Ethereum Price: Consolidating Between $3K and $4K

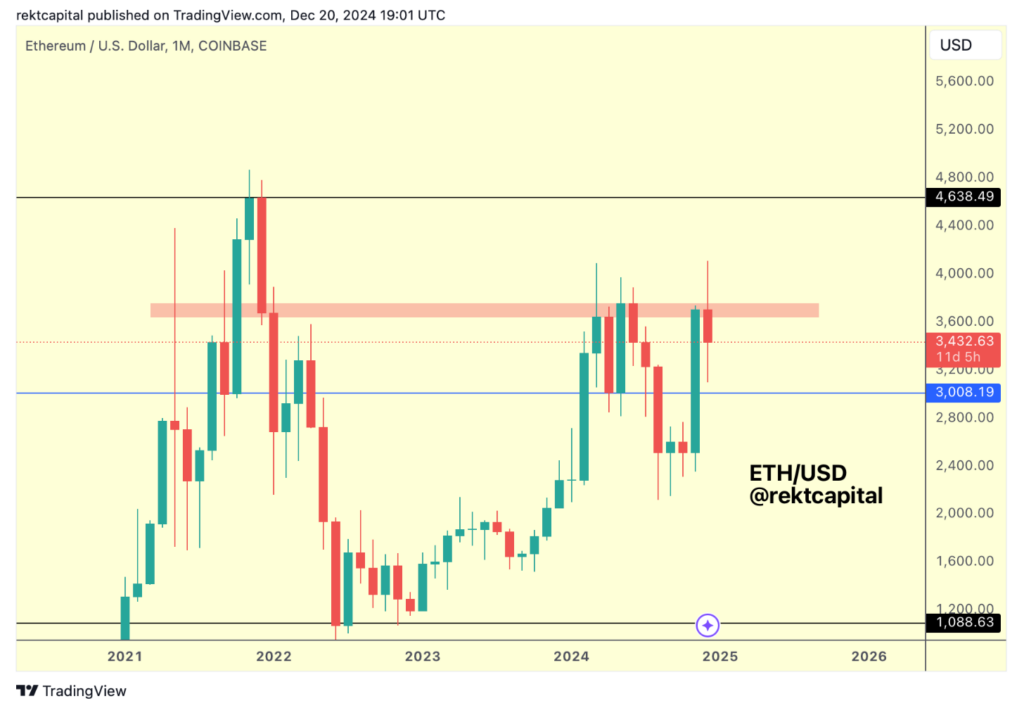

Ethereum Price– Ethereum’s (ETH) price is expected to remain range-bound between two key psychological levels—$3,000 and $4,000—in the near term, according to a recent market analysis. Despite multiple attempts to surpass the $4,000 mark, the leading altcoin has struggled to maintain its position above this critical price point.

Ethereum Faces Difficulty Holding Above $4,000

Ethereum has faced repeated resistance at the $4,000 level, with the cryptocurrency briefly touching $4,077 on December 6, but failing to sustain the price. According to Rekt Capital, a pseudonymous crypto trader, Ether has encountered consistent difficulty breaking through this psychological barrier. In his December 20 market report, Rekt noted, Ethereum continues to struggle with the psychological resistance of $4,000.

Although Ethereum reached new highs on several occasions in the past 30 days, it hasn’t been able to secure a foothold above $4,000. This price level remains a key point of resistance, and analysts believe it will continue to dictate the short-term direction of ETH’s price action.

Psychological Support at $3,000

On the other hand, $3,000 has now become a significant psychological support level for Ethereum, according to Rekt. This level was last tested on November 9, when ETH touched $3,000. Prior to that, ETH had been trading below this mark since early August 2023. The trader suggested that in the near future, Ethereum could consolidate within a rangebetween $3,000 and $4,000.

While some analysts speculate that ETH could dip further, potentially testing the $3,000 region again, others see this range as a strong support zone where Ethereum could stabilize in the coming weeks.

Potential for a Head-and-Shoulders Pattern

Rekt also highlighted the possibility of an inverse head-and-shoulders formation if Ethereum finds support near the $3,000 level. This pattern is often viewed as a reversal signal, indicating a potential trend shift. “It will be worth watching whether indeed ETH could form a bottom in and around that area, as that would give rise to a potential right shoulder to develop for an overall inverse head and shoulders formation,” Rekt explained.

The head-and-shoulders formation is a technical chart pattern that often signals a trend reversal. If Ethereum’s price does indeed find support near the $3,000 region, it could set the stage for a reversal and a subsequent move higher.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment