Impact of FOMC Meeting on Bitcoin: How the Meeting Could Impact BTC Prices?

One of the financial calendar’s most anticipated events, the Federal Open Market Committee meeting, has a significant impact on markets worldwide. Bitcoin, which is notoriously sensitive to macroeconomic developments, is at a critical point in time as traders prepare for possible volatility before the meeting.

The FOMC controls a significant portion of U.S. monetary policy by deciding on interest rates and liquidity measures. These gatherings frequently result in strong market reactions for Bitcoin. For instance, in the past, FOMC statements have caused significant price reactions for Bitcoin, with increased volatility in the hours and days that follow the decisions.

Low Trading Volumes Raise Questions Ahead of Bitcoin’s FOMC Rally

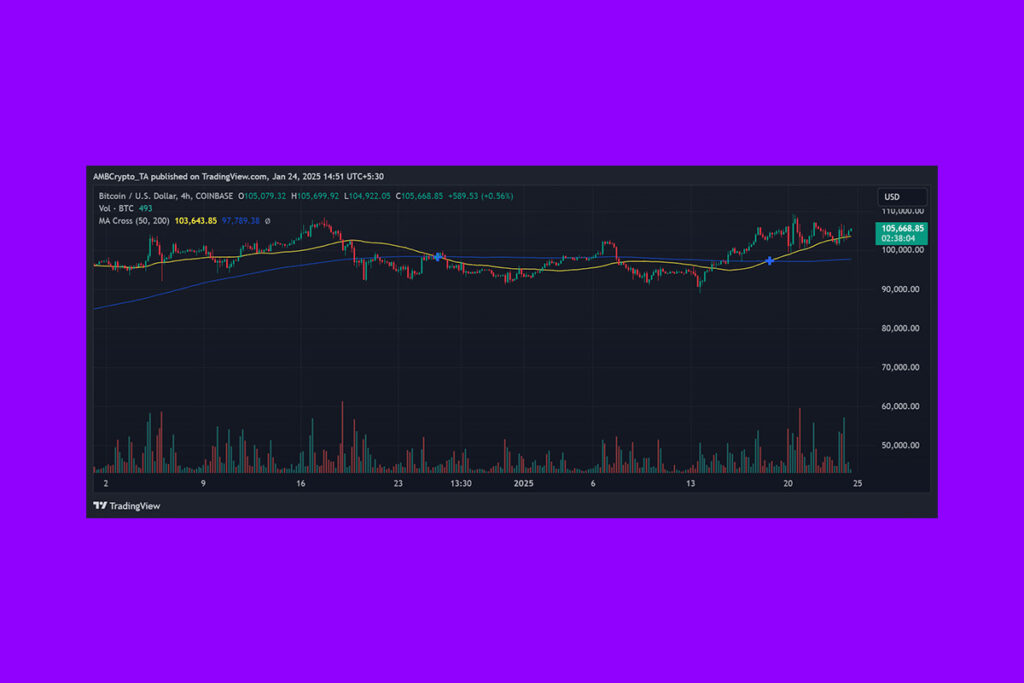

Analyzing Bitcoin’s recent price trends may provide some useful insights into how the cryptocurrency might behave in the run-up to the FOMC meeting. Bitcoin was trading just below $106,000, a significant resistance mark, on the 4-hour chart. Strong support was located at $102,750, which would have cushioned the loss, but a breach here would indicate a rally to $110,000. With the 50-day moving average advancing above the 200-day average, moving averages showed a bullish situation. But recently, trading volumes have stayed muted.

The MACD indicator showed positive momentum on the daily chart, suggesting a bullish continuation. However, a divergence that can indicate waning momentum makes traders cautious. According to the Fear & Greed Index, sentiment was mostly positive at the time of writing. It is still susceptible to hawkish acts from the FOMC, though.

Bitcoin’s Post-FOMC Recovery Hangs on Dovish Signals From the Fed

The price of Bitcoin fluctuated significantly in the run-up to the most recent FOMC report. In the beginning, Bitcoin soared to a record high of almost $109,356. However, the price of Bitcoin fell by around 15% to about $92,800 after the FOMC meeting, when the Federal Reserve predicted fewer interest rate reductions in 2025 than expected. The Fed’s hawkish stance and the associated rise of the US dollar, which frequently has a negative impact on Bitcoin’s value, were factors in this decline.

In the end, Bitcoin’s immediate trajectory will be determined by the FOMC’s decision. A dovish turn might push Bitcoin above the resistance, while a hawkish surprise could push it below its main support.

For more up-to-date crypto news, you can follow Crypto Data Space.

1 Comment