Ethereum Gas Limit Increase: Vital for DeFi Growth or a Risk to Stability?

Ethereum Gas Limit Debate – The Ethereum community is currently embroiled in a heated debate regarding a proposed increase in the gas limit on the Ethereum mainnet by as much as 100%. The gas limit is a critical parameter that sets the maximum amount of gas that can be spent for transactions to be included in a single Ethereum block, impacting the overall capacity and scalability of the network.

The Push for Higher Gas Limits

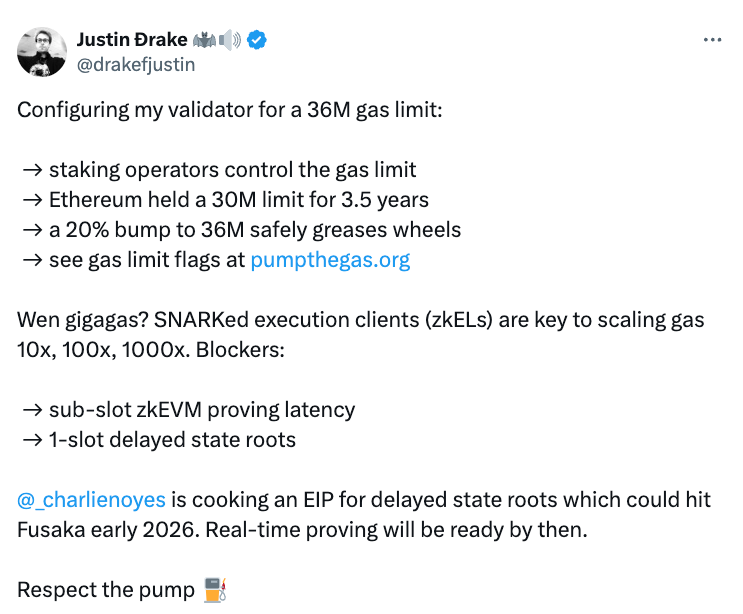

A significant faction of Ethereum developers and influencers are advocating for raising the gas limit, arguing that this adjustment could improve the Layer 1 (L1) network’s capacity and foster innovation. Emmanuel Awosika, creative director at 2077 Collective, emphasized that a higher gas limit would allow for more applications to be deployed without facing arbitrary price hikes due to network congestion.

“Right now, with such a low gas limit, there are certain applications you can’t really deploy because the moment those applications go viral, gas prices will spike, and it becomes a very degraded user experience,” Awosika said. He believes that higher gas limits would provide developers with the confidence to deploy high-value decentralized finance (DeFi) applications directly on Ethereum’s L1 network, rather than relying on L2 solutions.

Concerns Over Ethereum’s Scalability and Security

Despite the benefits proposed by some developers, there are significant concerns over the risks of raising the gas limit. Toni Wahrstätter, a researcher at the Ethereum Foundation, warned that increasing the gas limit could lead to serious stability and security risks. Ethereum’s consensus layer (CL) client enforces a maximum block size of 10 MiB for efficient propagation, and raising the gas limit to 60M gas per block could breach this restriction, causing propagation failures and potential network destabilization.

According to Dankrad Feist, Ethereum’s consensus is shaped by the validators, and any increase in gas limits requires their approval. However, Feist noted that although raising gas limits over 40M is technically possible, the Ethereum development community has tacitly agreed that a 36M gas limit should be considered a reasonable first step.

Ethereum’s Future: Should Layer 1 or Layer 2 Take the Lead?

The debate boils down to whether Ethereum should scale its L1 to accommodate high-value DeFi activities, or if such activities should be pushed to Ethereum’s Layer 2 (L2) solutions, given the L1’s limited scalability. Ethereum co-founder Vitalik Buterin has been an outspoken advocate for prioritizing L2 scaling since 2022, yet some believe that too much focus on L2s might undermine the L1 network’s role.

Awosika contends that the L1 must remain the home for high-value applications, such as Uniswap, which require robust security and decentralization. He argued that Ethereum’s uniqueness lies in its ability to provide a highly secure and decentralized L1 base layer, unlike Bitcoin, which is intentionally left unchanged at its base layer.

A Difficult Balance: Innovation vs. Stability

While increasing the gas limit is seen as an innovative step to enhance Ethereum’s capabilities, some critics, including crypto commentator Evan Van Ness, believe that such an increase would only offer temporary relief. Van Ness warned that raising the gas limit might initially reduce transaction costs and bring back certain applications, but eventually, demand would overwhelm the network, causing transaction fees to spike once again.

“You raise the gas limit a lot, you bring back a bunch of apps, everything is great for a while, and then demand overwhelms supply and it routinely costs 120 gwei for a transaction again,” Van Ness wrote on X (formerly Twitter).

Max Resnick’s Departure: A Sign of Ethereum’s Challenges?

The debate around gas limits comes at a time when Ethereum core developer Max Resnick announced his departure from the Ethereum project to join Solana. Resnick, who had long criticized Ethereum’s L2-focused roadmap, cited a rigid developer community and the lack of willingness to scale the Ethereum L1 as primary reasons for his decision.

Resnick’s departure is seen by some as a “sign of the times” for Ethereum. Awosika shared his frustrations with the Ethereum community’s treatment of Resnick, noting that his exit highlighted the intellectual challenges Ethereum is facing in adapting to the rapidly evolving landscape of blockchain development.

Ethereum’s Road Ahead: Balancing Growth and Decentralization

As Ethereum continues to debate the gas limit increase, the project’s future hinges on finding a balance between scaling its L1 network and maintaining the security and decentralization that have made it the leading smart contract platform. With DeFi activities and high-value applications still a significant part of Ethereum’s future, the decision to raise the gas limit will be pivotal in shaping the network’s capacity to support further innovation.

For now, the community remains divided, with some pushing for faster scaling and others warning of the potential dangers of prioritizing short-term growth over long-term stability. Ethereum’s ongoing efforts to scale Ethereum Layer 1 while fostering innovation through Layer 2 solutions will likely be central to the project’s evolution in the coming years.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment