Nvidia Shares Surge 354%: A Leader in the AI Chip Market

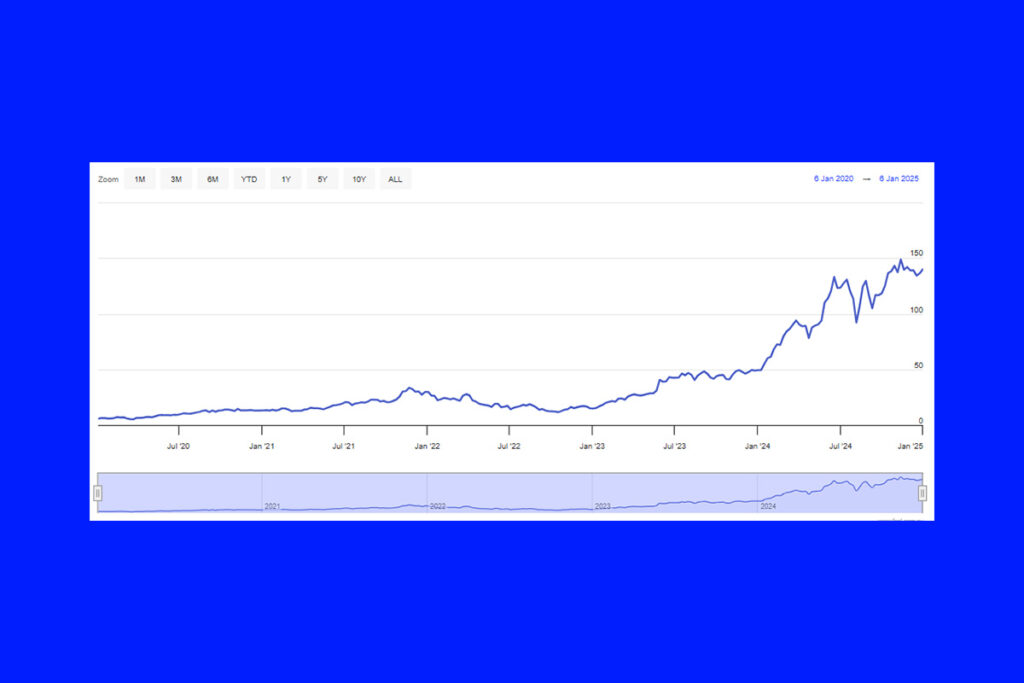

Over the last three years, investors have been much richer due to Nvidia stock, which, as of this writing, has increased an investment of $1,000 to over $4,500. Due to its leading position in the profitable artificial intelligence (AI) chip sector, the company’s shares increased by 354% during this time.

Notably, over the last three years, the chipmaker’s stock has beaten the Nasdaq Composite’s 23% growth by a wide margin. Customers and governments have been lined up to acquire Nvidia‘s AI processors in order to train and implement AI models, which has led to the company’s remarkable increase in sales and profitability and its exceptional stock market returns.

How Does Nvidia Plan to Scale to $610 Billion in Revenue by 2028?

Nvidia’s business has expanded significantly in the last three years. By adding its fiscal Q4 revenue prediction of $37.5 billion to the $91.1 billion it has made in the first nine months of the year, the corporation is on course to close fiscal 2025, which ends this month, with revenue of $128.6 billion. In contrast, Nvidia made $26.9 billion by the conclusion of fiscal year 2022, which covered most of 2021. Therefore, during the next three years, the chipmaker’s revenue is expected to grow at a compound annual growth rate (CAGR) of 68%.

By the conclusion of fiscal 2028, Nvidia’s top line could have grown to over $610 billion at a 68% CAGR over the next three years. Although that amount would initially sound very lofty, investors should be aware that Nvidia has a significant addressable market opportunity that could help it approach that amount. The data center business alone, for example, presents the company with a $1 trillion revenue prospect.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment