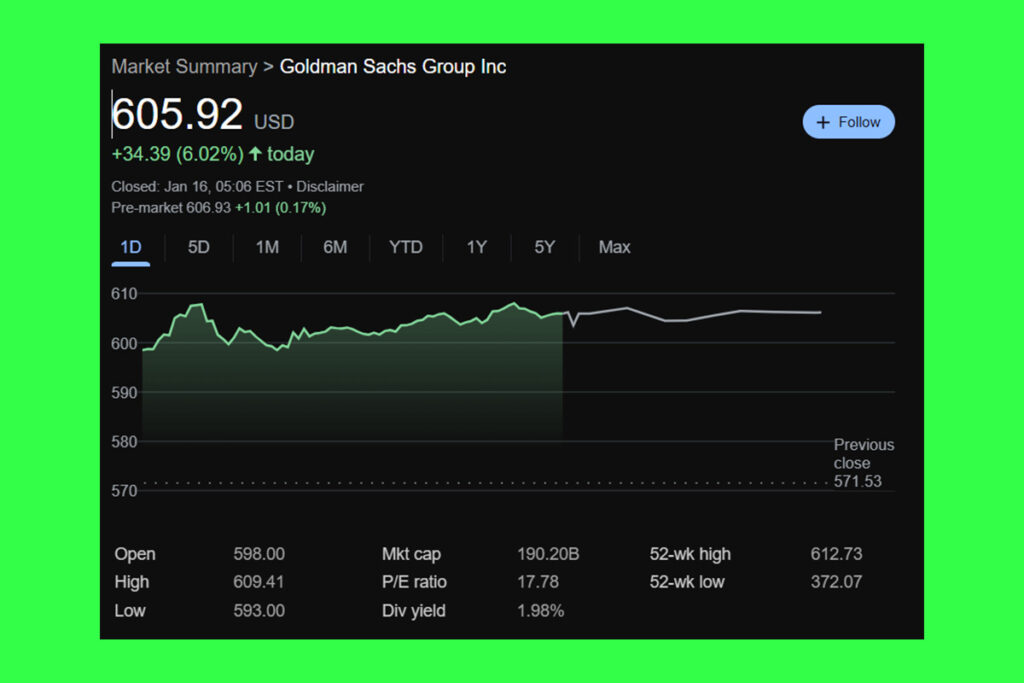

Goldman Sachs Q4 Success: Profits Double, Shares Climb 5.5% in Early Trading

As its traders profited from active markets and its investment bankers brought in more deal fees, Goldman Sachs exceeded Wall Street projections and generated its largest quarterly profit in over three years. Wednesday morning trading saw a 5.5% increase in shares as profits for the fourth quarter ending December 31 increased to $4.11 billion, or $11.95 per diluted share, from $2.01 billion, or $5.48 per diluted share, the previous year.

Fed Rate Cuts and Trump’s Remarks Spark Surge in Goldman Sachs’ Deal Activity

As the U.S. Federal Reserve lowers interest rates and President-elect Donald Trump’s pro-business remarks boost investor confidence, banking industry leaders expect stronger circumstances for acquisitions this year.

There has been a meaningful shift in CEO confidence, particularly following the results of the U.S. election. Additionally, there is a significant backlog from sponsors and an overall increased appetite for dealmaking, supported by an improving regulatory backdrop.

CEO David Solomon

In the fourth quarter, Goldman’s investment banking fees increased by 24% to $2.05 billion, driven by corporate bond sales and debt underwriting that profited from robust leveraged financing. Results for Wall Street’s leading banks in the second half of 2024 were improved by a rebound in mergers and acquisitions across the sector as well as fresh activity in the debt and equity markets. According to the firm, Goldman Sachs‘ advising revenue increased for 2024 despite declining by 4% for the quarter due to an increase in completed projects.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment