Crypto News – Both the approval of ETFs and the imminent Bitcoin halving were among the issues that affected the industry the most this week.

Weekend Report in Crypto: What Happened in the Crypto Sector in the Past 2 Days?

There are four topics that stood out over the past weekend. First, there were rumors that the Ordinals would help BTC miners’ wages after the halving. Then, ETH gas fees were allegedly causing errors in Yuga mints. Other highlights included a drop in Google search interest in Bitcoin and PlayDapp‘s exposure to fraud.

Ordinals May Support Declining BTC Miner Revenue

According to digital asset management company Grayscale, Bitcoin Ordinals inscriptions may give BTC mining companies a much-needed revenue boost following the planned halving event in April.

Since the advent of Ordinals, there have been multiple times when miners have derived over 20% of their transaction fees from inscription fees themselves,

Grayscale researcher Michael Zhao

Since the Ordinals protocol began in January 2023, miners have made $200 million from about 59 million NFT-like collectibles on Bitcoin, according to Zhao.

This trend is expected to persist, bolstered by renewed developer interest and ongoing innovations on the Bitcoin blockchain.

A combination of declining revenue and increasing costs could put many miners in a tense position in the near term,

Zhao

Yuga Labs’ Handling of Its Mistakes Described as a Train Wreck

After previously attempting to offer out a different NFT, Yuga Labs said it would reimburse gas prices for individuals who lost out trying to obtain “Loot,” an NFT for those who finished a mission in its “Legends of the Mara” game on its Otherside metaverse. In an X post from February 8th, Spencer Tucker, the company’s chief gaming officer, offered a “Catalyst” NFT and acknowledged that Yuga “got it wrong” on the Loot mint.

Further backlash followed Tucker’s post, with some in the Yuga community labeling Yuga’s handling of the problem “a train wreck” and arguing that distributing catalysts would be the wrong course of action because it would lower their value.

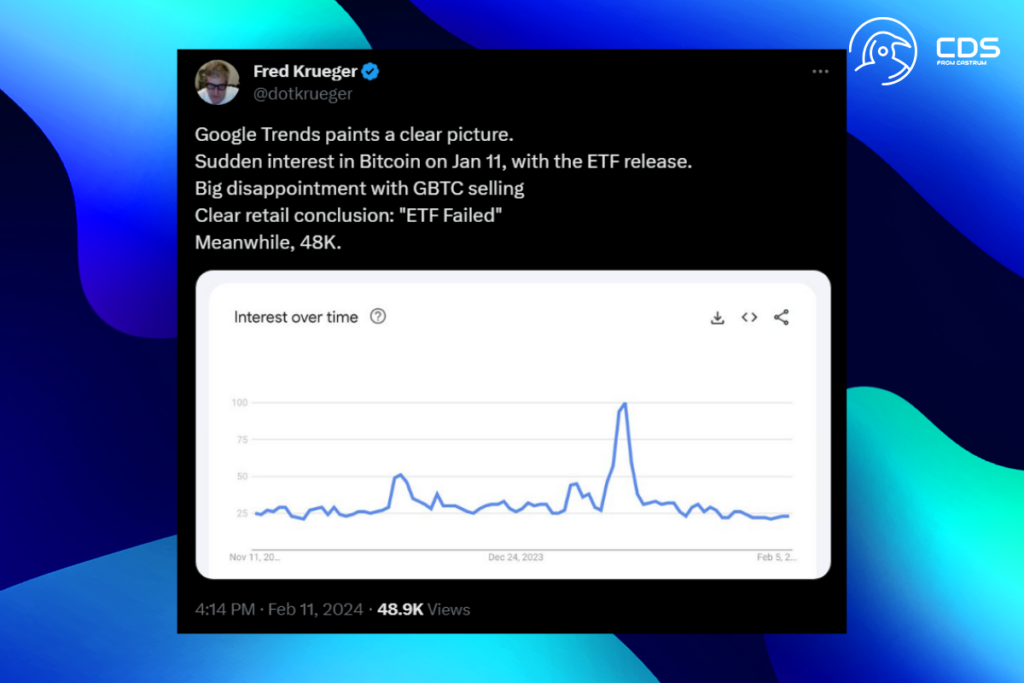

What’s the Reason for the Decline in Bitcoin Searches on Google?

Despite its recent price spike and the introduction of spot Bitcoin exchange-traded funds in the US last month, the number of people searching for “Bitcoin” on the internet is still very small. Despite Bitcoin rising by approximately 210% from $15,600 to $48,200 over that period, according to Google Trends data, search interest in the cryptocurrency fell from 21 at the beginning of 2023 to 18 at the time of publishing.

Hedge fund investor Fred Krueger said in a post on X on February 12 that it might be an indication that ordinary investors haven’t given Bitcoin another chance. Krueger focused on interest in the United States during the previous three months and found that while spot Bitcoin ETFs launched on January 11, search interest in the product peaked at 100 that day. Three days later, volumes fell to about 30.

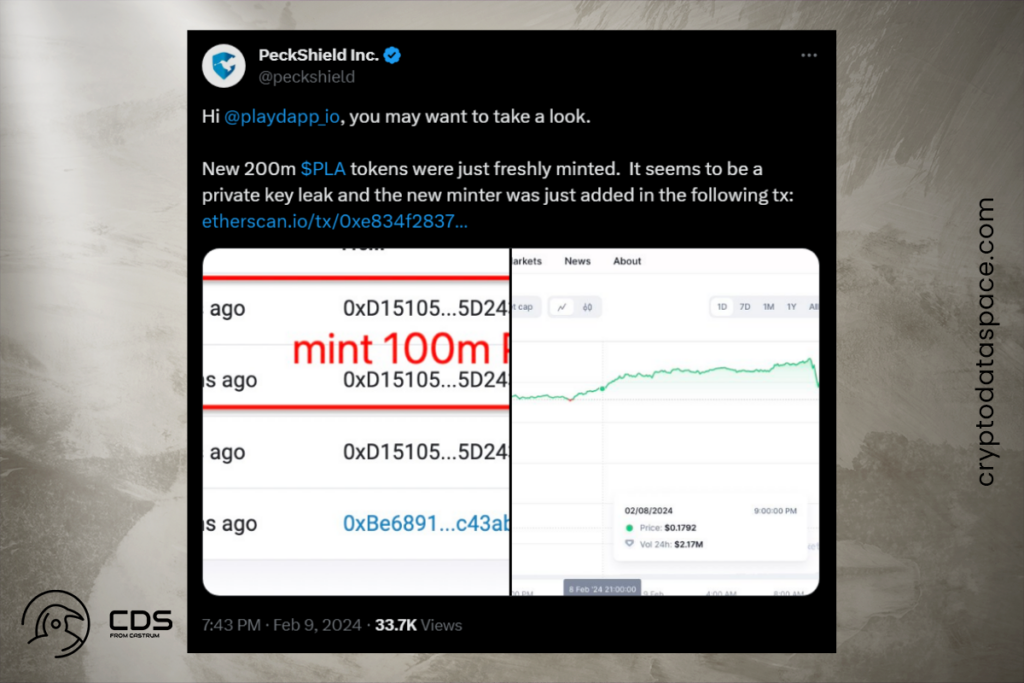

According to PeckShield, PlayDapp Lost $31 Million in a Private Key Leak

A $31 million attack occurred on PlayDapp, a blockchain-based gaming platform and NFT marketplace. One of the earliest notices of the issue was the blockchain security company PeckShield, which claimed in a Feb. 9 X post that the exploiter had successfully minted 200 million PlayDapp (PLA) tokens, valued at $31 million, and that the apparent cause of the exploit was a “private key leak.”

We are writing to inform you of a critical security incident involving the PLA token contract. We understand the gravity of this situation and assure you that we are taking immediate action.

PlayDapp

Leave a comment