DeFi Disaster: ETH Crash Claims Another Victim!

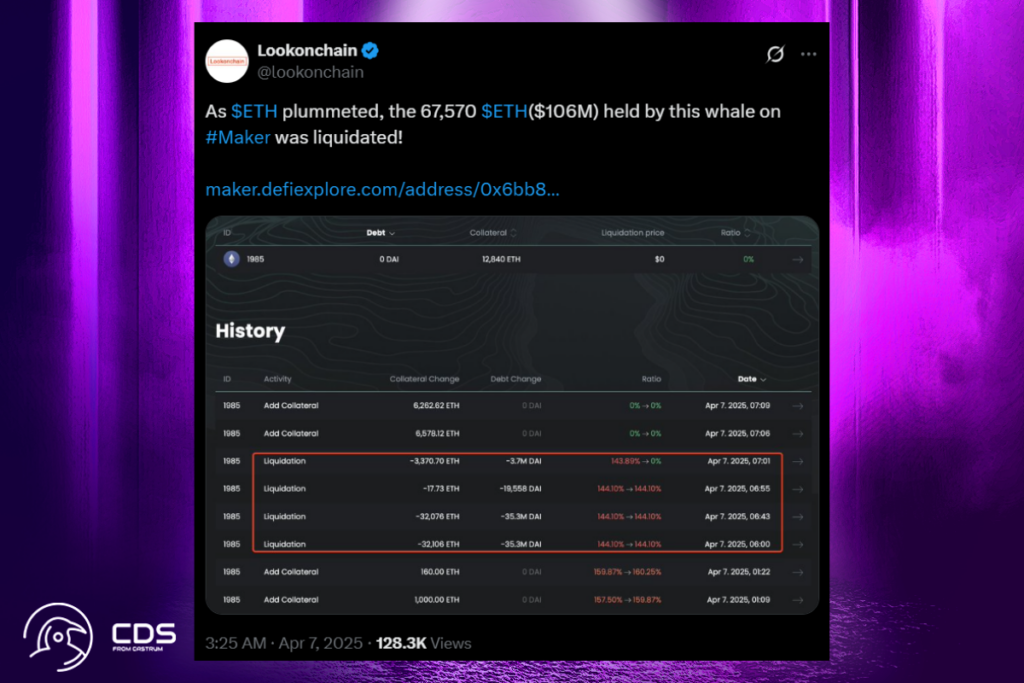

After the asset fell by almost 14% on April 6, an Ether whale lost 67,570 ETH, or about $106 million. According to statistics from Lookonchain and Maker Vaults explorer DeFi Explore, the steep drop caused his collateralized debt position on Sky to be liquidated.

DeFi members use the Sky lending protocol, which changed its name from Maker in August, to establish collateralized debt positions by lending the platform’s stablecoin, DAI, in exchange for cryptocurrency, in this case, ETH. The overcollateralization ratio used by the system is usually 150% or greater. This implies that in order to borrow 100 DAI, users must deposit at least $150 in ETH.

The value of the ETH collateral in relation to the loaned DAI is automatically tracked by the protocol. The position is subject to liquidation if the value of ETH declines and the collateral ratio falls below the required minimum.

Trump’s Tariff Fallout Sends ETH to 2023 Bear Market Levels

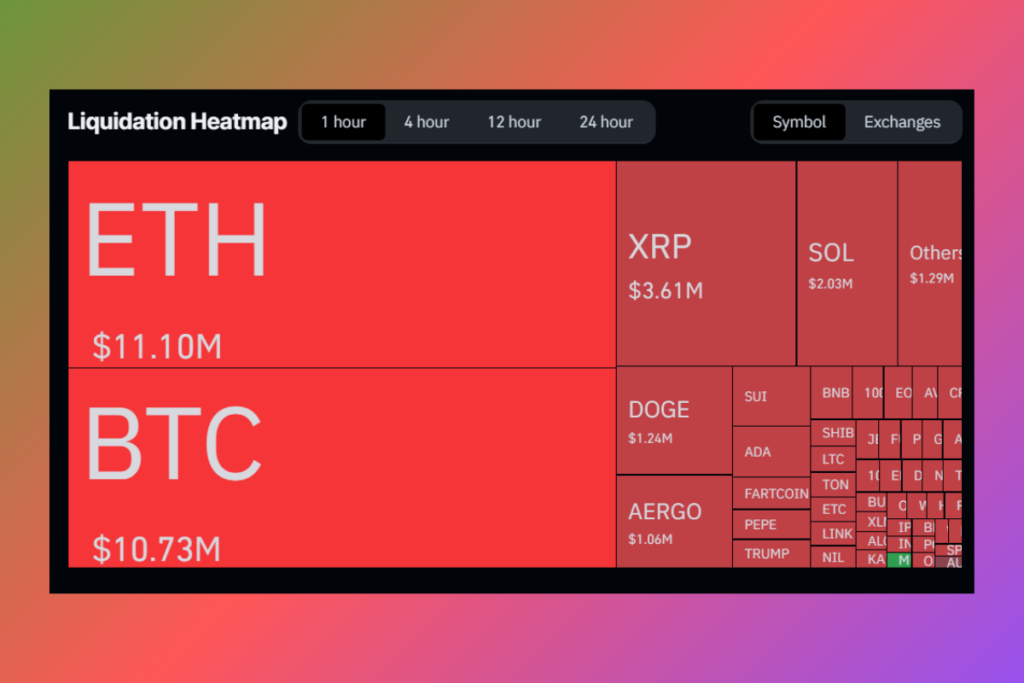

The price of ETH plummeted 16.59% in the last day, to $1,498 at the time of writing, as the whole cryptocurrency market collapsed in response to US President Donald Trump’s tariff-induced market sell-off. Nearly a year after the FTX exchange collapsed, in October 2023, when cryptocurrency was still in the depths of a bear market, ETH last traded at this level.

Since ETH is still down around 70% from its peak in 2021, more DeFi members will probably be liquidated if they are unable to produce further collateral. CoinGlass reports that 320,000 dealers were liquidated for nearly $1 billion in the last 24 hours. It showed that over the last four hours, ETH positions have accounted for the majority of liquidations.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment