MicroStrategy Shares Drop Slightly: Will Bitcoin’s Next Move Spark a Recovery?

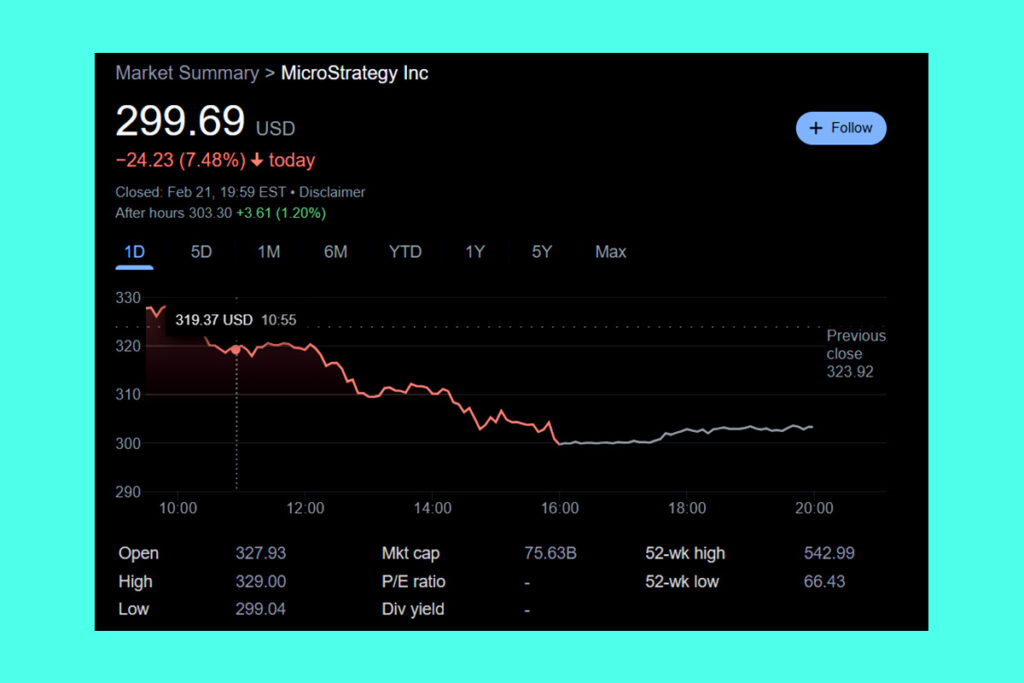

The 0.3% drop in MicroStrategy (MSTR) shares was a reflection of both the price movement of Bitcoin and general market swings. The company’s stock performance frequently reflects the volatility of the cryptocurrency because it is still one of the biggest institutional holders of Bitcoin.

MicroStrategy’s long-term optimistic outlook on Bitcoin is unaffected by the decline. The company is positioned for possible growth if Bitcoin starts another rise due to its strategy of building up BTC as a corporate reserve asset. However, investors seeking stability continue to be concerned about short-term swings.

Bitcoin’s Impact on MicroStrategy Stock: Institutional Sentiment and Fed Policies at Play

Because MicroStrategy has an aggressive BTC accumulation strategy, its stock is highly impacted by changes in the price of Bitcoin. Bitcoin’s inability to hold onto important support levels amid the recent market reversal has probably led to MSTR’s modest fall. As a major factor influencing the stock’s future performance, investors are still keeping an eye on Bitcoin’s trajectory.

The decline in MicroStrategy’s stock coincides with a confluence of institutional sentiment regarding Bitcoin, Federal Reserve policies, and economic worries. Any changes in macroeconomic conditions could have an even greater effect on MicroStrategy’s stock price because traditional markets are still hesitant.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment