Former FTX CEO SBF Faces Lengthy Prison Sentence Amidst Allegations of Offering Investment Advice to Prison Guards

Crypto News – Former FTX CEO, Sam “SBF” Bankman-Fried, finds himself embroiled in controversy yet again, as a recent report from The New York Times alleges his involvement in offering investment advice to prison guards, purportedly advocating for investments in Solana.

Legal representatives for Bankman-Fried have submitted a memo to the United States District Court in Manhattan, urging the presiding federal judge to consider a prison term ranging from five and a quarter to six and a half years. This plea comes in light of Bankman-Fried’s conviction on multiple charges of fraud and money laundering by a jury in November of the previous year, exposing him to a maximum sentence of 110 years.

Bankman-Fried faces an array of indictments, including two counts each of wire fraud and wire fraud conspiracy, alongside charges of securities fraud, commodities fraud conspiracy, and money laundering conspiracy. The impending sentencing announcement by Federal Judge Lewis A. Kaplan, slated for March 28, looms over Bankman-Fried’s legal proceedings.

As the deadline approaches for federal prosecutors to present their sentencing recommendations by March 15, the Pre-sentence Investigation Report (PSR) has suggested a staggering 100-year sentence for the former FTX CEO.

In response, legal counsel representing Bankman-Fried has vehemently opposed the proposed sentence, denouncing it as “barbaric.” They highlight Bankman-Fried’s clean record as a first-time offender, asserting that he was not acting alone in the alleged misconduct and stressing the imminent recovery of victims’ losses.

Emphasizing the absence of harm inflicted upon customers, lenders, and investors, given the anticipated full repayment through the FTX bankruptcy estate, Bankman-Fried’s legal team has submitted numerous testimonials from acquaintances advocating for leniency in sentencing.

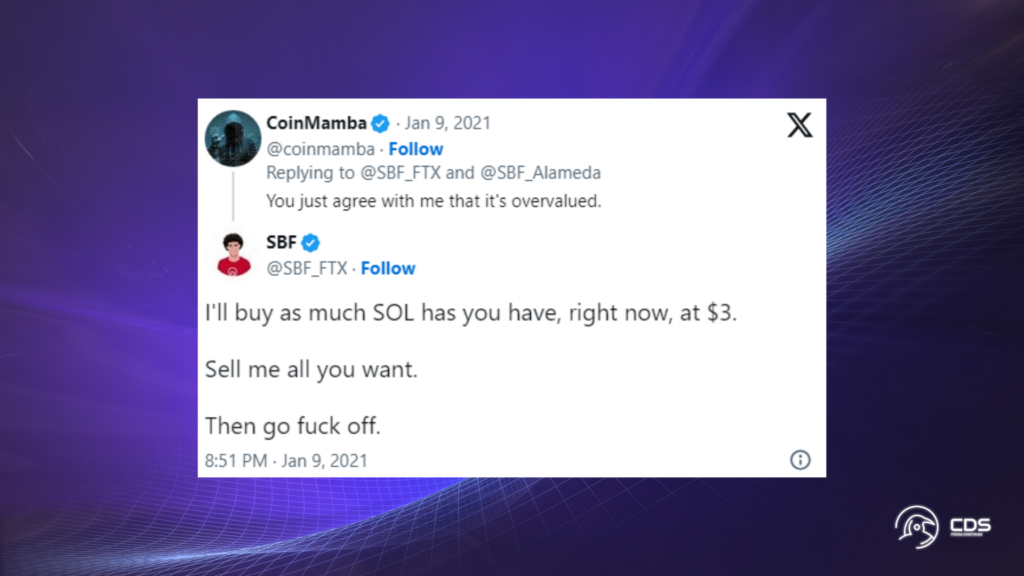

Currently detained at the Metropolitan Detention Center in Brooklyn since the previous summer, Bankman-Fried’s stint behind bars has garnered attention for various anecdotes, ranging from bartering commodities for services to facing extortion threats. The latest revelation from The New York Times suggests his engagement in offering financial advice to prison personnel, particularly endorsing investments in Solana’s SOL token, a cryptocurrency in which he has a significant history.

The downfall of FTX, once a behemoth in the crypto exchange sphere valued at $32 billion in January 2022, adds weight to Bankman-Fried’s legal saga. His conviction for the mismanagement of $8 billion in customer funds, coupled with multiple fraud charges, has cast a shadow over his professional legacy.

Leave a comment