Ethena Faces Whale Selloffs: ENA Price Surges 3% Despite $3.17M Unstaked

Amid major whale selloffs, Ethena, a synthetic dollar protocol, recently caused waves of anxiety among cryptocurrency market players. Following a 3.01% surge in the price of ENA, on-chain data on Thursday showed that whales had significantly offloaded millions of tokens, increasing investor trepidation. As a result of the market’s recent volatility, cryptocurrency fans are now closely monitoring coins for changes in price in the future.

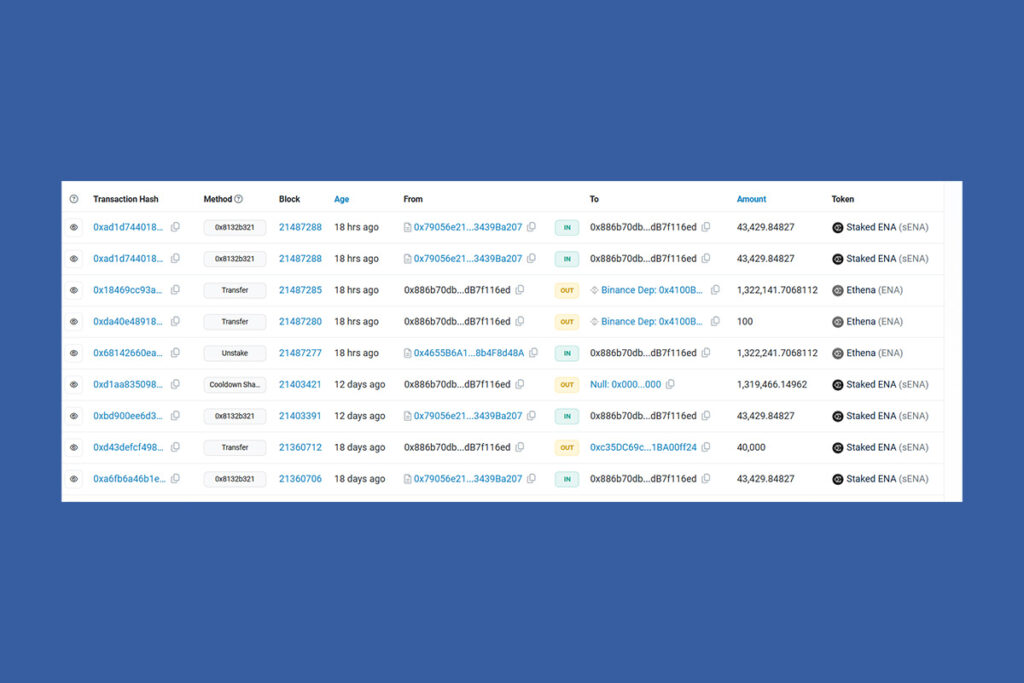

As of December 26, two whales unstaked 3.36 million ENA, or $3.17 million, and transferred the funds to the massive cryptocurrency exchange Binance, according to Lookonchain data. According to the statistics, a huge dump occurred during the most recent market decline, highlighting symptoms of panic selling. Notably, according to Etherscan data, these whale addresses were determined to be 0x886b.. and 0xbB22..

ENA Gains 49.8% Monthly Despite Whale Dumps and Market Decline

However, another story has raised more questions about the asset’s position in the market. Arthur Hayes of BitMEX recently unstaked 7 million ENA and transmitted it to Binance, according to CoinGape. Given that cryptocurrency is now experiencing a decline, this exchange dump adds to market fears. The price of ENA rose by around 3.01% intraday at the time of reporting, and it is now trading at $0.9711. Its 24-hour high was $0.9926, and its 24-hour low was $0.9153. Notably, the present downward trajectory is consistent with both the aforementioned Ethena whale dumps and the general trend of the cryptocurrency market.

However, it’s also important to note that the token’s monthly chart showed gains of 49.80%. The cryptocurrency team just announced a deal with Trump’s World Liberty Financial (WLFI), which reflects the market’s growing optimism. In order to incorporate Ethena’s USDe stablecoin as a primary collateral asset in WLFI’s future Aave-based lending and borrowing platform, a governance proposal has been made. Because of its collaboration with WLFI, the price of ENA may see a significant increase if the market rebounds in the near future.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment