How to Buy Gold with Bitcoin in 2025

Interested in purchasing gold with Bitcoin in 2025? Learn about secure transaction methods, the best platforms to use, tax implications, and strategies to avoid common pitfalls.

Why Use Bitcoin to Buy Gold?

Bitcoin (BTC) and gold share a unique appeal as reliable stores of value. While Bitcoin, the pioneering cryptocurrency, is a digital asset known for its price volatility and high growth potential, gold boasts a centuries-old reputation as a stable means of preserving wealth. Combining these two assets allows for diversification, mitigating risks while optimizing financial growth strategies.

Using Bitcoin to acquire gold offers numerous advantages, such as bypassing currency conversion fees, facilitating faster transactions, and seamlessly diversifying wealth within the crypto ecosystem. Gold’s stability complements Bitcoin’s dynamic value, making this pairing a robust hedge against market fluctuations.

Steps to Purchase Gold with Bitcoin

Step 1: Identify Trusted Gold Vendors

Begin by researching reputable gold dealers that accept BTC. Look for customer reviews, certifications, and robust security measures. Assess their inventory, which typically includes:

- Gold Bars: High-purity, rectangular blocks, ideal for substantial investments.

- Gold Coins: Smaller, legal-tender coins, often collectible and sold at a premium.

- Gold Rounds: Non-legal tender discs, offering cost-effective investment options.

Compare offerings by weight, purity, and fees to ensure you get the best value.

Step 2: Review Vendor Terms

Understand the dealer’s policies on pricing, delivery, and refunds. Given Bitcoin’s price volatility, review the BTC-to-gold conversion rates and ensure transparency.

Step 3: Set Up a Bitcoin Wallet

If you don’t already have one, create a secure Bitcoin wallet. Options include:

- Crypto Exchange Wallets: Platforms like Binance or Coinbase.

- Self-Custody Wallets: Trust Wallet or MetaMask for greater control.

- Hardware Wallets: For maximum security, use a hardware wallet and transfer a portion to a software wallet for transactions.

Step 4: Place Your Order

To buy gold:

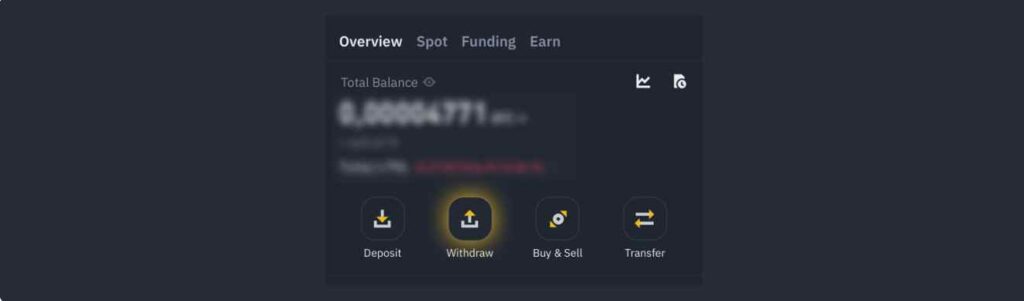

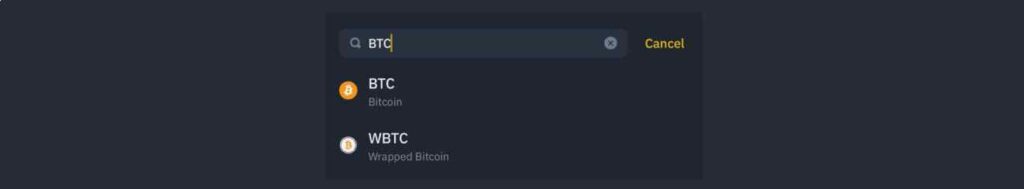

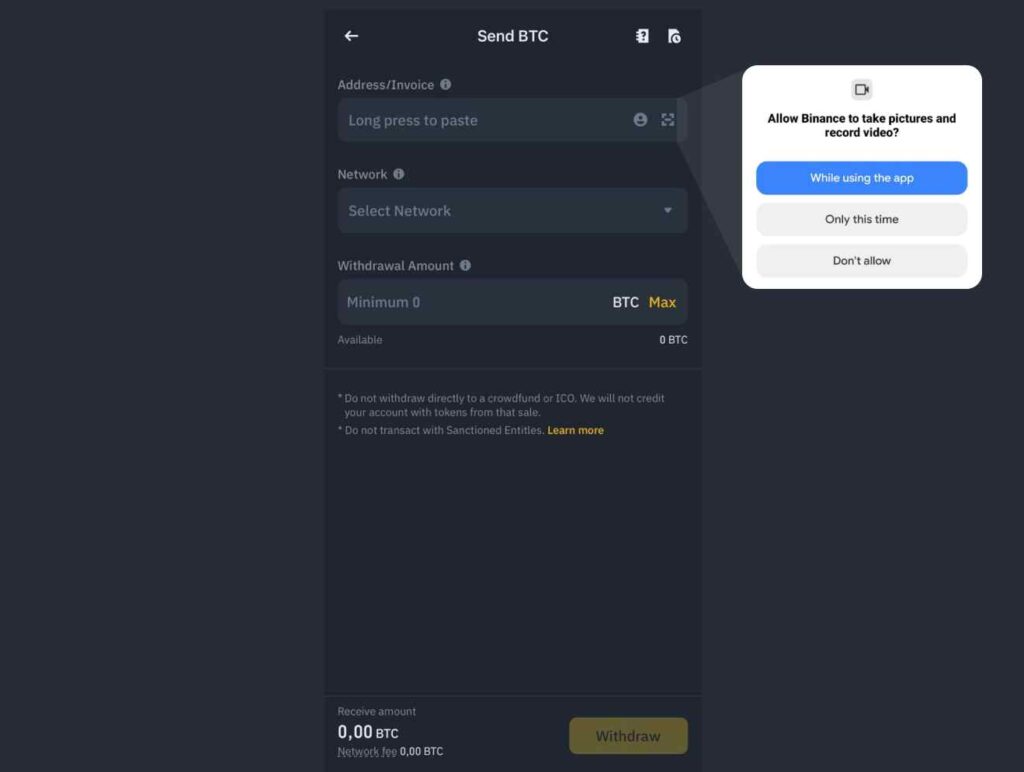

- Access your wallet and select “Withdraw.”

- Enter the dealer’s wallet address and amount. Double-check details to avoid errors, as crypto transactions are irreversible.

- Alternatively, use a QR code for seamless payment.

- Retain the transaction ID as proof of payment.

Step 5: Arrange Delivery or Storage

Once payment is confirmed, choose between:

- Physical Delivery: Receive gold directly at your address.

- Secure Vault Storage: A reliable option for protecting valuable assets.

Gold ETFs and Bitcoin: A Modern Approach

Gold Exchange-Traded Funds (ETFs) track gold prices, allowing investors to gain exposure to the commodity without physical ownership. With BTC’s increasing acceptance, you can now purchase gold-backed ETFs using BTC.

Benefits of Gold ETFs with BTC

- Liquidity: Easily tradeable on stock exchanges.

- Convenience: No need for secure physical storage.

- Global Access: Invest from anywhere using Bitcoin.

- Portfolio Diversification: Add stability to your crypto-heavy portfolio.

Before purchasing, choose a reputable platform and verify conversion rates to avoid hidden costs.

Tokenized Gold: The Best of Both Worlds

Tokenized gold represents ownership of physical gold on a blockchain. Each token is backed by a specific quantity of gold, providing digital accessibility and tradability.

Advantages of Tokenized Gold

- Transparency: Blockchain technology ensures secure and efficient transactions.

- Liquidity: Easily tradeable without intermediary involvement.

- Portfolio Diversification: A convenient way to hedge against crypto volatility.

Platforms like Tether Gold offer a seamless way to combine Bitcoin’s flexibility with gold’s enduring value.

Tax Implications of Buying Gold with Bitcoin

Purchasing gold with BTC often triggers tax events. Regulations vary by jurisdiction:

- United States: The IRS considers Bitcoin a taxable property. Buying gold with BTC may result in capital gains tax.

- United Kingdom: Transactions may incur capital gains or income taxes based on thresholds.

- Germany: Crypto gains are taxed at personal income tax rates (0%-45%).

- Singapore: No capital gains tax, but an 8% GST applies to fees.

- Japan: Crypto profits are taxed as income, with effective rates of 15%-55%.

Consult a tax advisor to navigate these complexities and remain compliant.

Risks of Buying Gold with Bitcoin

While rewarding, purchasing gold with BTC comes with challenges:

- Price Volatility: BTC’s value fluctuations may impact exchange rates.

- Tax Liabilities: Jurisdictions may classify these transactions as taxable events.

- Counterparty Risk: Unverified dealers pose fraud risks.

- Irreversible Transactions: Errors during payments can result in loss.

To mitigate risks, choose reliable vendors, verify regulatory compliance, and double-check transaction details.

Conclusion

Buying gold with BTC bridges the gap between traditional and digital assets, creating a forward-thinking financial strategy. Whether you prefer physical gold, ETFs, or tokenized gold, integrating BTC into your investment portfolio can enhance wealth management flexibility. Always conduct thorough research, remain aware of tax obligations, and adopt secure transaction practices to maximize the benefits of this innovative investment approach.

Leave a comment