Fidelity Study Reveals Investor Misconceptions Regarding Bitcoin Volatility

Crypto News– Despite ongoing debates surrounding Bitcoin’s volatility, prevailing perceptions often depict it as significantly more unstable than traditional assets. However, recent data challenges this notion, suggesting that Bitcoin’s volatility may be less pronounced than previously assumed, even when compared to renowned stocks like Netflix.

Comparing Bitcoin and Netflix Volatility

Over the past two years, Bitcoin’s volatility has shown a downward trend, with its 90-day realized volatility averaging 46%, compared to Netflix’s 53%. This notable shift indicates a maturation of Bitcoin as an asset class, moving away from its earlier erratic price movements.

Bitcoin’s Position Among Influential Stocks

Contrary to popular belief, Bitcoin’s volatility isn’t an outlier when compared to prominent stocks. According to Fidelity Digital Assets researchers, as of October 2023, Bitcoin exhibited lower volatility than 92 S&P 500 stocks, including numerous large-cap and mega-cap stocks.

Discrepancy Between Implied and Realized Volatility

The market often overestimates Bitcoin’s implied volatility, which remains higher than its actual realized volatility. This discrepancy suggests that traders are factoring in risks that aren’t as pronounced in real price movements, indicating an exaggerated perception of Bitcoin’s instability.

Bitcoin’s Trajectory Toward Stability

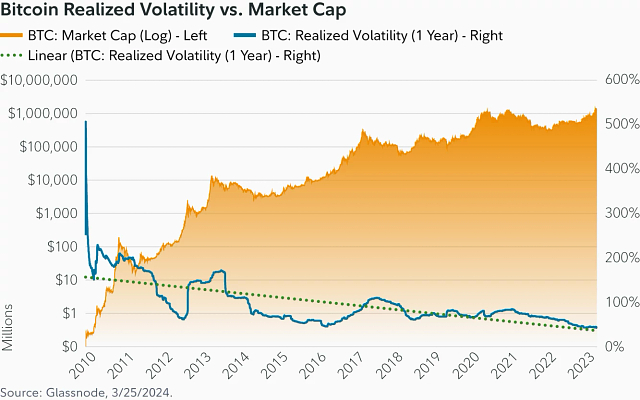

Similar to gold’s journey following its decoupling from the US dollar, Bitcoin’s volatility has decreased over time. Initially characterized by high volatility, gold stabilized as markets adapted to its status as an independent asset. Bitcoin’s recent behavior mirrors this pattern, hinting at a potential trajectory toward stability and substantial growth opportunities.

FAQs

What are the common misconceptions about Bitcoin volatility?

Bitcoin is too volatile to be a store of value. While Bitcoin’s price has fluctuated significantly in the past, it has also shown a long-term upward trend. Many believe that Bitcoin’s scarcity and decentralization make it a more reliable store of value than traditional fiat currencies.

Bitcoin is only used for illegal activities. Bitcoin is increasingly being used for legitimate transactions, such as online purchases and remittances. While there have been some cases of Bitcoin being used for illegal activities, these represent a small fraction of overall Bitcoin transactions.

Bitcoin is a bubble that will eventually burst. Bitcoin has been around for over a decade and has survived numerous price crashes. While there is always a risk that the price of Bitcoin could fall significantly, many believe that the cryptocurrency has a strong foundation and is here to stay.

What are the factors that contribute to Bitcoin volatility?

Supply and demand: The price of Bitcoin is determined by supply and demand. When demand for Bitcoin is high, the price goes up. When demand is low, the price goes down.

Media coverage: Positive media coverage can boost demand for Bitcoin, while negative media coverage can lead to sell-offs.

Regulation: Government regulation can also impact the price of Bitcoin. For example, a crackdown on Bitcoin exchanges in China in 2017 led to a sharp drop in the price of Bitcoin.

Market sentiment: The overall mood of the market can also affect the price of Bitcoin. When the market is bullish, Bitcoin tends to rise in price. When the market is bearish, Bitcoin tends to fall in price.

What are the implications of Bitcoin volatility for investors?

Bitcoin volatility can be a risk for investors, but it can also be an opportunity. Investors who are comfortable with risk may be able to profit from Bitcoin’s price swings. However, it is important to remember that Bitcoin is a speculative investment and there is a risk of losing money.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a comment