Ether Price Prediction for 2025 – Is Ether Ready for a Major Surge? Key Predictions for 2025

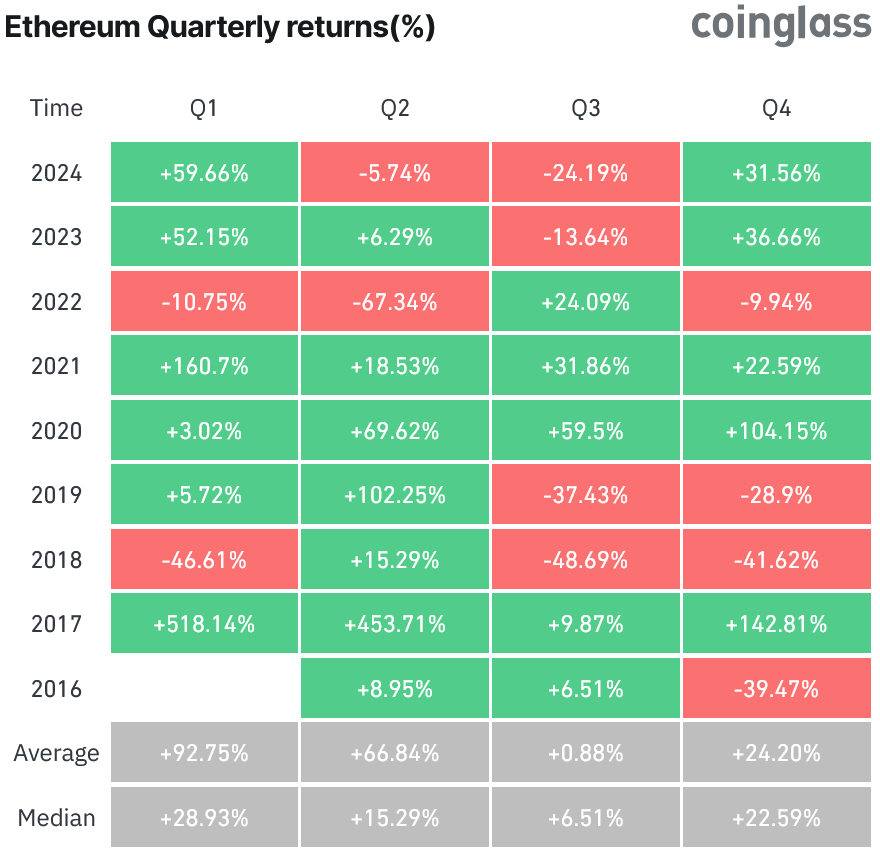

Ether Price Prediction for 2025 – As the cryptocurrency market looks ahead to 2025, Ether (ETH) has emerged as a key contender to lead the way in a potential rally during the first quarter. Historically, the first quarters following a United States election and Bitcoin halving cycle have seen remarkable performances for Ether. In particular, Q1 2017 and Q1 2021 stand out, with Ether experiencing massive price surges of 518% and 161%, respectively. This surge outpaced Bitcoin’s (BTC) growth of 11.9% in Q1 2017 and 103.2% in Q1 2021, as shown in CoinGlass data.

Could Ether Outperform Bitcoin Again in Q1 2025?

The performance of Ether during these periods has garnered significant attention from investors, especially as the cryptocurrency market enters a crucial phase. One potential catalyst for Ether’s rally could come from the growing interest in Ether Exchange-Traded Funds (ETFs). According to Farside Investors, spot Ether ETFs have seen inflows in 22 out of the last 24 trading days, with a total net inflow of over $2.5 billion. This trend has led some ETH enthusiasts to predict that Ether ETFs could see over $50 billion in net inflows in 2025.

Optimism for 2025: Increased Inflows and a Favorable Political Climate

Experts, including CK Zheng, Chief Investment Officer at ZX Squared Capital, are optimistic about 2025. Zheng believes that the cryptocurrency market will benefit significantly from increased inflows due to the anticipated crypto-friendly regulations from the new Trump administration. These regulatory changes could boost the digital asset class, including Ether, contributing to its strong performance in the coming year.

Zheng’s outlook is consistent with the belief that Ether could continue to gain momentum, particularly in light of the increasing acceptance of cryptocurrency ETFs and the possibility of stronger institutional participation. He anticipates that the broader macroeconomic conditions in 2025 will support the digital asset space, with Ether likely to see substantial growth.

A More Conservative Outlook: Risks of a Hawkish Macroeconomic Climate

However, not everyone shares the same level of optimism. Markus Thielen, founder of 10x Research, has a more cautious perspective. Thielen warns that Ether could struggle to set a new all-time high under a hawkish macroeconomic environment in 2025. A hawkish stance by the Federal Reserve, including higher interest rates, could dampen market enthusiasm for risky assets like Bitcoin and Ether.

Thielen notes that the current macro climate could make it difficult for Ether to replicate its past successes. In addition, a reduction in liquidity tailwinds, which had previously supported market growth, may prevent the cryptocurrency from seeing the explosive gains it experienced in the past. As a result, Thielen predicts that Ether may continue to underperform in 2025, with little to no growth in its price compared to previous years.

The Impact of Federal Reserve Policy on Ether’s Performance

The Federal Reserve’s policy decisions are a critical factor in determining Ether’s price trajectory in 2025. Since the Federal Reserve revised its interest rate cut projections in December 2023, reducing the number of cuts from five to two, market sentiment has shifted. As of December 18, 2023, the Federal Open Market Committee (FOMC) signaled that the federal funds rate could stabilize at 3.9% in 2025, higher than the previously expected 3.4%. This more hawkish stance could lead to slower growth for risk assets like Ether as the liquidity conditions tighten.

Despite these challenges, some analysts still predict Bitcoin could reach $160,000 in a best-case scenario. Thielen suggests that Bitcoin might find stability around $125,000, but these predictions underscore the uncertainty surrounding the future of cryptocurrencies.

Current Price of Ether and Market Sentiment

As of now, Ether is priced at $3,997, reflecting a 0.6% increase over the past 24 hours. However, the cryptocurrency remains down 30.3% from its all-time high of $4,878, which was set in November 2021. The price fluctuations in 2023 highlight the volatile nature of the market and the uncertainty surrounding the broader economic environment.

While Ether has the potential to lead a Q1 rally in 2025, various factors, including macroeconomic policies and market conditions, will play a crucial role in determining the extent of its growth. Investors should stay informed about upcoming developments in the US government’s stance on cryptocurrencies, interest rate policies, and corporate adoption, as these could significantly influence the price of Ether in the coming year.

Conclusion: Ether’s Prospects in 2025

Looking ahead to 2025, the future of Ether remains uncertain but full of potential. The cryptocurrency could experience significant growth if macroeconomic conditions favor digital assets and regulatory clarity boosts institutional participation. However, a hawkish macro climate and slower market momentum may lead to a more subdued performance. As the year progresses, Ether’s price will largely depend on the evolving economic landscape and the cryptocurrency market’s ability to navigate these challenges.

For now, Ether’s performance in Q1 2025 will be one of the most closely watched events in the crypto space, as the cryptocurrency community waits to see if the digital asset can replicate its past successes and lead the market in the coming year.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment