Crypto News – Analysts at cryptocurrency exchange Bitfinex predict that after the halving, the price of Bitcoin may consolidate for up to two months.

Post-Halving BTC Price Consolidation to Last Close to 2 Months, According to Bitfinex Report

According to the most recent Bitfinex Alpha market analysis, Bitcoin may remain the leading indication for the total cryptocurrency market capitalization and the benchmark for price action in the crypto market in May. The research states that the macroeconomic climate is more resilient than it was in prior years and that there is little chance of rate decreases in the near future.

In addition, compared to past cryptocurrency market cycles, the analysts claimed that businesses and the general public are “better prepared and informed” about the status of the underlying economy.

Consequently, we believe we could see a 1-2 month consolidation in Bitcoin prices, trading in a range with swings of $10,000 on either side.

analysts

Any positive effect on the price of Bitcoin after the halving, which has decreased the amount of new BTC available on the market, will be felt in the months to come, the report continues.

At this point, the economy is also expected to be performing better, having achieved a soft landing and avoiding a recession, providing further impetus to crypto assets,

the analysts

Many Researchers Agree About Consolidation

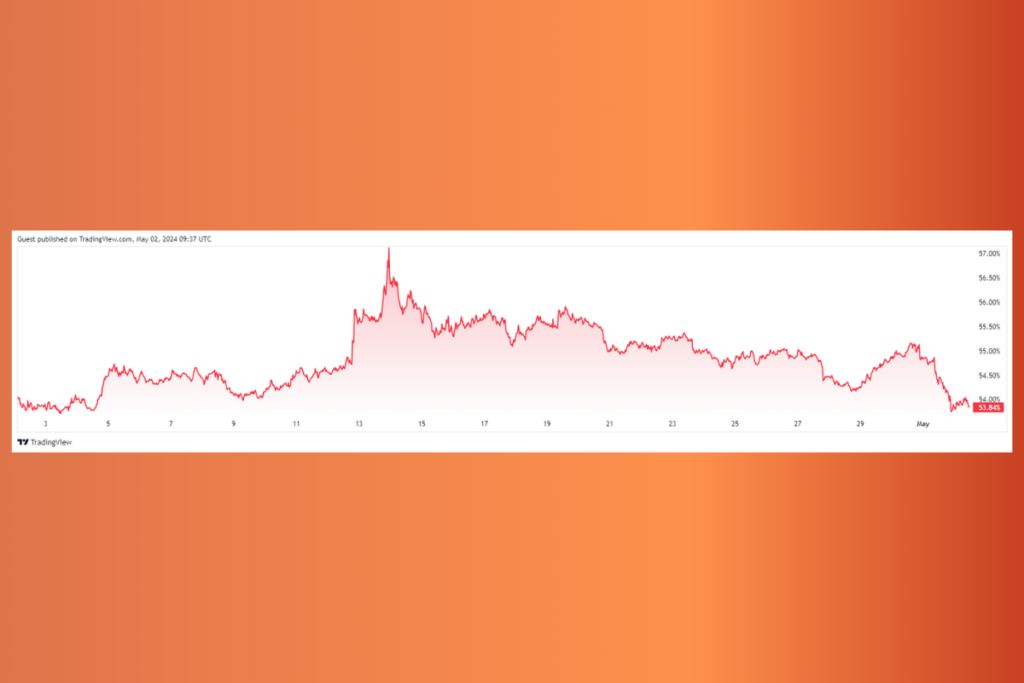

The opinions of different cryptocurrency traders regarding the recent consolidation of Bitcoin following its all-time highs more than a month ago are essentially the same. Bitcoin’s hegemony may have peaked as traders start shifting liquidity to altcoins, according to Michaël van de Poppe, founder of trading firm MNTrading. Bitcoin market dominance is losing significant support, as cryptocurrency trader Matthew Hyland noted in response to this.

The technical specifics of Bitcoin’s waning market dominance were also covered in length in the Bitfinex Alpha study. It mentions that during previous Bitcoin halvings, people’s focus shifted to alternative coins, which increased in value and share of the market.

This shift occurs as Bitcoin’s reduced supply growth rate is seen as a long-term bullish development, which increases investor risk appetite, leading investors to seek potentially higher returns from alternative cryptocurrencies,

the report

Leave a comment