MicroStrategy Stock – MicroStrategy’s Bitcoin Holdings Now Worth Over $30 Billion

MicroStrategy Stock – MicroStrategy (MSTR), the bitcoin-focused development company, has officially entered the ranks of the top 100 publicly traded U.S. companies, securing the 97th position as of Tuesday. The company’s impressive performance, which saw its stock price surge by 12% to over $400 a share, is closely tied to the current bitcoin rally, with the cryptocurrency hitting new all-time highs exceeding $94,000.

MicroStrategy’s 500% Year-to-Date Growth Amid Bitcoin’s Surge

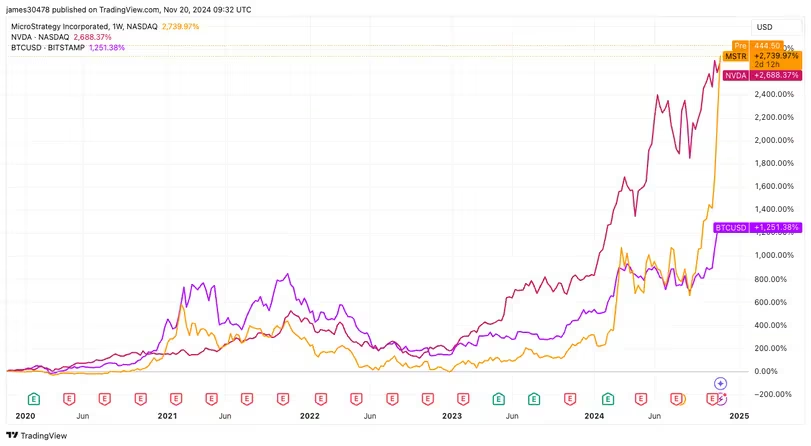

MicroStrategy has become one of the standout stories of 2024, experiencing an extraordinary 500% increase in its stock price year-to-date. This stellar performance mirrors the more than 100% rise in the price of bitcoin (BTC) over the same period.

Since adopting bitcoin as its treasury asset in August 2020, MicroStrategy has dramatically outperformed many large companies, including NVIDIA (NVDA). Over the past five years, MicroStrategy has seen a jaw-dropping 2,739% increase in its stock price, while NVIDIA, in comparison, has gained 2,688%. This highlights how significantly the company’s bitcoin strategy has paid off.

MicroStrategy’s Bitcoin Holdings Soar to $30 Billion

As of November 18, 2024, MicroStrategy holds 331,200 bitcoins, an impressive stash now valued at over $30 billion. This makes MicroStrategy the largest publicly traded bitcoin company by holdings, solidifying its position in the market. The company’s aggressive bitcoin acquisition strategy continues to be a key driver of its success.

Convertible Senior Note Issuance: MicroStrategy’s Latest Move

In a bold move to raise capital, MicroStrategy announced on November 18 that it had issued a $1.75 billion convertible senior note at a 0% coupon rate. This note, maturing on December 1, 2029, is unsecured and does not bear regular interest. The convertible note allows for early redemption or repurchase based on the terms outlined.

The issuance of the note could be oversubscribed, potentially increasing its size by $250 million, bringing the total to $2 billion. This indicates significant investor interest in MicroStrategy’s ongoing expansion and bitcoin-centric strategy.

Pre-Market Trading Shows Continued Investor Confidence

MicroStrategy’s stock continued to show positive momentum in pre-market trading on Wednesday, up over 3%. This uptick reflects growing investor confidence in the company’s long-term strategy and its position as a major player in the bitcoin market.

Leave a comment