The Allure of Penny Stocks in 2024 During Economic Uncertainty and Rate Adjustments

The changes in major indexes are being closely watched by investors as global markets traverse a terrain of interest rate adjustments and economic slowdown. For investors who are ready to investigate smaller or up-and-coming businesses, penny stocks continue to be a fascinating investing option despite these developments.

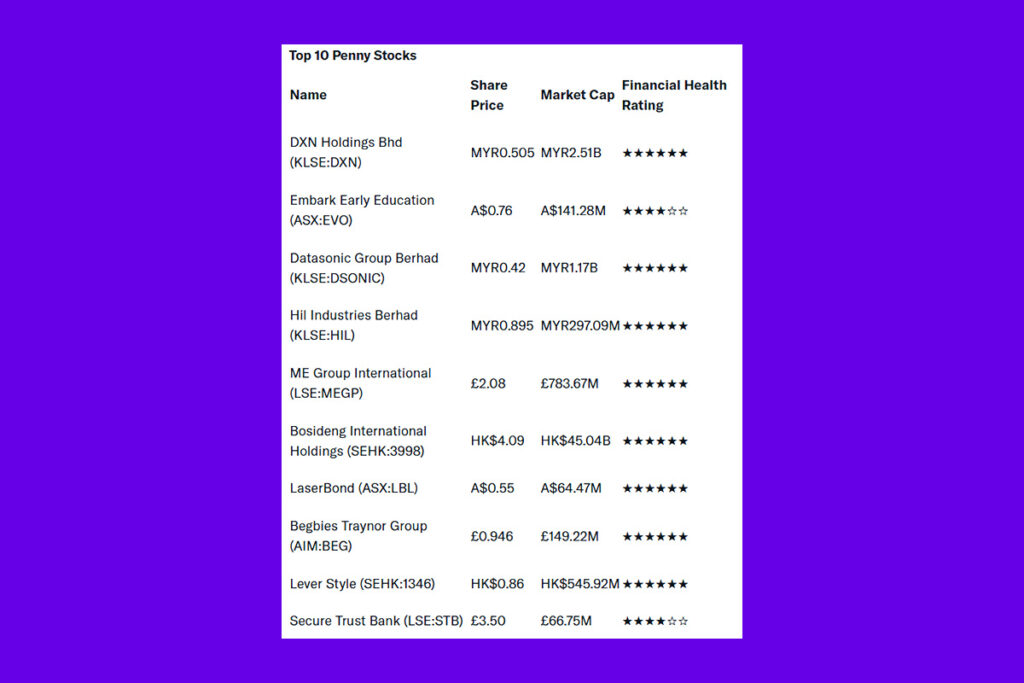

Even though the name is a little out of date, penny stocks, when supported by solid financials and development potential, can nevertheless offer substantial value. Some businesses stand out to investors looking for undiscovered chances in cheap stocks because of their strong balance sheets and bright futures. These include Daisho Microline Holdings, FIPP, and Asset Plus, all of which provide distinctive investment options across several industries.

Penny Stocks with Promising Potential: Asset Plus, FIPP, and Daisho Microline

With an emphasis on real estate investments, Asset Plus has shown steady growth in recent years. Strong asset management skills and a growing portfolio of premium properties are what set Asset Plus apart.

FIPP, which specializes in technological solutions and industrial automation, is well-known for its cutting-edge goods and robust market position. With little debt and strong cash flow, the company’s balance sheet is in good shape.

Daisho Microline Holdings, renowned for its proficiency in the semiconductor sector, has achieved noteworthy progress in the development of high-tech components and microelectronics. The corporation maintains a competitive edge because of its exceptional financials and strong focus on research and development.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment