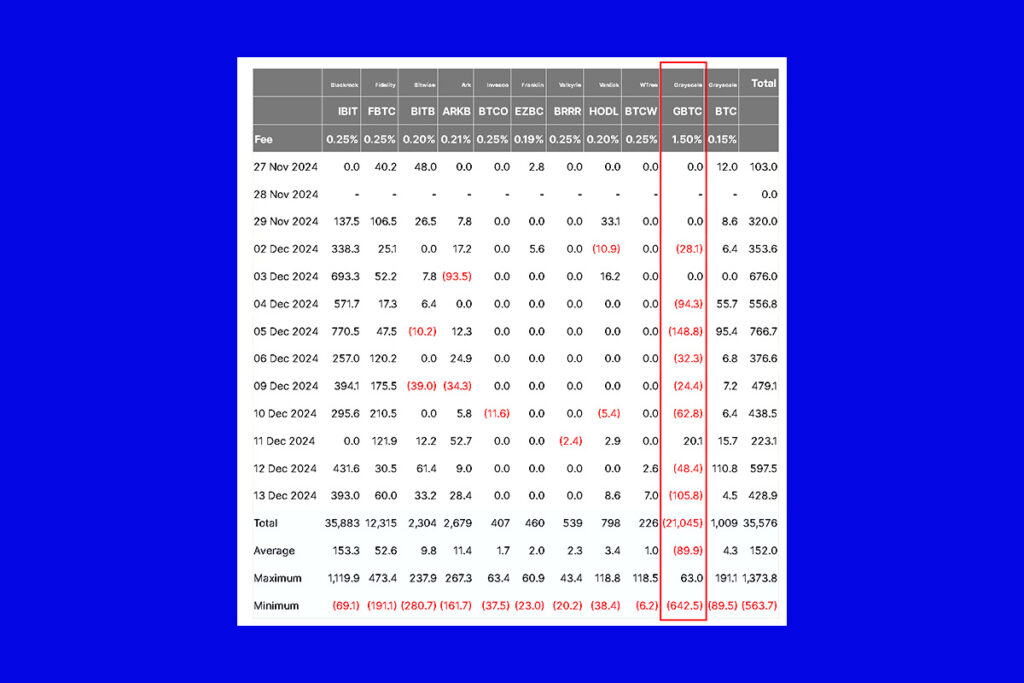

Grayscale Bitcoin Trust Outflows: $89.9M Daily Outflows Over 11 Months

The only spot Bitcoin exchange-traded fund (ETF) in the US with a negative net investment flow is the Grayscale Bitcoin Trust (GBTC), which has seen withdrawals totaling more than $21 billion since its introduction on January 11. GBTC continues to lose millions of dollars in investment every day, with $21.045 billion in total outflows as of December 16.

Over the previous 11 months, GBTC has lost $89.9 million on average every day, according to data from Farside Investors. As can be seen in the above chart, the outflows of GBTC outweigh the investments made by nine of the other ten spot Bitcoin ETFs that have been licensed in the US, even if their balance sheets have remained positive.

Spot ETH ETFs See Mixed Trends: ETHE Loses $3.5B While BlackRock Leads Gains

In less than a year, the overall spot Bitcoin ETF market has grown to nearly $35.5 billion in assets despite the billions of dollars in outflows. Like its Bitcoin equivalent, Grayscale’s Ethereum Trust ETF (ETHE), which was introduced in the US along with eight other spot Ether ETFs, is trending in the same direction.

Since its July 23 inception, ETHE has lost more than $3.5 billion in less than six months as of December 13. With investments of about $3.2 billion and $1.4 billion, respectively, BlackRock’s iShares Ethereum Trust ETF (ETHA) and Fidelity Ethereum Fund (FETH) are driving the positive inflow for all other funds in the spot ETH ETF ecosystem.

For more up-to-date crypto news, you can follow Crypto Data Space.

1 Comment