Nvidia Faces Trade War Fallout: Will Gamers and AI Developers Pay the Price?

It appears that the future is becoming more unpredictable as trade tensions between the largest economies in the world intensify. Even the most powerful tech companies are susceptible to market turbulence, as evidenced by the over $183 billion decline in the value of Nvidia’s shares in the last trading day alone.

The United States has levied import charges of 32% and 34% on Nvidia, which has a significant portion of its production based in Taiwan and China. This is a costly setback that can raise GPU costs and reduce consumer demand. Nvidia’s operations are under further pressure in one of its most important markets, as China isn’t standing still and is retaliating with a 34% tariff on U.S. imports.

Nvidia Could Plunge Further, Analyst Warns After Dow Jones Inclusion

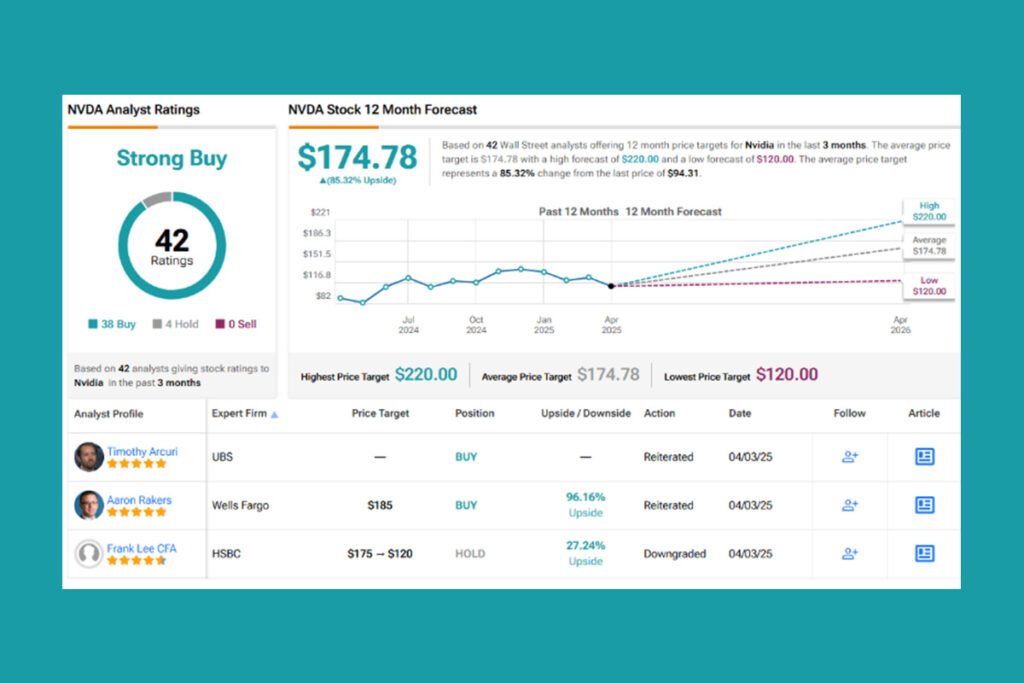

According to investor Vladimir Dimitrov, Nvidia may be severely impacted by rising tariffs, which could cause analysts to turn against the once-untouchable Wall Street favorite.

The intensifying trade war could now act as a catalyst for the equity market and sell-side analysts are likely to use it as an excuse to downgrade the stock,

Dimitrov

Another possible red flag raised by the investor is Nvidia’s recent membership in the Dow Jones Industrial Average. What many celebrated as a turning point, he saw as a peak precisely marked.

On the day prior to NVDA’s inclusion into the index I outlined the possibility of this event having serious repercussions for shareholder returns and the risks that shareholders were taking by buying NVDA near the $150 handle. Not surprisingly perhaps, NVDA stock has lost roughly 30% of its value since then. I do not expect the stock to return to its $150 level anytime soon. More downward pressure is not something that I would rule out.

Dimitrov

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment