Pump fun Achieves $400M Revenue as Memecoin Market Cap Shrinks

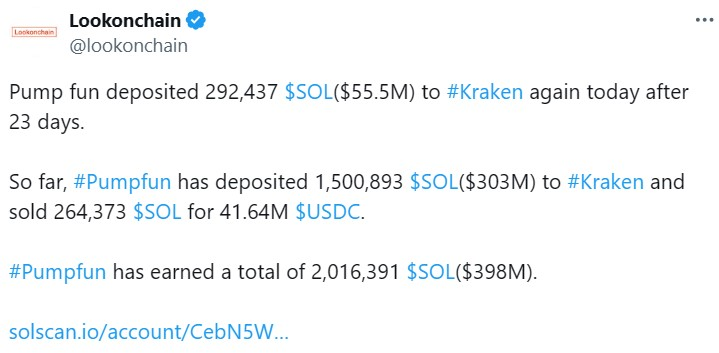

Pump fun– Despite a downturn in the memecoin market, Solana-based memecoin generator Pump.fun has achieved impressive financial results. According to blockchain analytics platform Lookonchain, Pump.fun has earned a total of 2,016,391 SOL tokens, equating to nearly $398 million in revenue. The platform has deposited more than $300 million in SOL tokens to Kraken and converted a significant portion to USD Coin (USDC). This marks an impressive start to 2024, following a record-setting performance in November, when Pump.fun generated $106 million in decentralized application (DApp) revenue, making it the first Solana DApp to surpass $100 million in monthly revenue.

Memecoin Market Sees $40 Billion Drop in December

While Pump.fun continues to thrive, the overall memecoin market experienced a significant decline in December. According to CoinMarketCap, the total market capitalization for memecoins was $120 billion on December 1, peaking at $137 billion on December 9, before dropping to $92 billion by December 23. By the end of the month, the market cap had settled at $96 billion, reflecting a 20% decrease from the beginning of the month.

Challenges Faced by Pump.fun

Despite the overall market decline, Pump.fun’s daily revenue remains robust, indicating continued user engagement with meme-based tokens. However, the platform faced significant challenges last year. On November 25, Pump.fun’s livestream feature came under fire for broadcasting harmful content, including violence, self-harm, and animal cruelty. This led to a backlash from the community, prompting Pump.fun to pause the livestream feature indefinitely. Additionally, on December 6, the UK’s Financial Conduct Authority (FCA) issued a warning about the platform, accusing it of promoting financial services without permission and blocking access to the site in the country.

Pump.fun’s ability to maintain strong revenue despite these challenges shows the continued demand for meme-related projects, but also highlights the importance of addressing regulatory concerns and maintaining community trust.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment