DeepSeek AI News Triggers Nasdaq Drop: Bitcoin ETFs Approach $96,400 Level

Geoffrey Kendrick of Standard Chartered has advised purchasing the Bitcoin fall since the cryptocurrency is under pressure due to its increasing association with the Nasdaq. According to Kendrick, news about DeepSeek caused a 3% decline in Nasdaq futures, which led to large overnight cryptocurrency liquidations and strengthened the connection between the tech and cryptocurrency industries. Additionally, this decline was followed by several tech stocks.

After DeepSeek, a Chinese AI startup that has only been around for a year revealed its primary AI model, R1, Nvidia fell more than 13% in pre-market trading. The model is said to be far more affordable while matching OpenAI’s capabilities.

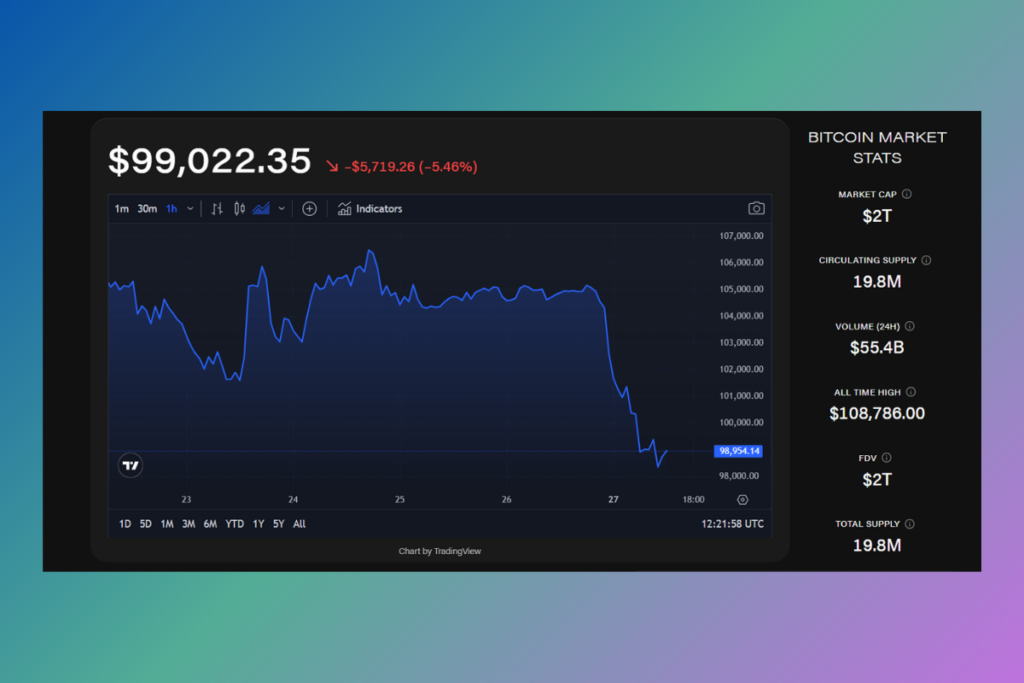

BTC remains strongly correlated to Nasdaq, much more so than it does to gold. The risk now is that if Nasdaq liquidation continues during the U.S. session (and ahead of this week’s earnings releases — Wednesday sees Microsoft, Meta, and Tesla — and likely disappointing FOMC (Federal Open Market Committee) Wednesday), then we start to approach other key levels for BTC. Specifically, the average purchase level for BTC ETFs since the U.S. election now stands at $96,400.

Kendrick

Why Geoffrey Kendrick Says Buy the Dip as Bitcoin Risks Diminish?

However, he believes that the risks to the Bitcoin market have diminished with the public release of news from the Trump administration. The disappointment/confusion stage is over, according to Kendrick, and the next step is to buy the dip. Kendrick proposed a three-stage plan for the cryptocurrency market:

- When Hope Dies: Market declines and an uncertain time.

- Buy the Dip: Market dominance by institutional investors with BTC and ETH price targets of $200,000 and $10,000, respectively, by the end of the year.

- Alt-Coin Alpha: A cryptocurrency surge that may occur after institutional accumulation and be referred to as a light season.

The disappointment for me was two-fold. 1. ‘Stockpile’ rather than ‘Reserve’ sounds more like seized assets rather than purchased assets. 2. The executive order is now done and any further clarity/action will have to go through Congress which will take some time.

Kendrick

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment