Ethereum ETFs Could Spark Next Wave of Institutional Demand, Says OKX Executive

Institutional investors are poised to inject $500 million into Ethereum ETFs next week, contingent on their approval this Thursday, according to analysis from crypto exchange OKX.

“This approval could be as significant, if not more, than the Bitcoin ETF approval,” stated Lennix Lai, OKX’s Global Chief Commercial Officer, in an interview with DL News. “The potential approval of Ethereum as a tradable asset within a traditional framework could ignite the next wave of institutional demand.”

Building Anticipation

Anticipation has reached a fever pitch after the U.S. Securities and Exchange Commission signaled this week that it may finally abandon its longstanding resistance to a spot price exchange-traded fund for Ethereum.

Since Monday, Ethereum has surged 24%, bolstering the proof-of-stake sector. For example, Lido Staked Ether has risen 27% over the past seven days, according to CoinGecko.

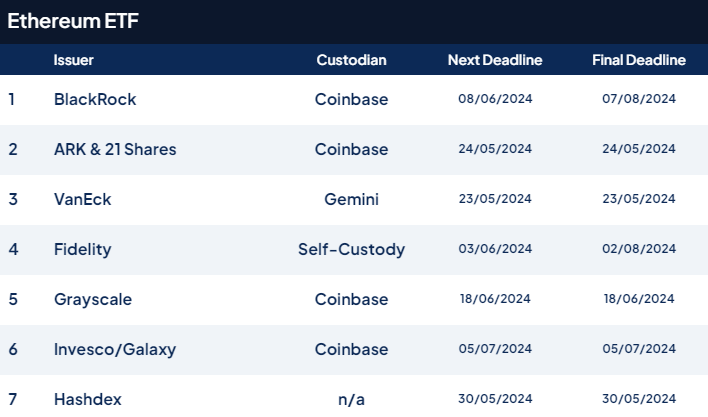

Several applicants, including BlackRock, Invesco Galaxy, Fidelity, and Franklin Templeton, are eagerly awaiting the SEC’s decision. Asset manager VanEck is at the front of the line, set to receive the first decision from the regulator.

VanEck’s Head of Digital Assets Research noted on Wednesday that the company expects the SEC to honor the queue order. However, any approval is likely to extend to other applicants to prevent the agency from appearing biased.

Market Expectations

Investors predict that Ethereum ETFs will follow a similar trajectory to the Bitcoin funds launched in January. Since then, ten such products have traded with volumes exceeding $1.5 billion.

Record Rally

The introduction of Bitcoin ETFs and Wall Street’s acceptance of the asset class sparked a historic rally in the crypto market. This year, the market’s value has soared by 50% to $2.7 trillion.

An Ethereum ETF could further invigorate market sentiment. Bernstein analysts predicted this week that Ether could surge to $6,600 if the funds are approved.

“Ethereum could potentially surpass its all-time high shortly after an ETH ETF approval,” commented Lai.

Accessibility for Retail Investors

An Ethereum ETF would simplify and reduce the cost for retail investors to gain exposure to the second most valuable cryptocurrency. “Like the Bitcoin ETF before it, an Ethereum ETF will be a significant milestone for the industry,” said Jean-Baptiste Graftieaux, CEO of Bitstamp, to DL News.

Impact on Crypto Exchanges

There may be some impact on crypto exchanges such as Coinbase and Kraken. ETFs allow traders to access the asset class without needing digital wallets or native industry exchanges. This mainstream integration has multiple implications.

Nevertheless, Lai minimized the long-term risks for exchanges, suggesting that ETFs will act as a gateway for newcomers to crypto. “It may actually expand the overall market size, including volume and participants, meaning it’s complementary rather than cannibalistic,” he explained.

Leave a comment