Crypto Options Expire on 24 January Could Shape Short-Term Market Trends

Today, around $4 billion worth of Ethereum and Bitcoin options will expire on cryptocurrency marketplaces. Because it can impact short-term trends through the volume of contracts and their notional value, market observers pay close attention to this occurrence. An understanding of traders’ expectations and potential market directions can be gained by looking at the put-to-call ratios and maximum pain points.

The Bitcoin options that expire today have a notional value of $3.19 billion. Deribit’s data indicates that the put-to-call ratio for these 30,645 Bitcoin options that are about to expire is 0.48. This ratio indicates that purchase options (calls) are more common than sales options (puts). The maximum pain point for these expiring options is $100,000, according to the research.

Today marks the expiration of 173,830 Ethereum contracts in addition to Bitcoin options. The notional value of these expiring options is $574.8 million, and the put-to-call ratio is 0.47. $3,300 is the maximum pain point. The price at which the majority of contracts expire worthless is the maximum pain point in cryptocurrency options trading.

ETH and BTC Options Traders Eye Losses as Prices Exceed Max Pain Points

Both Ethereum’s and Bitcoin’s current market values are above their respective maximum pain points. ETH is currently trading at $3,305, while BTC is trading at $103,388.

BTC max pain ticks higher, while ETH traders position near key levels,

This implies that option holders would typically experience losses if the options expired at these levels. Depending on the precise strike prices and positions that an options trader holds, the results can differ substantially. Traders must take into account both the state of the market and their whole options position in order to appropriately estimate prospective gains or losses at expiration.

BTC and ETH Options Expiry Meets SEC Crypto Reform: A Volatility Catalyst?

The presidential order issued by President Donald Trump to establish a digital asset stockpile in the United States coincides with these expiring contracts. If authorized, this project might feature a reserve that holds cryptocurrency assets other than Bitcoin. In addition to establishing a bitcoin stockpile, the president also formed a work group to create a federal regulatory framework for digital assets. The SAB 121 restriction was also repealed by the US Securities and Exchange Commission (SEC), allowing banks to hold cryptocurrency.

The expiration of the BTC and ETH options, along with these developments, provides bullish fundamentals that may spur volatility. The intriguing investor perspective presented by CryptoQuant analysts indicates that thorough analysis is necessary before drawing any conclusions.

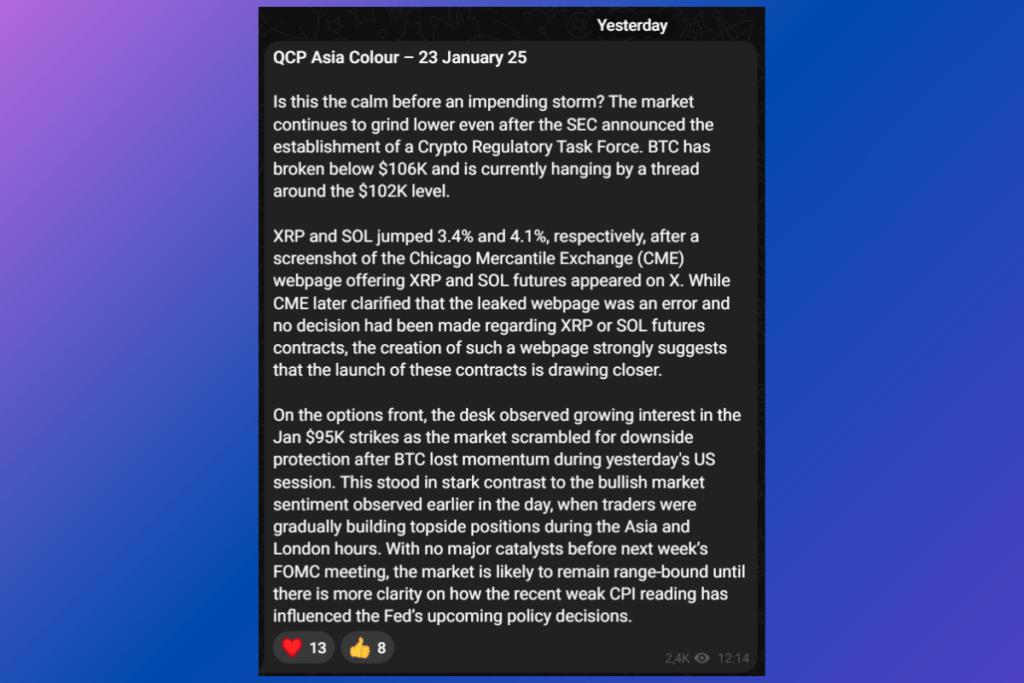

Is this the calm before an impending storm? The market continues to grind lower even after the SEC announced the establishment of a Crypto Regulatory Task Force. BTC has broken below $106,000 and is currently hanging by a thread around the $102,000 level,

the analysts

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment