Praise for Bitcoin: Robert Kiyosaki Backs Bitcoin as Good Money Against the Declining US Dollar

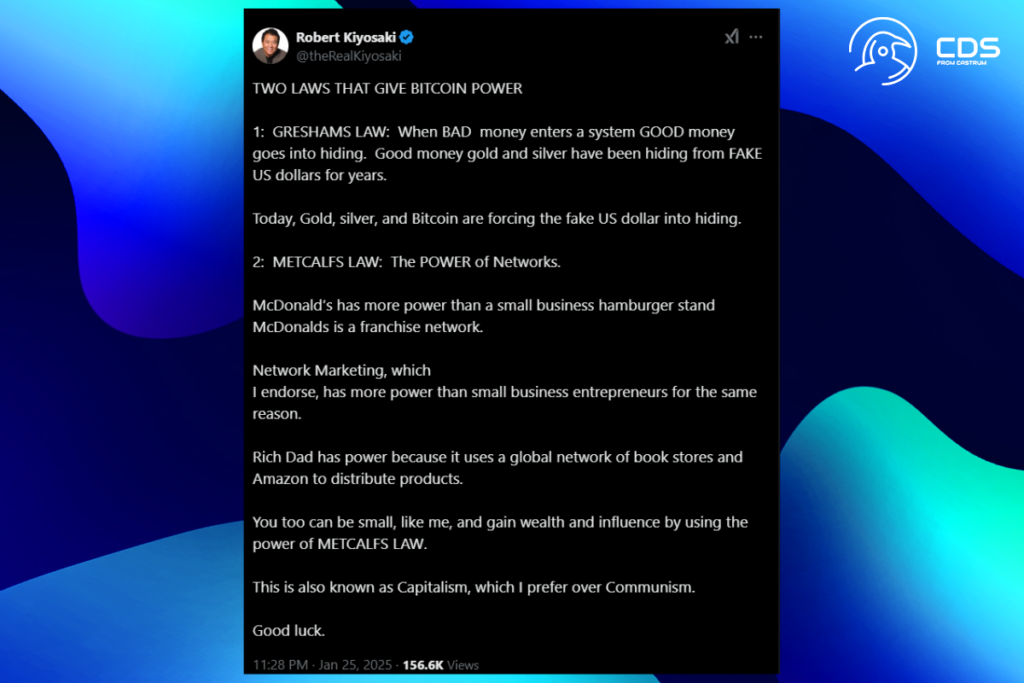

Renowned financial analyst Robert Kiyosaki emphasized Bitcoin’s (BTC) advantages over the US dollar as the cryptocurrency continues to gain popularity. Kiyosaki reaffirmed his optimism for the cryptocurrency in a recent X post, pointing to Gresham’s Law and Metcalfe’s Law as key ideas bolstering Bitcoin’s long-term worth and usefulness.

When BAD money enters a system GOOD money goes into hiding. Good money gold and silver have been hiding from FAKE US dollars for years. Today, Gold, silver, and Bitcoin are forcing the fake US dollar into hiding.

Kiyosaki

He maintained that excessive money printing and widespread inflation have caused fiat currencies, such as the US dollar, to lose their credibility gradually. On the other hand, assets like gold, silver, and Bitcoin have become dependable stores of value. As a result, when public confidence in paper money declines, these assets are emerging as the safest investment options.

Kiyosaki Champions Bitcoin as Goldman Sachs CEO Doubts Its Stability

Furthermore, Kiyosaki clarified Metcalfe’s Law, which states that a network’s value rises exponentially with the number of users. He clarified that Bitcoin‘s growing user base and increasing worldwide adoption greatly increase its worth and clout. The rise of Bitcoin as a potent asset is largely due to this decentralized network effect.

Despite the positive sentiment surrounding Bitcoin, David Solomon, the CEO of Goldman Sachs, has reiterated his position on the dominance of the U.S. dollar, calling Bitcoin a speculative asset rather than a danger to the stability of the global financial system. However, Bitcoin’s market momentum was noteworthy in spite of this criticism. At the time of writing, prices were trading at $98,852, after a slight 4.77% increase in the month.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment