Crypto News – Of the nine Bitcoin ETFs that were just introduced, BlackRock and Fidelity have seen inflows of $1.2 billion each in the direction of the north.

IBIT and FBTC ETFs Reach Over $4 billion in AUM

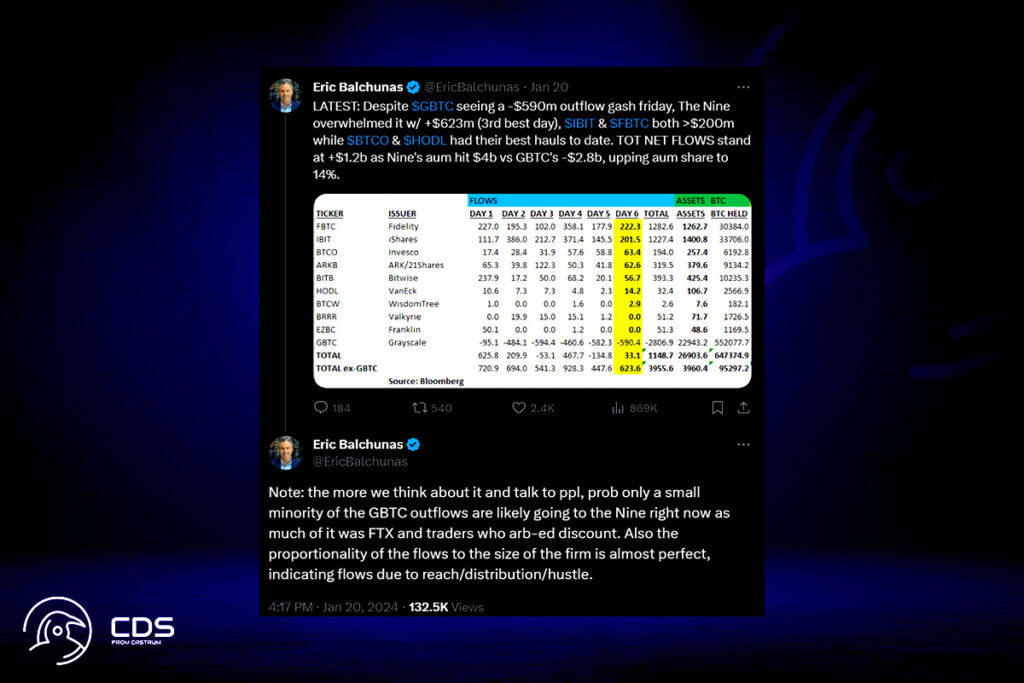

The newly established “Newborn Nine” Bitcoin ETFs have accomplished a noteworthy benchmark, with their combined assets under management (AUM) reaching 95,000 BTC, or around $4 billion, based on obtainable statistics. Eric Balchunas, a Bloomberg ETF analyst, highlights the significant capital inflow into these ETFs, underscoring the growing acceptability of cryptocurrencies in mainstream finance as well as the growing hunger of investors for digital assets.

ETFs Other Than IBIT and FBTC are Also Rising

The Newborn Nine has defied the trend in an industry where many ETFs see a fall in trading volume following launch. These ETFs saw an astounding 34% spike in volume on the fifth day of trading, with Fidelity’s FBTC and BlackRock’s IBIT leading the increase. In this short time, investors have made significant inflows totaling over $1.2 billion into BlackRock’s IBIT and Fidelity’s FBTC, which each contain little more than 30,000 Bitcoin.

AUM has not yet topped $200 million, but other noteworthy ETFs in the group include Invesco’s ETF, which had over $63 million in trading on its biggest day on January 19. The performance of VanEck’s ETF has been comparable; on the sixth day of trading, its AUM exceeded $100 million.

Leave a comment