MiCA (Markets in Crypto-Assets) is a groundbreaking regulatory framework designed to bring order and stability to the cryptocurrency landscape across Europe. By addressing the chaotic nature of the market, it aims to safeguard investors, prevent fraudulent activities, and promote smoother operations in the sector.

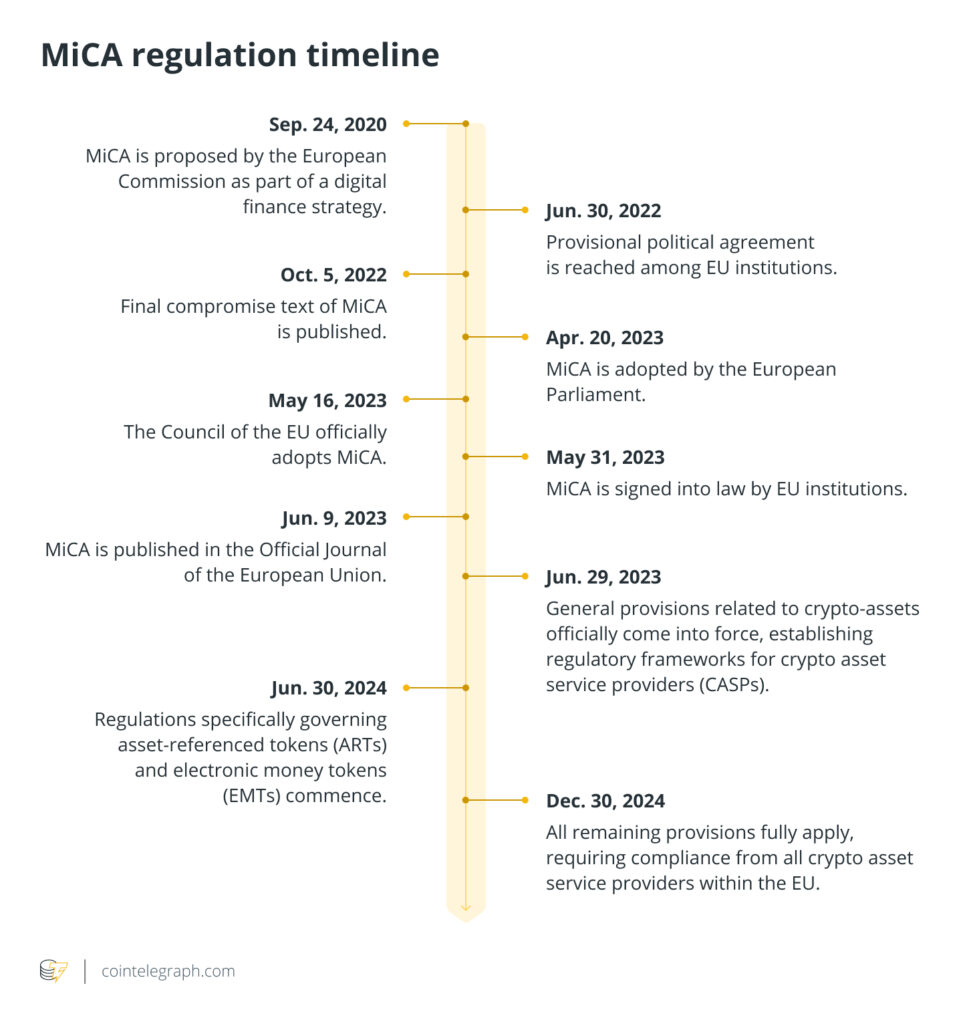

The initiative was born out of necessity, with discussions beginning in 2018 as the cryptocurrency market surged in popularity. Recognizing the pressing need for a unified approach, the European Commission formally proposed MiCA on September 24, 2020, as part of a broader strategy to enhance digital finance and protect consumers.

Why Was MiCA Introduced?

MiCA’s creation was driven by three main factors:

- Regulatory Consistency:

Before MiCA, the lack of a clear regulatory framework caused confusion among businesses and consumers. Each EU member state had different rules, complicating cross-border operations and leaving consumers with inconsistent levels of protection. MiCA resolves this by establishing a harmonized framework across the EU. - Investor Protection:

With the rapid growth of cryptocurrencies came an increase in scams and fraudulent activities. MiCA enforces strict transparency requirements, obligating crypto issuers to disclose potential risks to help investors make informed decisions. - Financial Stability:

The unregulated nature of the crypto market posed significant risks to financial systems. MiCA addresses this by setting rules to deter market manipulation and promote responsible innovation within the sector.

Timeline of MiCA Implementation

- September 2020: MiCA was officially proposed.

- May 2023: The regulation was adopted.

- December 2024: MiCA becomes fully enforceable across the EU.

While MiCA applies directly to all EU member states, its enforcement requires countries to develop national laws, which has contributed to its lengthy rollout process.

Key Elements of MiCA

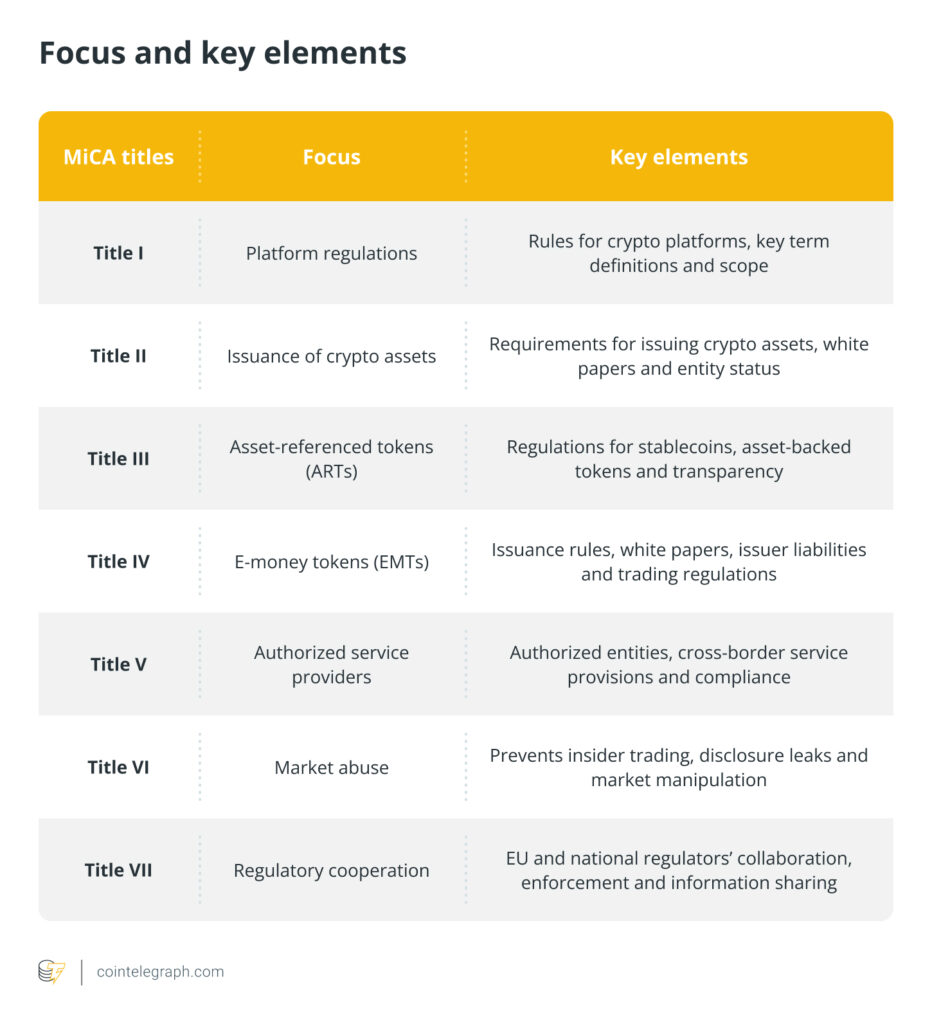

MiCA is divided into seven main titles, each addressing specific aspects of crypto regulation. Here’s a breakdown:

Title I: General Provisions

This title outlines the foundational rules for platforms that offer and trade publicly available crypto assets, defining key terms like distributed ledger technology (DLT), utility tokens, and crypto-asset services. It also clarifies the entities and operations to which the regulation applies.

Title II: Rules for Crypto Asset Issuers

Entities issuing crypto assets (excluding asset-referenced tokens or e-money tokens) must meet specific requirements:

- Legal Entity Status: The issuer must be legally established within an EU member state.

- White Paper: A detailed document outlining the purpose, technology, and risks associated with the crypto asset must be published.

- Marketing Materials: Communications must accurately describe the asset and its intended use.

- Regulatory Notification: Issuers must inform relevant authorities and provide the white paper and other necessary documentation.

Notably, MiCA excludes tokens distributed for free or those serving only as utility or payment tokens.

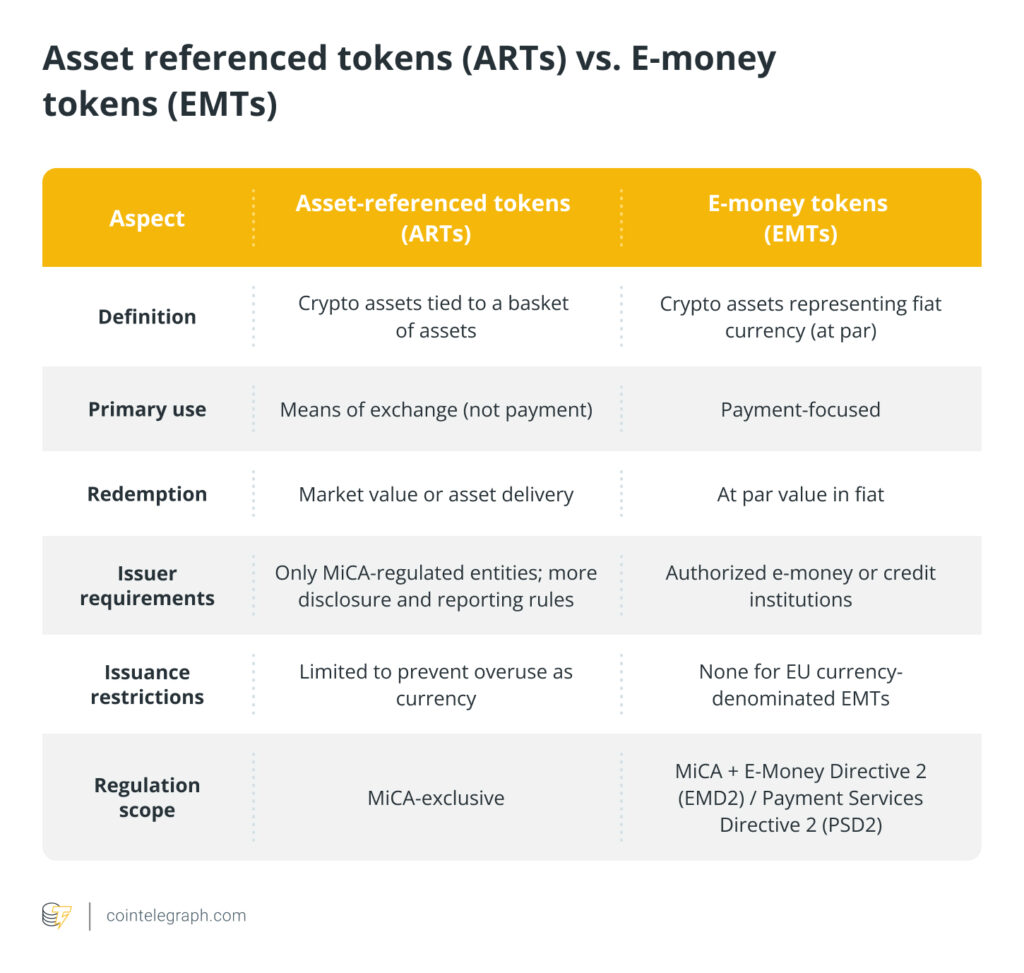

Title III: Asset-Referenced Tokens (ARTs)

Asset-referenced tokens, or stablecoins, are pegged to a mix of assets to maintain value stability. Issuers of ARTs must adhere to strict rules, including:

- Maintaining Reserves: Backing tokens with adequate collateral such as fiat currencies, commodities, or other cryptocurrencies.

- Transparency: Disclosing the assets backing the token and ensuring operational stability.

For example, a token like “EcoCoin,” backed by a combination of euros, gold, and Bitcoin, would fall under these regulations.

Title IV: E-Money Tokens (EMTs)

E-money tokens are pegged to official currencies like the euro or dollar, functioning as digital equivalents of fiat money. Issuers must:

- Obtain Authorization: Be licensed as a credit institution or electronic money institution.

- Submit a White Paper: Clearly explain the token’s features and redemption process.

- Ensure Transparency: Notify authorities and provide investors with accurate information.

Additionally, platforms are prohibited from trading EMTs with built-in anonymization features unless transactions and traders can be fully identified.

Title V: Crypto-Asset Service Providers

This title specifies the types of institutions authorized to offer crypto-related services, including credit institutions, investment firms, and electronic money institutions. It simplifies cross-border operations, allowing licensed entities to provide services across the EU with proper notifications.

Title VI: Market Abuse Regulations

Title VI addresses practices like insider trading and market manipulation:

- Insider Trading: Prohibits trading based on non-public information.

- Market Manipulation: Bans activities like wash trading or spreading false information to influence market prices.

These rules apply to both centralized and decentralized platforms, ensuring fair practices across the ecosystem.

Title VII: Regulatory Collaboration

This section establishes a framework for cooperation among national and EU regulators, outlining:

- The designation of National Competent Authorities (NCAs) in each member state.

- Cross-border collaboration for tackling issues like fraud or manipulation.

- Enforcement powers, including penalties for non-compliance.

Exclusions: What MiCA Doesn’t Cover

MiCA carefully delineates the assets outside its scope, including:

- Financial Instruments: Covered under other EU laws.

- Insurance Policies, Pension Products, and Social Security Schemes.

- Non-Fractionalized NFTs: Unique digital assets with no utility or trading functionality.

- Central Bank Digital Currencies (CBDCs): Issued by central banks.

For instance, a unique NFT representing digital art would not be subject to MiCA unless it provides additional utility or serves as a tradable asset.

The Future of MiCA

By 2025, MiCA’s provisions will be fully implemented, establishing a robust regulatory framework. Its success may inspire other regions, including the U.S., U.K., and Singapore, to adopt similar approaches, fostering global alignment in cryptocurrency regulation.

MiCA is more than just a regulatory milestone—it’s a foundation for safer, more transparent crypto markets, ensuring consumer protection and promoting innovation worldwide.

Leave a comment