Crypto News – With its biggest gain in more than a month, Ethereum‘s latest 8% rally has sparked the cryptocurrency community. This spike has sparked a lot of discussion among members of the cryptocurrency community and is tied to rumors of possible US ETFs for Ethereum.

With Ethereum Price Up 8%, Rumors About ETH ETFs Also Rise

Ethereum outpaced popular cryptocurrency assets like Bitcoin on Monday. At the time of writing, Ethereum’s price was $3,607. It has gained 62% year to date, closely trailing the 68% increase of Bitcoin.

Advocates of spot Ethereum ETFs have apparently communicated with the SEC recently, indicating a change in the regulatory environment. In January of last year, the SEC, which has always been cautious, exhibited transparency by authorizing spot Bitcoin ETFs following a court ruling. The market’s potential for regulated cryptocurrency investments has been shown by the $59 billion in assets that these ETFs have drawn since then.

16% Chance of Ethereum ETFs Approval Before May

Ethereum’s success has also sparked rumors of a potential surge. Prominent firms, including Fidelity Investments and BlackRock, have submitted applications for Ethereum ETFs. The SEC‘s ultimate judgment is still up in the air, though.

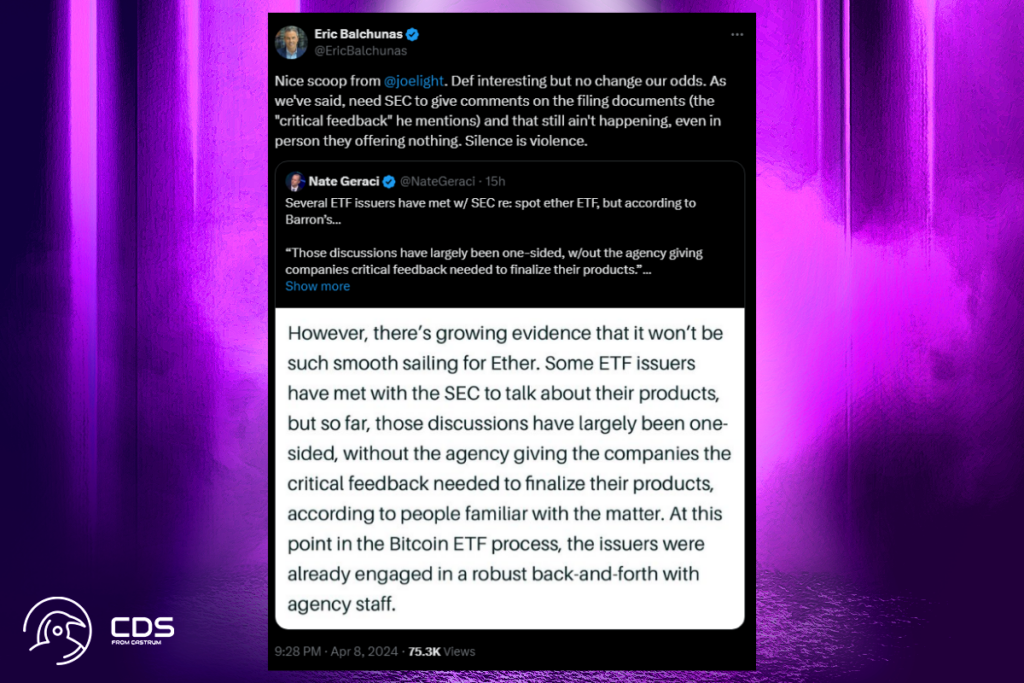

Eric Balchunas, an ETF expert, expressed doubt despite this, pointing to the SEC’s unwillingness to offer comments on ETF applications. With only a 16% probability of a spot Ethereum ETF clearance before the May deadline, Polymarket estimates that this caution mirrors broader market sentiment.

Definitely interesting, but no change our odds. As we’ve said, need SEC to give comments on the filing documents and that still ain’t happening, even in person they offering nothing. Silence is violence,

Balchunas

Leave a comment