Dogecoin News – What’s Behind the Recent Sell-off in Dogecoin?

Dogecoin News – Dogecoin’s price saw a sharp decline of 5% on Wednesday, reaching as low as $0.35 on Binance. Despite a flurry of positive developments in the Dogecoin market, the digital asset’s price experienced a “sell-the-news” reaction, a phenomenon where traders take profits after favorable news events.

Dogecoin’s Price Decline: A Response to Bullish Events

This downward movement occurred after a series of bullish catalysts ignited excitement among Dogecoin investors. On Tuesday, U.S. President Donald Trump signed a significant bill into law, the “Department of Government Efficiency,” which prominently featured the Dogecoin logo on its official website. This connection to Dogecoin, coupled with Elon Musk’s long-time support for the cryptocurrency, sparked optimism among traders.

Then, on Wednesday, the asset management firm Bitwise filed for a spot Dogecoin ETF with the U.S. Securities and Exchange Commission (SEC). The application further fueled expectations that Dogecoin could soon gain institutional exposure through the launch of a spot ETF.

Despite these positive developments, the market reacted negatively, as Dogecoin holders began to lock in profits. Many of these holders bought DOGE when Elon Musk publicly aligned with Trump’s campaign in September 2024, yielding over 200% unrealized gains. With Dogecoin reaching significant milestones, traders opted to sell, causing the price to fall by 5% over the span of 24 hours, reaching $0.35 by Thursday.

Why the Sell-the-News Cycle Occurred

The sharp drop in Dogecoin’s price following positive news points to a typical “sell-the-news” scenario, where investors capitalize on favorable market conditions to take profits. Sell-the-news cycles are common in markets when positive catalysts trigger a rush of buying, but the excitement eventually fades as traders exit positions.

Despite the recent downturn, this behavior doesn’t necessarily point to a deterioration in Dogecoin’s fundamentals. In fact, the overall sentiment surrounding Dogecoin remains bullish in the long term, especially with growing institutional interest in the cryptocurrency.

Leverage Traders Eyeing Dogecoin’s $0.33 Support Level

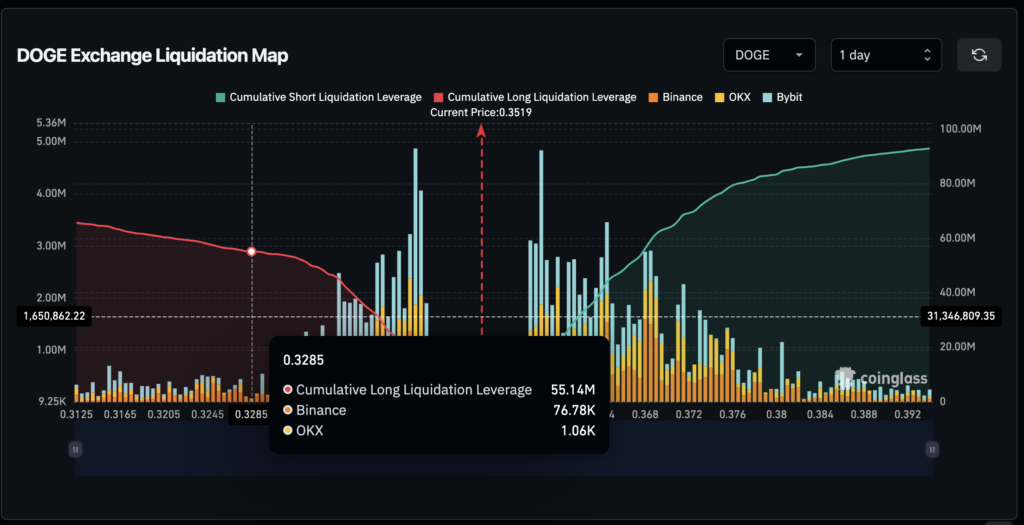

The price dip coincided with Bitwise’s ETF filing and broader market developments, but leveraged traders have been actively positioning themselves around key support levels. A recent chart from Coinglass Liquidation Map indicates that there are significant positions concentrated around the $0.33 price level. Bearish sentiment currently dominates the Dogecoin derivatives market, with $92 million in active short positions, compared to $65 million in active long positions.

Over 80% of the short positions are clustered around the $0.33 level. This suggests that if Dogecoin’s price falls below this level, leveraged traders could face significant liquidations worth $55 million. To avoid these losses, traders may be forced to cover their positions by purchasing spot DOGE, which could trigger an early price rebound if the sell-offs start to ease.

Dogecoin Price Outlook: Bulls Hope for $0.33 Support Defense

Currently, Dogecoin is trading at $0.3505, and technical indicators suggest the possibility of a price rebound. Bollinger Bands have narrowed, signaling reduced volatility and potential consolidation before a directional move. Dogecoin’s price is testing the lower band at $0.35, signaling oversold conditions and the potential for an upward rebound if buyers regain control.

The Relative Strength Index (RSI) stands at 47.68, approaching neutral territory but still below its signal line. This indicates that the bearish momentum is starting to wane, offering hope for a bullish recovery.

For the bullish scenario to unfold, Dogecoin needs to reclaim the midline of the Bollinger Bands at $0.362. This could trigger a rally towards the upper band at $0.41, setting the stage for further price gains. Renewed buying interest would also need to be supported by increasing volume, which has remained relatively subdued.

Possible Bearish Breakdown Below $0.33

On the flip side, if Dogecoin fails to hold the $0.33 support level, it could face further downside. A breakdown below this level could expose DOGE to losses targeting $0.31 and potentially $0.28.

Traders should keep a close eye on volume spikes and RSI movement, as divergences could signal a shift in the market’s directional trend. For now, the technical outlook for Dogecoin remains cautiously bullish, with critical resistance at $0.41 and the $0.33 support level serving as the near-term trend’s key point of focus.

Long-Term Bullish Outlook for Dogecoin

Despite the recent pullback, Dogecoin’s long-term prospects remain strong. Bitwise’s ETF filing indicates growing institutional interest, which could provide substantial capital inflows into DOGE in the coming months. Additionally, Elon Musk’s support continues to be a major driver of the cryptocurrency’s value, especially as the market looks for mainstream adoption and regulatory clarity.

In conclusion, while Dogecoin’s price may face short-term volatility, the bullish long-term outlook remains intact. Traders and investors alike will be watching closely to see if Dogecoin can defend the critical $0.33 support level and set the stage for an upward rebound.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Leave a comment