Crypto News – How to Avoid Fine: Lessons from FalconX Regulatory Violations

Crypto News – The Commodities Futures Trading Commission (CFTC) has fined FalconX, a well-known cryptocurrency prime brokerage service, $1.7 million in a historic enforcement action. Their failure to register as a futures commission merchant (FCM) while giving US customers access to trading platforms for cryptocurrency derivatives is the reason for this punishment.

FalconX, a company registered in the Seychelles, made it easier to access cryptocurrency exchanges without the required paperwork. FalconX is required by the CFTC’s decision to stop these operations right away and pay $1,179,008 in disgorgement in addition to a $589,504 civil monetary penalty. This lawsuit sets a major precedent as it is the first time the CFTC has initiated legal action against an unregistered middleman in the cryptocurrency market.

The CFTC’s enforcement program has made clear it will not tolerate crypto exchanges that fail to register with the CFTC or comply with the agency’s rules that maintain integrity in the derivatives markets,

Ian McGinley, Director of Enforcement at the CFTC

Inside the Case

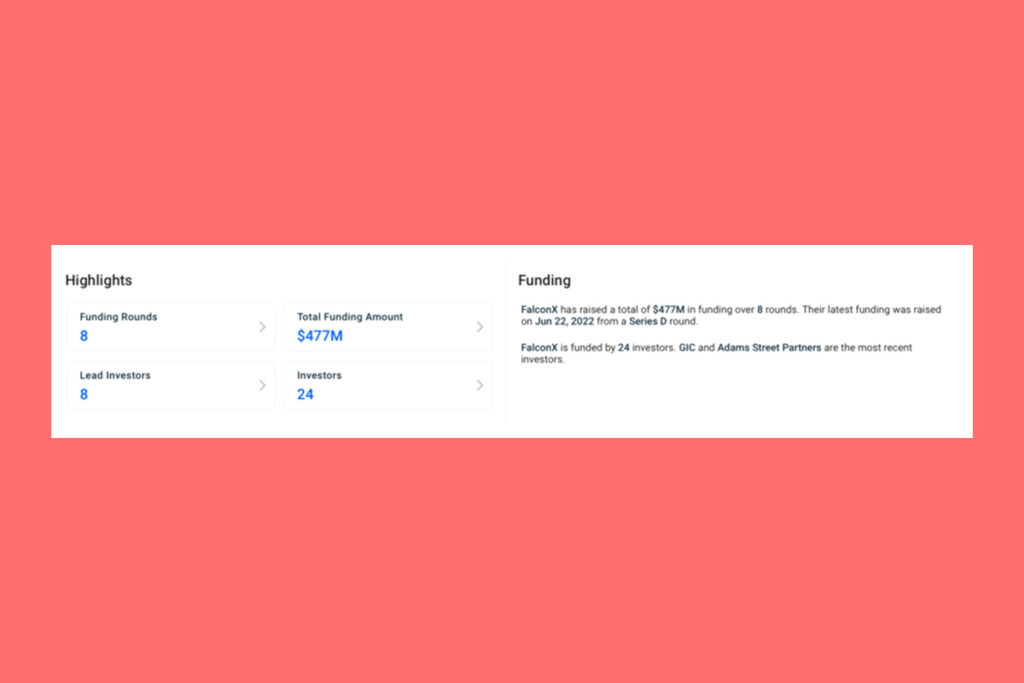

FalconX, operating as a middleman, invited US clients to place orders for cryptocurrency derivatives between October 2021 and March 2023. It established primary accounts on multiple exchanges and subsequently established sub-accounts for clients, frequently evading the need for customer-identifying data. FalconX was able to collect net fees of about $1,179,008 from these actions.

The CFTC commended FalconX for taking proactive measures to strengthen its controls over customer identification after filing a complaint against Binance and its affiliates for engaging in comparable behavior. The lowered penalty was largely due to this cooperation.

FAQ

What is Regulation Violation?

Every firm needs to follow the rules and policies that apply to them. Agencies at the federal, state, and municipal levels create and implement these regulations. A claim for securities fraud may arise from a failure to follow the relevant regulations.

Who is the CEO of FalconX?

At FalconX, one of the biggest and most reputable digital asset brokerages servicing organizations worldwide, Raghu Yarlagadda serves as both CEO and co-founder.

What is the Role of a Futures Commission Merchant (FCM)?

An organization that buys or sells futures contracts, options on futures, retail off-exchange forex contracts, or swaps and takes money or other assets from clients to back such orders is known as a futures commission merchant (FCM).

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment