What’s Next for MicroStrategy’s Bitcoin Strategy in 2025?

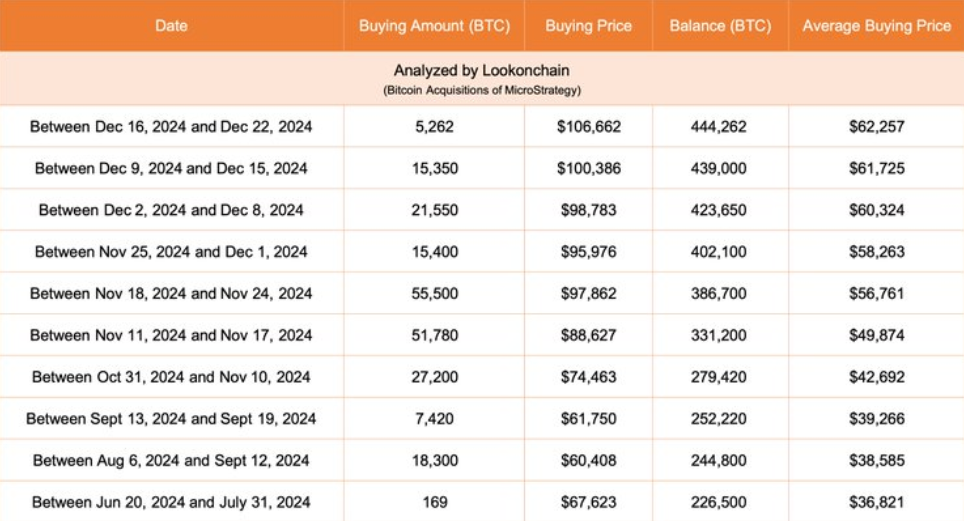

MicroStrategy, the corporate Bitcoin investor led by Michael Saylor, has continued its aggressive Bitcoin acquisition strategy, purchasing an additional 5,262 BTC between December 16 and December 22. The purchase, totaling around $561 million, comes as part of the company’s ongoing commitment to accumulate Bitcoin even at peak prices. This latest buy brings MicroStrategy’s total holdings to 444,262 BTC, which were acquired at a total cost of $27.7 billion, with an average purchase price of $62,257 per Bitcoin.

MicroStrategy’s Bitcoin Buying Pace Slows in December

While MicroStrategy’s Bitcoin purchasing spree has slowed compared to previous months, it still remains an active player in the market. In the last three weeks, the company has added 42,162 BTC to its holdings, worth around $4 billion. However, the most recent purchase represents only about 12% of its December Bitcoin acquisitions. This is a noticeable decrease from previous months, where the firm made larger purchases. The December 23 purchase is 191% smaller than the one announced just a week earlier on December 16, and 309% smaller than the purchase announced on December 9.

Is a ‘Blackout’ Period Looming for MicroStrategy in 2025?

MicroStrategy’s decision to scale back its Bitcoin buying comes amidst market speculations and warnings from figures like Arthur Hayes, co-founder of BitMEX. Hayes has cautioned that a market drop could be triggered by the upcoming inauguration of U.S. President-elect Donald Trump. His fund, Maelstrom, is reportedly planning to clear some positions and buy back at lower prices. There are also rumors circulating that MicroStrategy may enter a ‘blackout’ period in January 2025, potentially halting its ability to issue shares or convertible bonds to fund further Bitcoin purchases.

Michael Saylor’s Commitment to Bitcoin

Despite the potential slowdown in purchasing, MicroStrategy’s founder Michael Saylor has remained steadfast in his commitment to Bitcoin. Speaking in early December, Saylor reiterated his belief that he will continue purchasing Bitcoin even if its price reaches $1 million per coin. He boldly stated, “I’m sure that I will be buying Bitcoin at $1 million a coin — probably $1 billion dollars a day of Bitcoin at $1 million a coin.”

MicroStrategy’s strategy continues to make headlines as the firm stays focused on its long-term vision of Bitcoin as a store of value. Whether the company enters a period of pause or continues to buy aggressively, the Bitcoin investment narrative remains a critical part of its corporate structure.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment