Ethereum Price Forecast: Will It Hit $2,100 or Face More Downturn?

Ethereum Price– Ethereum (ETH) experienced a significant decline of over 15% last week as both the stock and crypto markets faced heightened tension. Several factors contributed to this downturn, including ongoing uncertainty due to Trump’s tariff decisions, weakening investor confidence, and a lack of significant announcements to catalyze market growth.

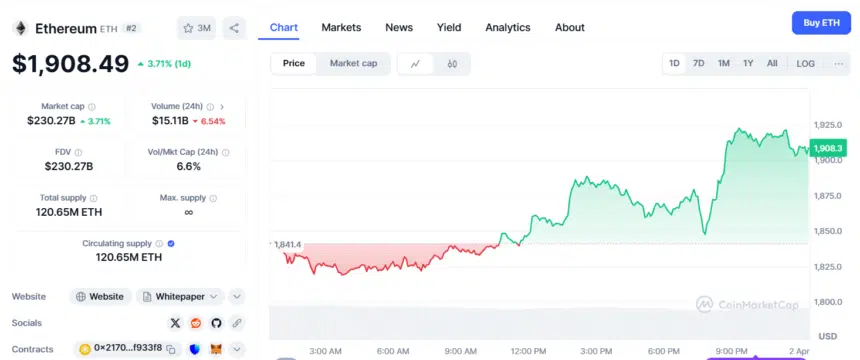

Despite these challenges, Ethereum (ETH) has shown notable recovery as markets opened on Monday with a more favorable tone. At the time of writing, Ethereum (ETH) is trading near $1,908, marking a 3.7% increase over the past 24 hours. The cryptocurrency hit a daily high of $1,922 and surged 5% from an earlier low of $1,819. Ethereum’s 24-hour trading volume stands at $15.11 billion, with a market cap of $230.27 billion.

Factors Influencing ETH’s Recent Decline

ETH’s recent price drop was not an isolated event. Last week’s downturn occurred alongside broader market turbulence, where both stock and crypto markets experienced increased volatility. Investor sentiment has been significantly affected by external factors, particularly the tariff war under President Trump, which has caused concerns about global economic growth. This, combined with the absence of a major market-moving announcement, left many investors feeling uncertain, leading to the 15% price drop for Ethereum.

Ethereum’s price decline mirrored the broader trend in the market, with other major assets also experiencing downward pressure. However, the rebound observed in recent days indicates that investor sentiment may be improving as the market stabilizes, at least temporarily.

ETH’s Path Ahead: $2,100 or Back to $1,800?

Ethereum’s recent recovery presents an interesting development. The cryptocurrency has shown strong bullish momentum, suggesting that it could continue its upward trajectory. However, Ethereum (ETH) must face significant resistance levels before it can gain further.

Resistance appears in the $1,950–$1,970 zone, a crucial area where sellers may attempt to cap further gains. If Ethereum (ETH) breaks through this resistance range, it could potentially rally toward $2,050 and possibly even $2,100. However, this scenario hinges on a successful breakout above these levels, which will be closely watched by investors in the coming days.

On the downside, Ethereum (ETH) must hold above the $1,880 support level to maintain its current bullish structure. A failure to maintain this level could lead to further price declines. In such a case, Ethereum (ETH) could retest the $1,850 level, and even dip back into the $1,700 range seen during last week’s low.

Market Sentiment and the Role of Bitcoin

ETH’s price movements are not just influenced by its own market forces but are also closely tied to broader market sentiment, including Bitcoin’s performance. Bitcoin, as the largest cryptocurrency, tends to have a significant impact on the rest of the market, and its stability above the $85,000 price mark will be crucial for maintaining confidence across the crypto sector.

As Bitcoin remains strong, ETH’s price is likely to benefit from its positive momentum. However, if Bitcoin experiences any significant downturns, Ethereum could also see similar price corrections. Therefore, Bitcoin’s stability will play a key role in shaping ETH’s trajectory in the near term.

The Pectra Upgrade and Its Potential Impact on ETH

Another critical factor that could influence Ethereum’s price is the anticipation surrounding the Pectra upgrade. The Ethereum (ETH) network’s continuous development and improvements are closely watched by the market, and any updates or technical enhancements can have a considerable impact on investor confidence.

If the Pectra upgrade successfully boosts Ethereum’s scalability and overall network performance, it could strengthen ETH’s position in the market. Investors may be more inclined to buy Ethereum (ETH), anticipating positive outcomes from the upgrade. This could provide the necessary momentum for Ethereum (ETH) to break through key resistance levels and push towards $2,100.

However, if the upgrade faces delays or technical challenges, it could lead to a decline in investor confidence, which might weigh on ETH’s price. As always, market participants should remain vigilant and adjust their strategies according to developments surrounding the Ethereum network and its upgrades.

Will Ethereum Break Above $1,970?

The crucial price level to watch for Ethereum (ETH) in the coming days is $1,970. A sustained push past this level could signal the beginning of a strong uptrend for Ethereum (ETH), potentially propelling it towards the $2,100 mark. Investors will closely monitor this resistance zone to determine if Ethereum (ETH) can maintain its bullish momentum.

On the other hand, if Ethereum faces rejection at these levels, it could indicate renewed selling pressure and lead to a price correction. The presence of key support levels, such as $1,880 and $1,850, will be vital in preventing further declines.

Ethereum’s Short-Term Outlook

In conclusion, Ethereum’s short-term outlook remains uncertain but promising. The recent rebound from its lows suggests that there is still strong bullish potential for Ethereum (ETH), although resistance levels in the $1,950–$1,970 range remain crucial. The broader market sentiment, Bitcoin’s stability, and the anticipation of network upgrades will play a key role in determining whether Ethereum can continue its upward momentum or face further declines.

Investors should continue to monitor developments surrounding Ethereum (ETH), especially the Pectra upgrade, and remain cautious of any external market pressures, such as Trump’s tariff decisions and global economic uncertainties, that could impact the overall crypto market. ETH’s price trajectory will ultimately depend on these factors, and the next few days will likely provide more clarity on its short-term direction.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment