Metaplanet and El Salvador Invest in Bitcoin as Prices Drop

Metaplanet and El Salvador– Ahead of the February 25 crypto market slump, both Metaplanet and El Salvador made strategic Bitcoin purchases. Over a 10-hour period, Bitcoin fell as much as 5%, but these purchases were made just before the drop.

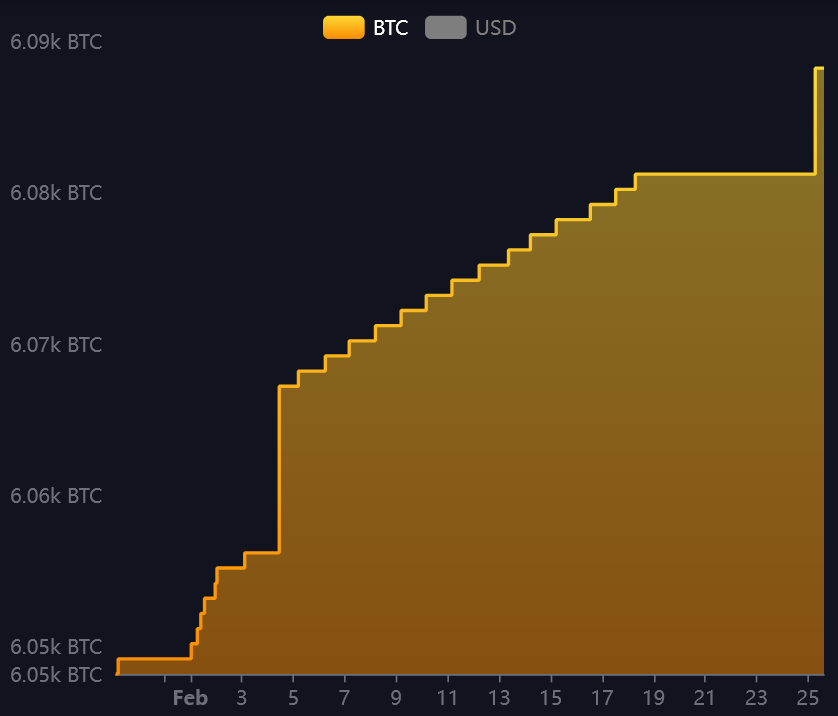

Metaplanet, a Japan-based firm, bought 135 Bitcoin for $13 million on February 25, purchasing at around $96,185 per coin. This purchase brings the company’s total Bitcoin holdings to 2,225 BTC, valued at over $205 million. The firm’s average Bitcoin purchase price stands at $81,834. Since its initial Bitcoin investment announcement in April, Metaplanet has seen a 12.7% increase on its Bitcoin investment.

According to Metaplanet, their “BTC Yield” has risen 23.3% in the current quarter, which is on track to meet the company’s target of a 35% growth per quarter. Despite this, Metaplanet’s recent Bitcoin acquisition did not result in an increase in its stock price, which fell 0.16% to ¥6,130 ($41.06) on the Tokyo Stock Exchange.

El Salvador’s Bitcoin Purchase

On February 24, El Salvador, the first country to adopt Bitcoin as legal tender, purchased 7 Bitcoin, exceeding its usual daily purchase of one Bitcoin. The purchase was made shortly before former President Donald Trump confirmed the U.S. would impose a 25% tariff on imports from Canada and Mexico, which contributed to the decline in crypto market sentiment.

This move came as El Salvador continued its Bitcoin investment strategy despite scaling back certain Bitcoin policies in a $1.4 billion agreement with the International Monetary Fund (IMF). One such adjustment was not requiring merchants to accept Bitcoin as a payment method.

Bitcoin ETF Outflows Amid Market Uncertainty

On February 24, several Bitcoin exchange-traded funds (ETFs) saw significant outflows, totaling $357.8 million. The Fidelity Wise Origin Bitcoin Fund was particularly hit, with $247 million in outflows. Meanwhile, the BlackRock iShares Bitcoin Trust experienced $159 million in outflows, highlighting investor caution amidst broader market uncertainty.

Both Metaplanet and El Salvador continue their Bitcoin investment strategies, but with the market showing signs of volatility, the future direction remains uncertain.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment