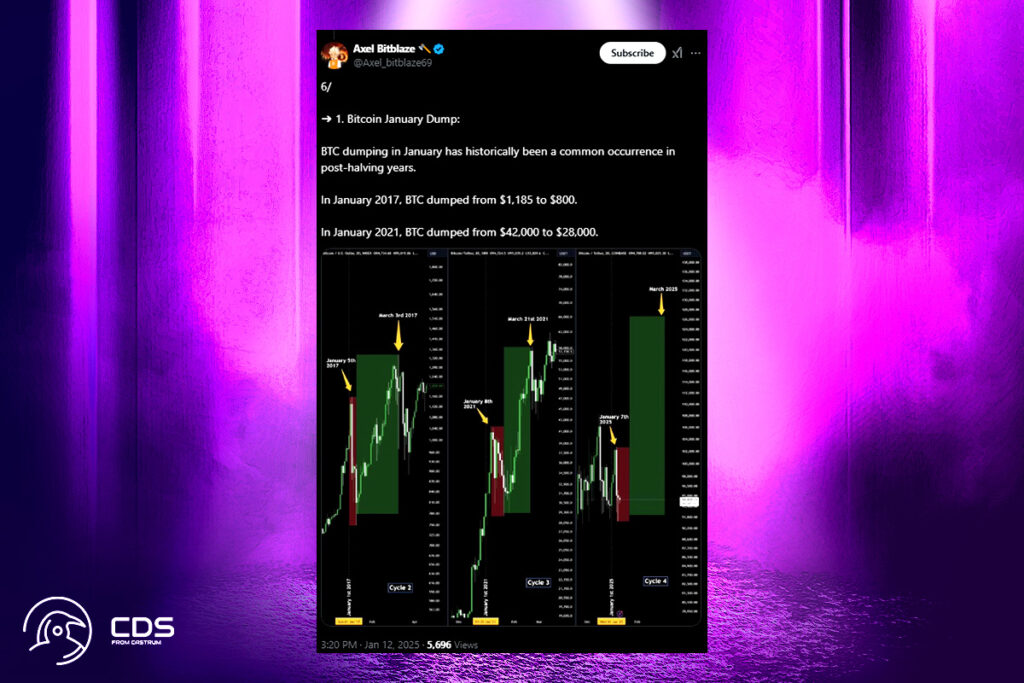

Post-Halving BTC Patterns: Crypto Analyst Predicts More Volatility as Bitcoin Corrects 10% This Month

Analysts who have examined past cycles say it is historically not unusual for Bitcoin to have a significant correction in the first month of a year following a halving of the blockchain.

Bitcoin dumping in January has historically been a common occurrence in post-halving years. We all know what happened after the 2017 and 2021 dumps.

crypto analyst Axel Bitblaze

From its peak of $102,300 on January 7 to just around $92,000, Bitcoin is down 10% so far this month. It has now recovered a little to hover around $94,000. Bitcoin dropped in value by about 25% from over $40,000 to just over $30,000 at the end of January 2021, the most recent year following the halving. By November, it had soared 130% to a new peak of $69,000. The year following the 2016 halving, in January 2017, Bitcoin experienced a 30% decline, dropping from $1,130 to $784. After that, it increased by 2,400% that year, reaching its highest point ever—$20,000—by December.

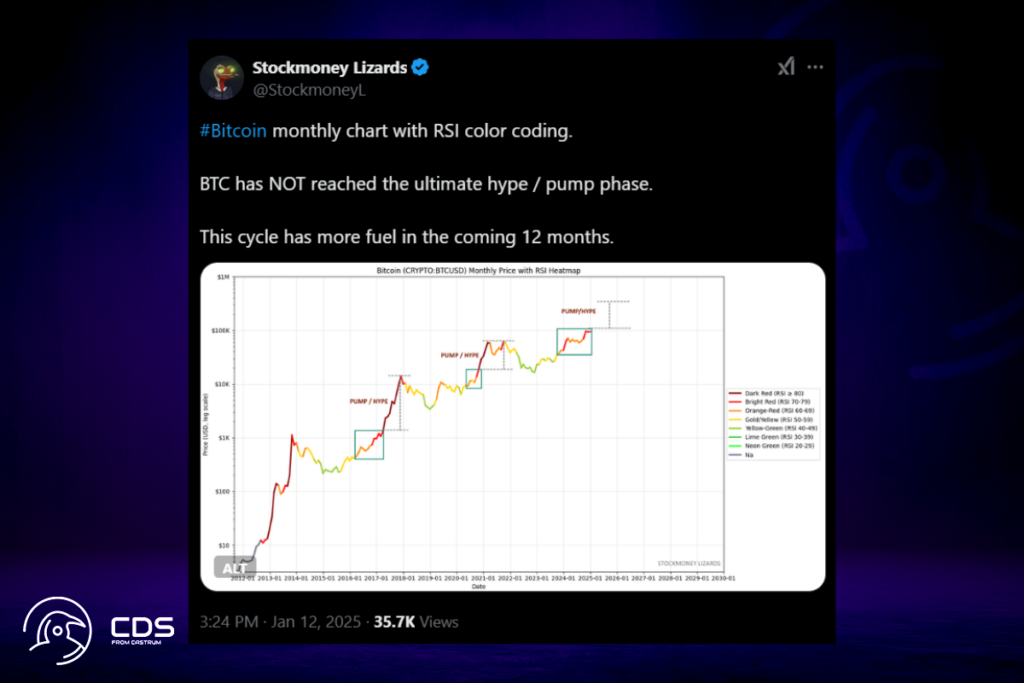

Pro-Crypto Governments and ETFs: Will Bitcoin’s Cycle Peak at $200K?

Stockmoney Lizards X account stated on January 12 that Bitcoin has not yet entered the final hype/pump phase.

This cycle has more fuel in the coming 12 months.

Lizards

Every cycle has its differences, the analyst admitted. The analyst did, however, add that he believes the notion is supported by widespread use, pro-crypto governments around the world, ETFs, etc. Bitcoin prices might rise from their present levels to over $200,000 before the end of 2025 if they make a 130% advance like they did in the last cycle’s peak year. On the other hand, prices could drop below $70,000 if there is a downturn of the size shown in January of the last two cycles.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment