$1.3 Billion Polygon Stablecoin Reserve Proposal: Community Weighs Economic Potential

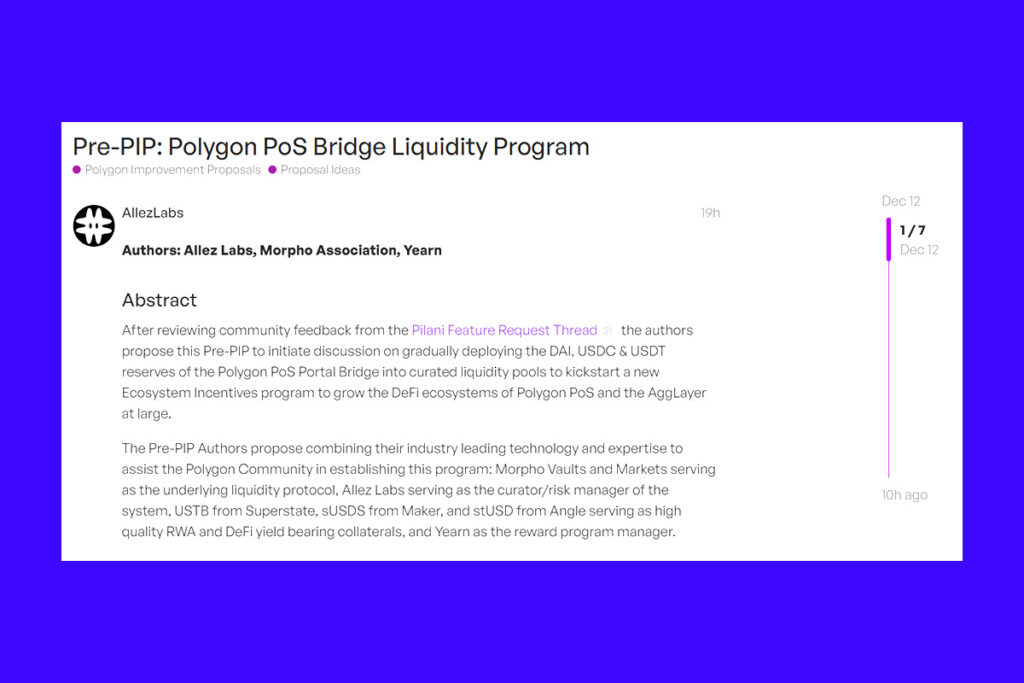

The Polygon community is debating a proposal to generate a return from almost $1 billion held on the PoS Chain bridge, the canonical bridge that links the network to Ethereum. In order to gather input from the Polygon community on the deployment of over $1.3 billion in stablecoin reserves (DAI, USDC, and USDT) via the Polygon PoS Bridge, Web3 risk provider Allez Labs created a Pre-Polygon Improvement Proposal in conjunction with the DeFi protocols Morpho and Yearn.

The proposal states that the $1.3 billion stablecoin reserve that is not being used represents an annual opportunity cost of about $70 million. These funds will be utilized to promote increased participation on Polygon PoS and across the AggLayer as a whole.

Polygon’s Stablecoin Reserve Plan: Phased Deployment into ERC-4626 Vaults

Each asset type’s ERC-4626 vault would get a phased deployment of the stablecoin reserves. It was suggested that Maker’s sUSDS vault would house DAI reserves, while USDC and USDT would rely on Morpho Vaults as their main yield source. The proposal calls for Allez to risk-manage these vaults. Moreover, the Polygon‘s specialized Protocol Governance Council and community forums will be used to discuss the proposal.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment