Hawkish Fed Decision Triggers Spike in Bitcoin Put Option Premiums

With Chairman Jerome Powell lowering interest rates on Wednesday but expressing caution about the pace and scope of further reduction, cryptocurrency traders’ early concerns about a hawkish Fed came to fruition. And the sentiment has now soured.

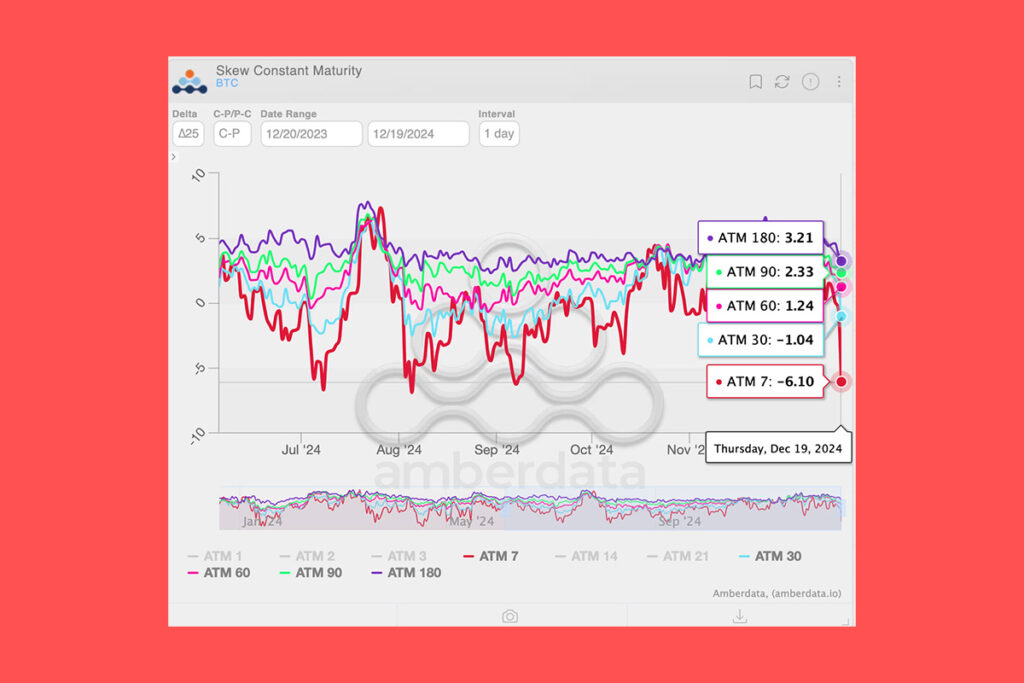

Amberdata data indicates a noteworthy pattern in Bitcoin’s seven-day call-put skew. Deribit’s put options, which provide protection against the downside and have a one-week expiration date, have been trading at their biggest implied volatility premium to call options since September. In other words, over a three-month period, put options are the most expensive relative to calls. It is an indication of traders rushing to protect their optimistic wagers from a possible extension of the price decline that was set off by a hawkish Fed on Wednesday.

Bitcoin Faces Pressure as Fed Cuts Rates: Options Skew Reflects Bearish Tendency

Additionally, the negative one-month skew, which shows a bias for puts and a much weaker call bias in options with a duration of two to six months, reflects the gloomy sentiment. At press time, these calls were trading at a 3-vol premium to puts, which is lower than the 4-5-vol premium seen earlier this month.

The Fed lowered the benchmark interest rate to the 4.25% to 4.5% range on Wednesday, a 25 basis point decrease. This is 100 basis points below the levels at which the easing cycle started in September. After the rate cut, Bitcoin fell, and Fed Chairman Jerome Powell called it a close call and stressed the need for care in future movements as rates get closer to the neutral level.

Powell added that neither the Fed nor any board members intend to support any government proposal to create a strategic bitcoin reserve or push for changes to Fed policy. According to Trump, the president-elect, his administration will consider establishing a Bitcoin reserve similar to the country’s oil reserves.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment