Crypto News – BlackRock’s IBIT spot bitcoin exchange-traded fund had net inflows of $10 billion on Friday, a feat accomplished in just two months.

IBIT Spot Bitcoin ETF Inflows Surpass $10 Billion as Newborn Nine Hits $20 Billion

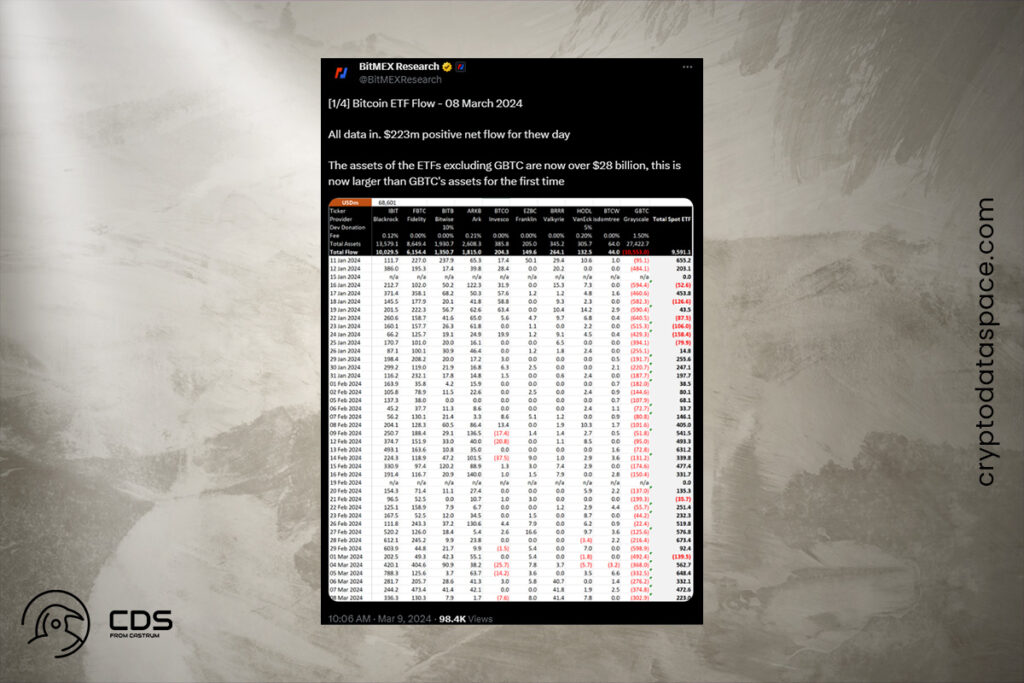

Grayscale’s converted GBTC fund alone saw outflows of $10.55 billion, nearly canceling out IBIT’s total flows of $10.03 billion. It is also similar to the $10.1 billion in inflows from the other eight spot bitcoin ETFs put together, with the newly launched nine ETFs (not including GBTC) surpassing 20 billion on Friday. Over $9.5 billion has been received in net inflows for all products to date.

On Friday, IBIT recorded $336.3 million in inflows, once again leading the daily flows. BitMEX Research data shows that Valkyrie’s BRRR came in third with $41.4 million, and Fidelity’s FBTC came in second with $130.3 million in inflows.

iShares Bitcoin BTC ETF has eclipsed $10 billion net inflows. That’s net inflows in 40 days. Pulling down an average of $250 million/day. Now at $13.6 billion AUM. For context, Ark Invest has about $16.5 billion total assets. Firm launched in 2014.

Nate Geraci, The ETF Store President

Leave a comment