Crypto correlation offers investors valuable insights into how digital assets interact with traditional financial instruments, enabling more effective risk management and portfolio diversification. Navigating the volatility of cryptocurrency markets requires strategic planning, and understanding asset correlations can be a game-changer for building a balanced investment portfolio.

Why Crypto Correlation Matters in Risk Management

Managing cryptocurrency investments is inherently challenging due to the market’s unpredictable nature. To mitigate risks, investors often diversify their portfolios, combining cryptocurrencies with traditional equities, bonds, and commodities.

Crypto correlation helps investors understand how different assets within their portfolio interact. By analyzing these relationships, you can optimize your risk management strategy, ensuring a robust and diversified portfolio less vulnerable to sudden market swings.

What Is Crypto Correlation?

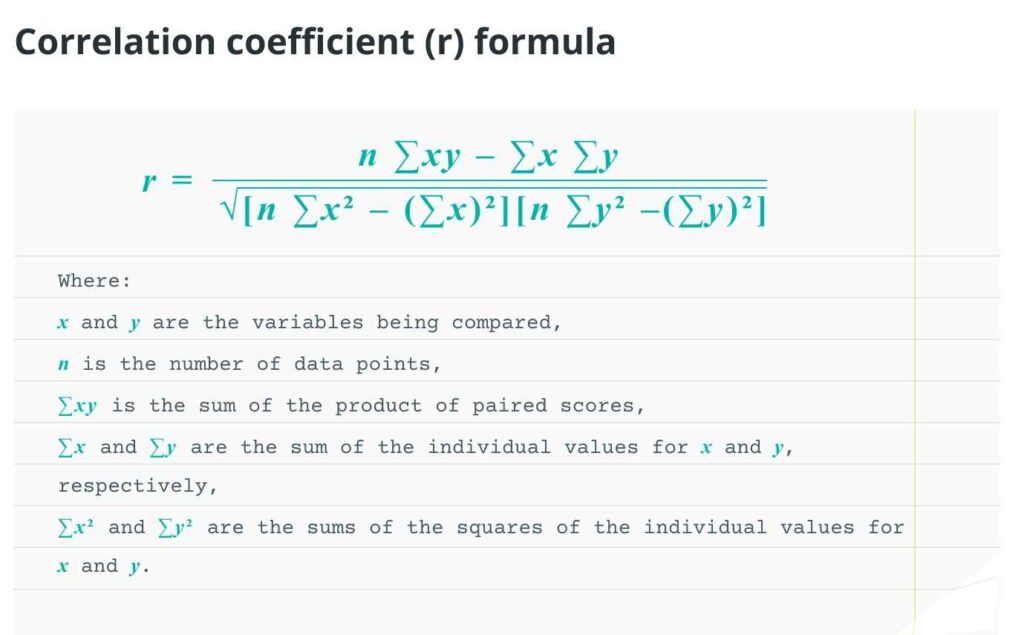

Crypto correlation is a mathematical measure of how the price movements of cryptocurrency align with other assets. It’s expressed as a correlation coefficient, which ranges between +1.0 and -1.0:

- Positive Correlation: When two assets move in the same direction. A perfect positive correlation is +1.0.

- Negative Correlation: When two assets move in opposite directions. A perfect negative correlation is -1.0.

- No Correlation: When the price movements of one asset are completely independent of the other, represented by a coefficient of 0.

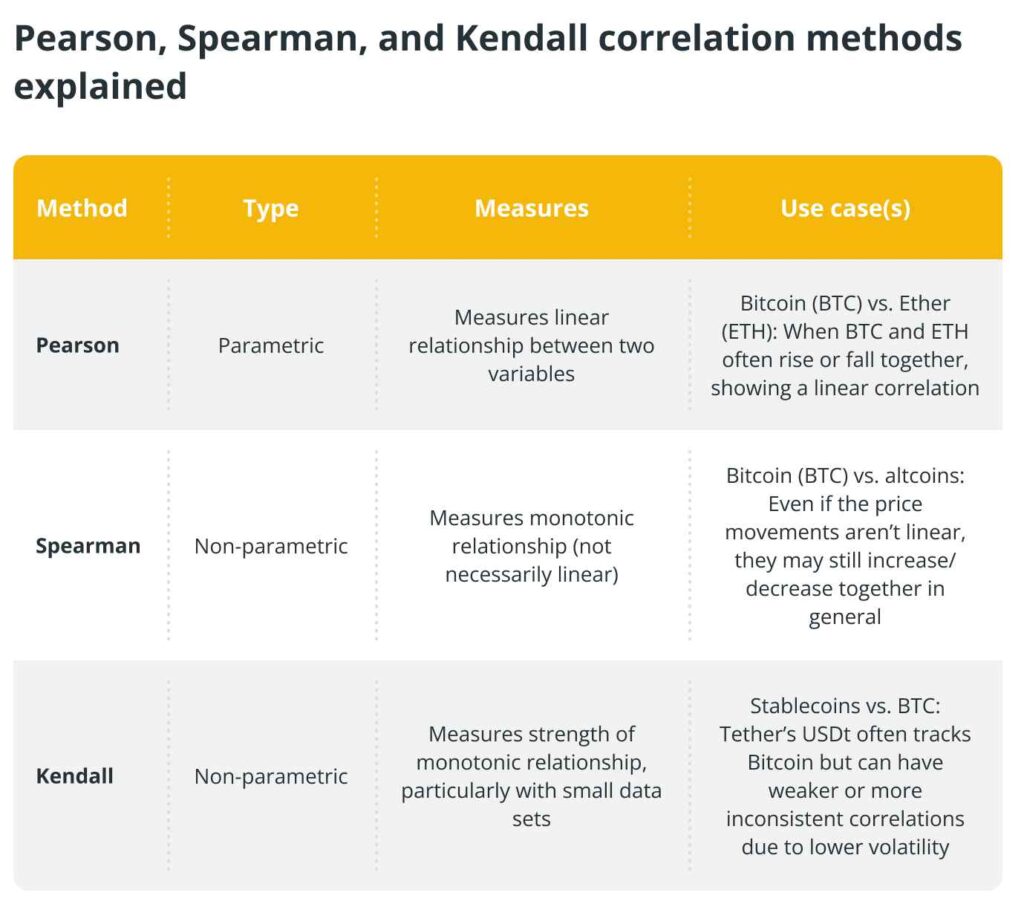

The Pearson method is commonly used to calculate correlation coefficients. However, alternative approaches like Spearman rank correlation and Kendall’s Tau are useful for specific datasets, offering additional insights for complex market behaviors.

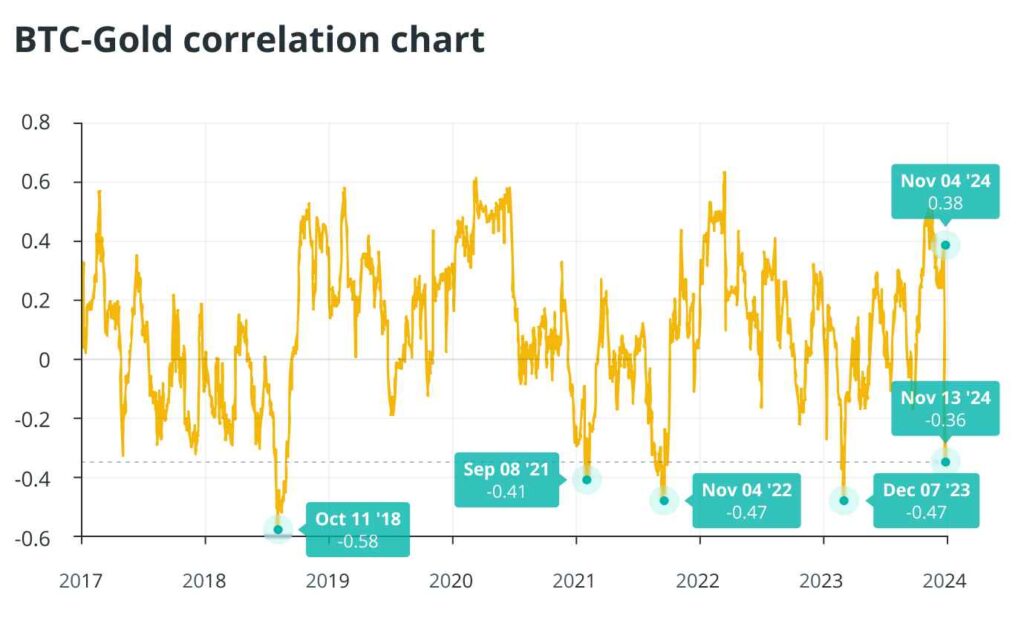

The Evolving Relationship Between Bitcoin and Gold

As a case study, Bitcoin and gold provide an interesting dynamic. Gold, often considered a safe-haven asset, typically rises when equities decline. In contrast, Bitcoin’s behavior is more erratic.

Historical Insights

- In October 2018, Bitcoin and gold had a strong negative correlation (-0.58). When gold prices increased, Bitcoin values decreased, and vice versa.

- By November 2024, the correlation stood at -0.36, showing a moderate tendency for Bitcoin and gold to move inversely, though not consistently.

Election Impact on Gold and Bitcoin

The 2024 U.S. presidential election triggered significant asset shifts. Gold dropped over 4% after Donald Trump’s victory, reflecting diminished safe-haven demand, while Bitcoin’s moderate negative correlation with gold (-0.36) highlighted differing investor reactions to political and economic changes.

Using Crypto Correlation to Mitigate Risk

Understanding correlation is vital for crafting effective risk management strategies in crypto investing. Cryptocurrencies are notoriously volatile, and their rapid price swings can expose portfolios to substantial risk.

Investors often reduce their exposure during strong market periods by taking profits and reallocating assets to those with less volatility or a negative correlation to cryptocurrencies. Conversely, some traders use positive correlations to anticipate market reactions and explore related investment opportunities, such as blockchain-focused exchange-traded funds (ETFs).

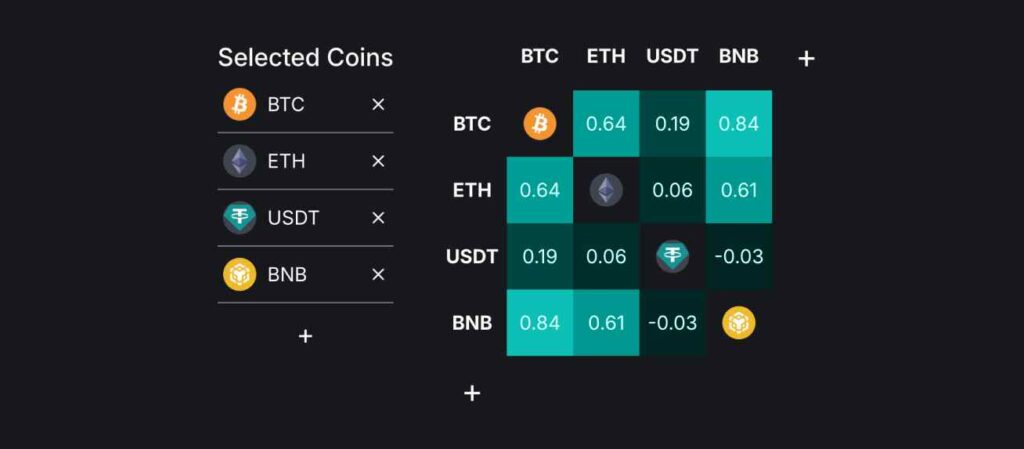

Diversifying Your Portfolio With Correlation Insights

Diversification is the cornerstone of risk management. A well-balanced portfolio includes assets with varying correlations to minimize losses during market downturns. For instance, pairing cryptocurrencies with negatively correlated or uncorrelated assets can shield your investments from market volatility.

Example:

Recent data shows an increasing correlation between cryptocurrencies and the S&P 500, rising from 0.54 to 0.80. This trend suggests that cryptocurrencies are behaving more like equities, making diversification strategies even more critical.

How to Measure Crypto Correlation

While calculating crypto correlation can be complex, several tools and platforms simplify the process:

- Choose a data source: Reliable providers like CoinMarketCap, CoinGecko, or Bloomberg.

- Gather historical data: Download price histories for your chosen assets.

- Select a calculation method: Options include Pearson, Spearman, or Kendall.

- Analyze data: Use tools like Excel, Google Sheets, Python, or R to visualize correlations.

Tools for Crypto Correlation Analysis

- BlockchainCenter: Offers interactive tools for comparing crypto correlations with traditional assets like gold and the S&P 500.

- DefiLlama: Provides Pearson coefficients for Bitcoin and altcoin trends, customizable with personal data.

- Coin Metrics: Features advanced platforms for analyzing multiple correlation methods.

Avoiding Common Mistakes in Crypto Correlation

While crypto correlation offers valuable insights, there are pitfalls to avoid:

- Over-relying on historical data: Past trends don’t guarantee future performance. Regulatory changes and economic shifts can drastically alter correlations.

- Ignoring market conditions: Event-driven volatility can cause unexpected changes in asset relationships, impacting portfolio performance.

- Misinterpreting data: Incorrect calculations or flawed analysis can lead to poor investment decisions and increased risk.

By staying vigilant and adapting to market conditions, you can use crypto correlation to create a resilient investment strategy.

Conclusion

Crypto correlation is a powerful tool for managing risk in volatile markets. By analyzing how cryptocurrencies interact with other assets, investors can build diversified portfolios that reduce risk and maximize returns. With the right tools and strategies, you can turn crypto correlation into a cornerstone of your investment approach.

Leave a comment