Ethereum Loses Momentum: Liquidations Soar Amid Price Slump

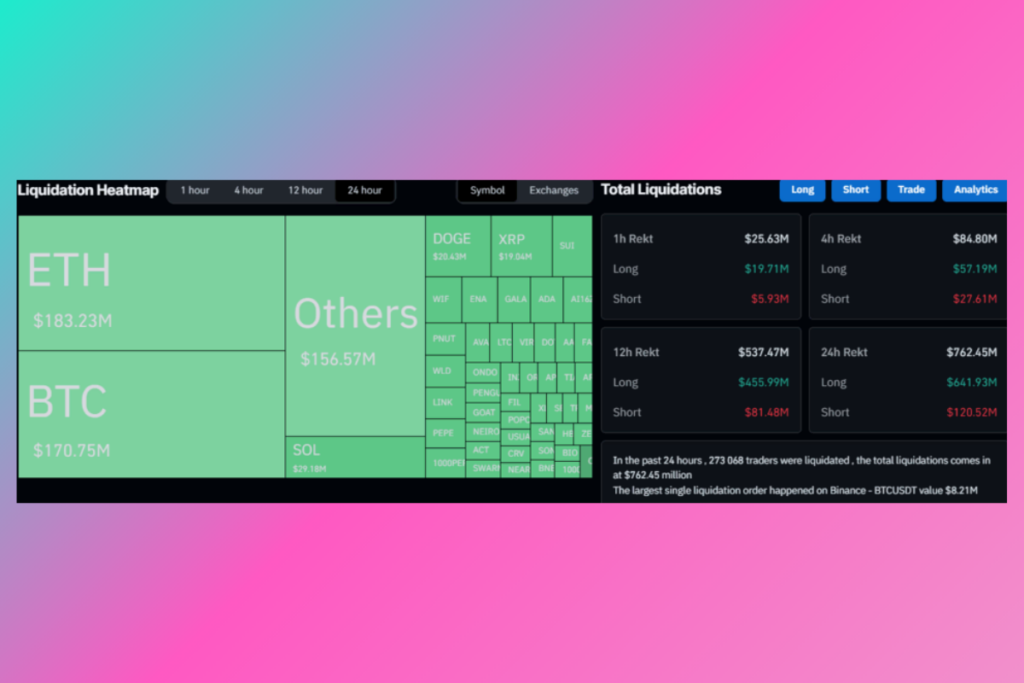

ETH’s price has taken a significant knock and fallen below $3,000 for the first time since early November during today’s downturn in the overall market. Due to this, the number of liquidations for over-leveraged bulls has increased dramatically, reaching about $200 million for positions involving simply ETH.

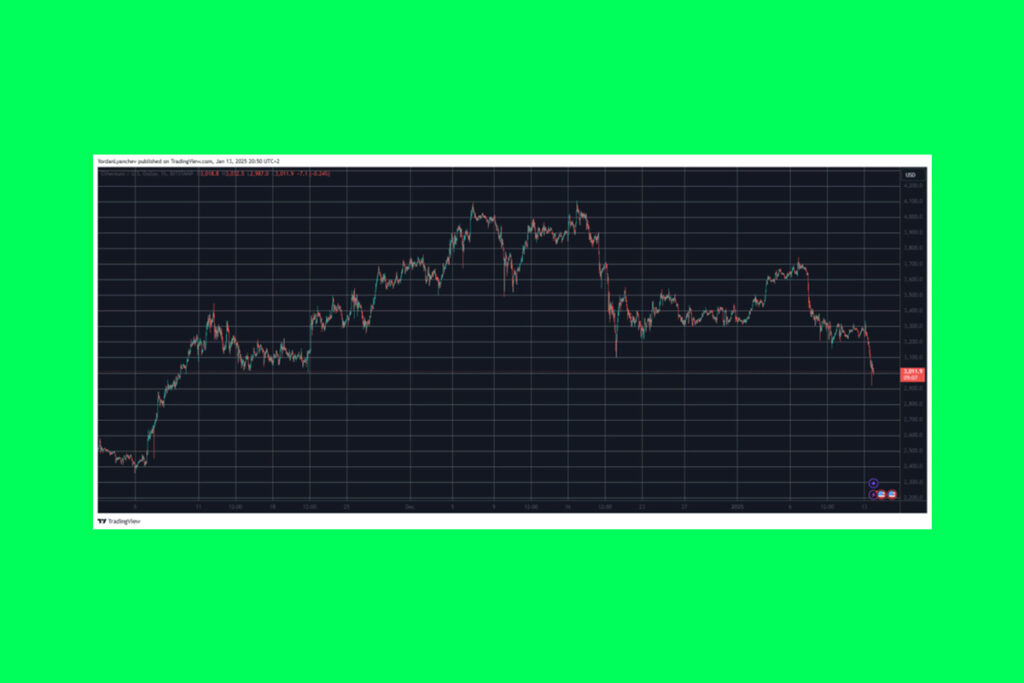

After the US elections in early November, the second-largest cryptocurrency, as seen in the above graph, broke above $3,000 and didn’t look back for the next two months. Furthermore, on December 16, the asset reached its highest point at slightly over $4,100, but that was its maximum value. ETH fell to $3,100 during the year-end meltdown, but it was able to hold onto the $3,000 support. At the beginning of 2025, it recovered and launched an offensive. On January 7, it reached its annual top of $3,750. However, everything started to go downward at that point, and ETH and the market as a whole began to fall.

ETH Drops 20% From January High: Bears Take Control

After that rejection, Ethereum’s price spiked to $3,300, where it remained for the majority of the following days. It fell below $3,000 for the first time since early November, though, after the bears started another leg down today and sent it even further south.

Since its peak on January 7, ETH has dropped exactly 20%. Since the total amount of these liquidations has increased to $185 million, according to CoinGlass, today’s decline was especially painful for traders who were too leveraged and had long positions. The price of Bitcoin, which fell from $96,000 earlier this morning to less than $90,000 for a brief while, has been eclipsed by ETH’s liquidations.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment