Is Bitcoin on the Verge of Another Rally? Long-Term BTC Holders Say Yes

When traders start unloading their holdings of precious assets, it can often be interpreted as an indication of an imminent market drop. However, the story is different in the cryptocurrency market, where analysts who look at past patterns in the supply held by long-term investors or wallets that have held coins for at least 155 days or more than five months claim that such selling signals bullishness.

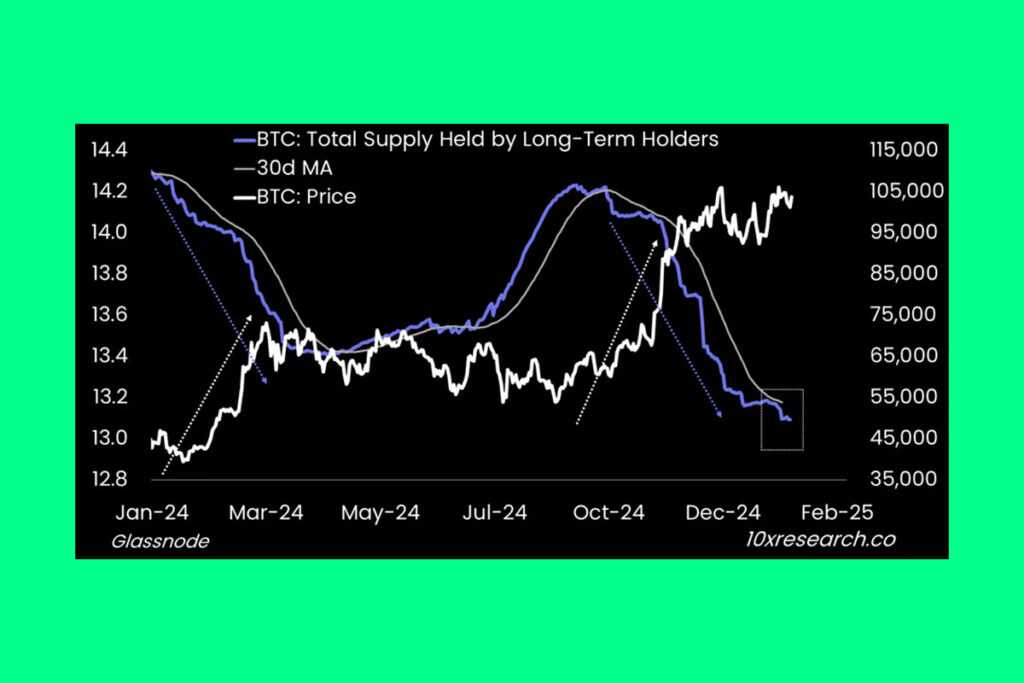

Based on our analysis, sharp declines in long-term holder supply (purple line) have frequently coincided with strong bitcoin rallies (white line), as seen in Q1 and Q4 of 2024. As long as long-term holders continue reducing their balances, Bitcoin remains at risk of a short squeeze to the upside,

Markus Thielen, founder of 10x Research

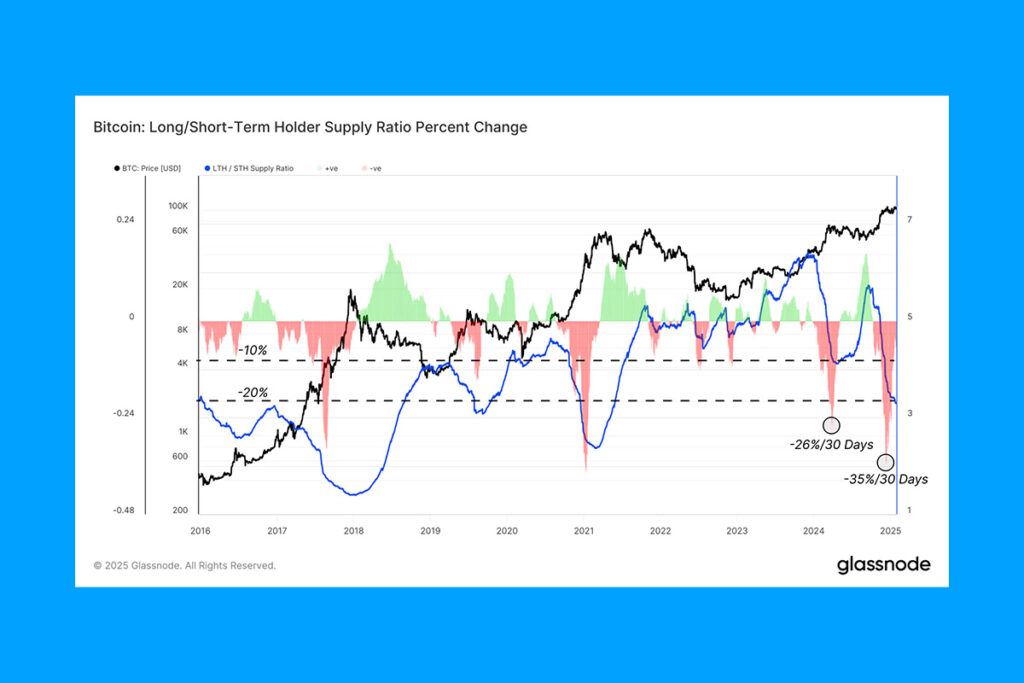

These wallets’ total holdings have decreased to almost 13 million Bitcoin. As short-term traders snatched up the long-term holder distribution, more than a million Bitcoins have exchanged hands during the current price spike above $100,000, according to analytics firm Glassnode.

During the recent rally above $100K, 1.1M BTC have transferred from long-term to short-term holders, representing an impressive inflow of demand to absorb this supply at prices above $90K,

Glassnode

The Changing Bitcoin Liquidity Landscape: Supply Shock or ETF Shift?

However, the rate of sales by long-term holders has slowed. The monthly rate of change in the long-term to short-term holder supply ratio makes this slowing clear. It’s less damaging now than it was at the beginning of the month, suggesting that long-term holders are selling more gradually.

Many people consider the withdrawal of Bitcoin from exchanges, which lowers the quantity of coins available for immediate sale, to be a bullish sign. However, since spot ETFs were introduced in the United States a year ago, the dynamics have shifted.

While many interpret this as a form of supply shock caused by a mass of coins being withdrawn by individual investors—potentially creating upward price pressure—we believe the majority of this decline stems from coins reshuffling into ETF wallets managed by custodians like Coinbase,

Glassnode

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment