Ethereum Price Outlook: Is $2,000 Within Reach?

Ethereum Price Outlook– Ether (ETH) has experienced a 6.4% price rise from its March 30 low of $1,768, currently trading at $1,819. However, it still faces difficulty breaking the $2,000 resistance level. Some analysts attribute this stagnation to the deflating memecoin market, which, while not exclusive to Ether (ETH), has led to a noticeable decline in activity across decentralized applications (DApps) and the broader crypto ecosystem.

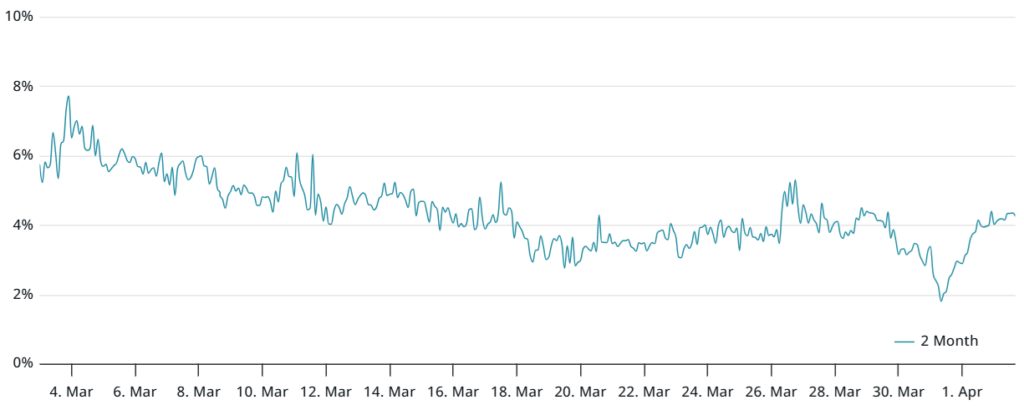

Year-to-date, Ether (ETH) is down by 44%, and market indicators suggest traders remain cautious. A key metric, the premium on Ether (ETH) futures compared to spot markets, illustrates this lack of optimism. As of April 2, the premium stands at 4%, up from 2% on March 31, but still below the neutral 5% threshold. This suggests that even with some support at the $1,800 mark, confidence in a quick recovery remains low.

Further insight into market sentiment can be found in the options market. The 25% delta skew, which indicates the demand for call versus put options, shows a reading of 7%. While this is down from 9% on March 31, it still reflects risk-averse sentiment, with investors fearing further downside.

Ethereum’s Strong Fundamentals Amidst Market Struggles

Despite the price struggle, Ethereum’s underlying fundamentals remain robust. The network has seen strong adoption, with stablecoin holdings nearing a record high of $124.5 billion. Additionally, Ethereum continues to lead decentralized finance (DeFi), with $49 billion in total value locked (TVL). While the DApp revenue decline and reduced interest in NFTs and memecoins have impacted Ethereum’s performance, the network’s dominance in DeFi and growing use cases offer long-term potential.

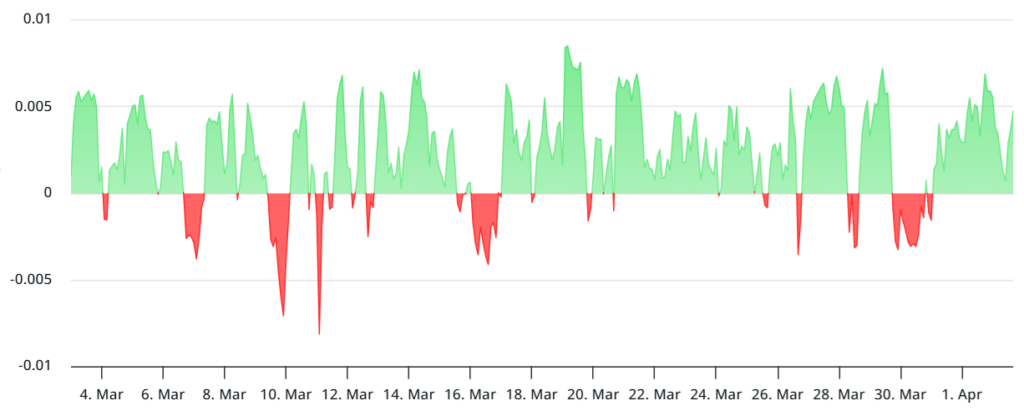

Retail investor sentiment also mirrors the cautious mood in the market. The perpetual funding rate for Ether (ETH) has remained neutral since March 31, signaling that retail traders are not aggressively trading. The outflow of $37 million from Ethereum ETFs in the last two weeks suggests that retail enthusiasm remains subdued, contributing to the broader neutral market sentiment.

In conclusion, while Ether (ETH) faces challenges, its strong position in the DeFi space and the growing adoption of new use cases provide a promising long-term outlook, even as the short-term sentiment remains cautious.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment