Market Uncertainty Hits DeFi: What’s Behind the Decline?

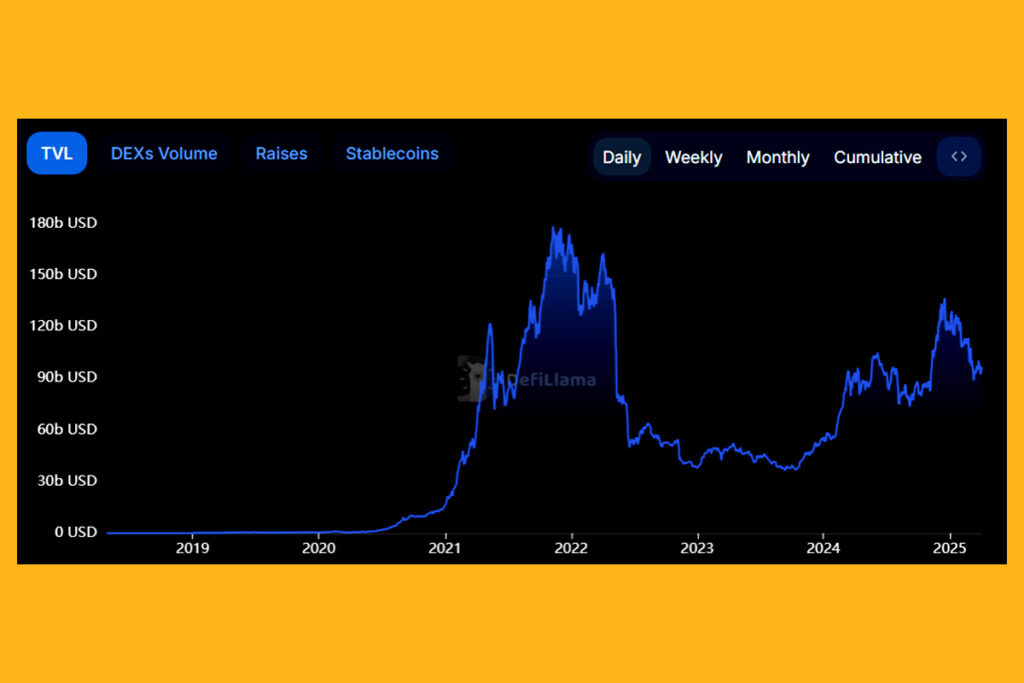

DeFi’s TVL is at $94.49 billion, according to DefiLlama data, after steadily declining from its peak of $137 billion on December 17. Last month, the DeFi TVL also fell to a new low of $88 billion. DeFi’s locking value spike coincides with the general crypto market’s, which was sparked by the election of pro-crypto U.S. President Donald Trump on November 5. The current TVL of $94.49 billion is comparable to levels seen before a sharp increase above $100 billion, around the time of the election.

The drop illustrates how market uncertainty can significantly impact decentralized finance. Both Ethereum and Bitcoin have experienced a decrease in active addresses over the past week, signaling a shift in user confidence amid price corrections, rising competition from other blockchains, and looming macroeconomic concerns.

Kronos Research CIO Vincent Liu

Liu said that in addition to the stability of cryptocurrency prices, the DeFi industry needs to continue innovating if it is to regain its momentum. According to Liu, a possible reversal in Trump’s tariff plans and next week’s strong U.S. consumer price index data could help DeFi recover through a wider market recovery for the time being.

DeFi Struggles as Trump’s Trade War Shakes Crypto Markets!

As the U.S. President unveiled massive reciprocal tariffs on trading partners, the Trump-led cryptocurrency boom waned in the first quarter, overshadowing the optimistic atmosphere surrounding the administration’s prior pro-crypto initiatives. Worsening sentiment was further exacerbated by tariffs, concerns about sustained U.S. inflation, and a protracted halt to rate decreases by the Federal Reserve. The DeFi ecosystem has not matured enough, according to HashKey Research Director Kevin Guo, who also ascribed the DeFi drop to the challenging macroeconomic climate.

While the broader DeFi ecosystem has matured over the past few years, it still needs to mature further to build integrations with institutions and financial products at competitive rates and security assurances that licensed exchanges currently offer. Retail investors may find DeFi less accessible due to complicated interfaces, higher fees, and complicated custody practices, while seasoned traders still rely on the liquidity and tooling that are housed by licensed exchanges.

Guo

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment