Bitcoin Drops Below $100K as Fed Hints at Rate Cuts, Futures Liquidations Top $700M

A decline in bitcoin (BTC) led to liquidations totaling over $700 million across futures that tracked major tokens; XRP and dogecoin (DOGE) contracts saw exceptionally substantial losses. The Federal Reserve’s suggestion of a couple of rate cuts in 2025 caused Bitcoin to drop below $100,000 in late U.S. hours before bouncing back modestly in early Asian hours on Thursday. Fed chair Jerome Powell then responded to a question regarding President-elect Donald Trump’s strategic reserve pledges during a post-FOMC press conference by stating that the central bank was not permitted to hold bitcoin under existing regulations.

That’s the kind of thing that Congress should consider, but we are not looking for a law change,

Powell

In reference to the nation’s stockpile of confiscated bitcoin, Trump declared during a July campaign that the government will retain 100% of every bitcoin it presently owns or purchases in the future.

Bitcoin Falls 3% After Powell’s Remarks: Altcoins See Steeper Declines

Following Powell‘s remarks, Bitcoin dropped 3%, sending majors into a tailspin. BNB Chain’s BNB and Ether (ETH) saw a 2.5% decline, while XRP, dogecoin (DOGE), and Solana’s SOL saw a 5.5% decline. With a 10% decline, Chainlink’s LINK performed the worst, wiping out some gains made earlier in the week when World Liberty Financial, backed by Trump, bought $2 million worth of tokens.

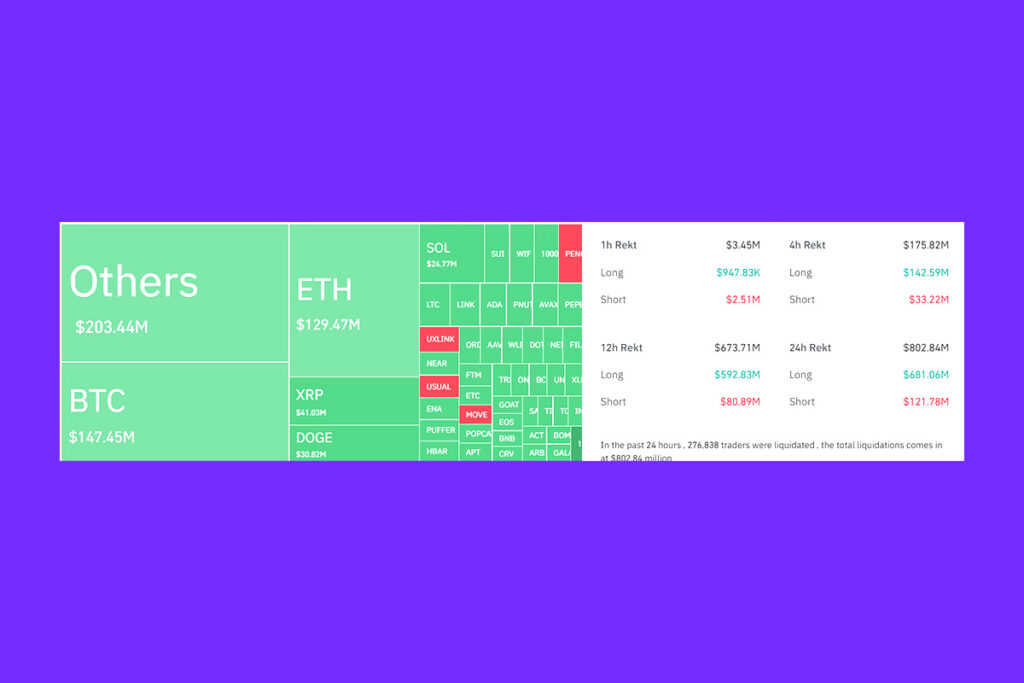

Data indicates that more than $700 million in optimistic bets were canceled as a result of the market decline, with futures tracking smaller altcoins and meme tokens experiencing bigger losses than BTC or ETH futures in an unexpected move. According to some traders, Powell’s remark might signal a local peak, lowering hopes for a sustained surge by the end of the month.

Crypto markets may have entered a peak if a U.S. Bitcoin strategic reserve is no longer in play, as this promise helped to fuel the recent months’ rally to new all-time highs. Although an interest rate cut would normally have a bullish reaction since it was largely expected, the market strongly reacted after Fed Chair Jerome Powell stated that inflation would be a continuing problem throughout the next year.

Nick Ruck, director at LVRG Research

For more up-to-date crypto news, you can follow Crypto Data Space.

1 Comment