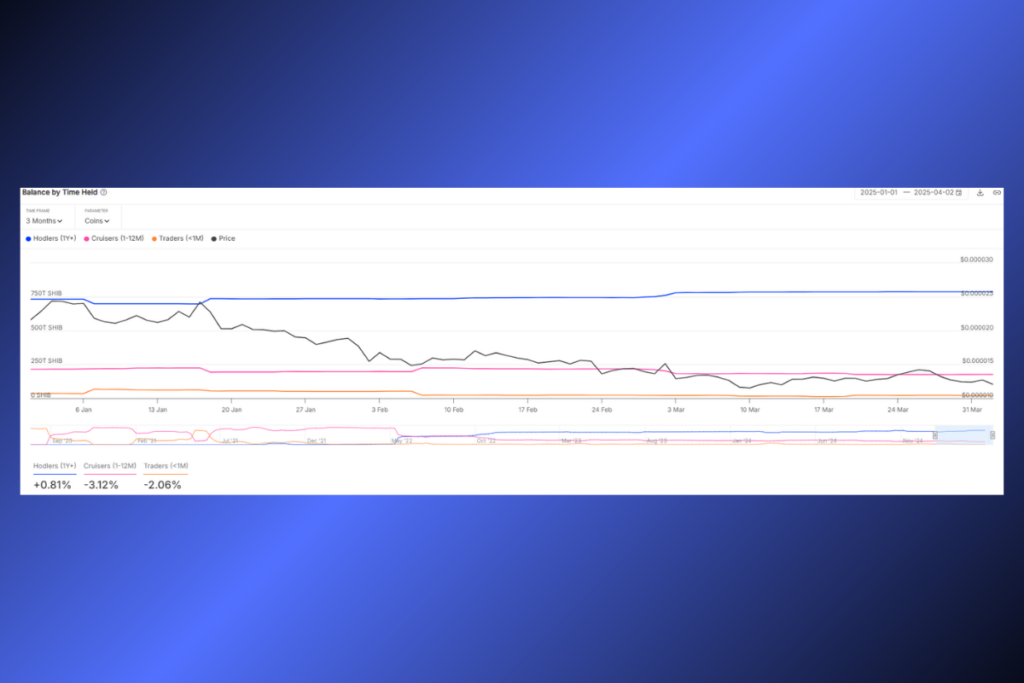

In the first quarter of 2025, Shiba Inu’s (SHIB) investor ecosystem experienced a significant change. Nevertheless, in Q1 2025, SHIB whales grew their shares by 7.5% in spite of a 45% decline in price. Between January 1st and April 2nd, wallet balances increased from 732 trillion to 787 trillion tokens, according to wallet statistics. Mid-term holders, on the other hand, reduced their holdings by 18%. Short-term traders saw a 43% decline in holdings from 36 trillion to slightly under 21 trillion SHIB, making the departure even more noticeable.

Data from CryptoQuant shows that SHIB exchange reserves decreased 37.6%, from 139.7 trillion to 87.2 trillion, within the same time period, confirming this behavioral shift. This significant outflow points to tightening sell-side liquidity, which is often regarded as positive during volatile times. SHIB’s price, however, kept declining in spite of this pattern, indicating either weak demand or the impact of broader market dynamics.

SHIB Whale Activity No Longer Drives Price: Has the Market Matured?

IntoTheBlock’s large holder netflow data shows contradictory behavior, which further muddies the story. Inflows surged as over 33 trillion Shiba Inu entered exchanges on January 6 and 7. After then, netflows fell by over 212% in February and March. SHIB’s price, however, remained stable, suggesting that market timing is no longer determined by whale movements.

During high-volume events, SHIB’s price stayed largely steady despite this significant shift in the behavior of major holders. This decoupling implies that either other factors, such as retail sentiment or general market conditions, are taking primacy or that whale movements may no longer have the same impact as they once did. The market appears to be more mature, as retail sentiment and general circumstances seem to outweigh the influence of major players.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment